Office Depot 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

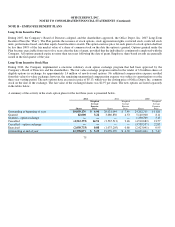

Office Depot also sponsors the Office Depot, Inc. Non-Qualified Deferred Compensation Plan that, until December 2009, permitted

eligible highly compensated employees, who were limited in the amount they could contribute to the 401(k) Plan, to alternatively

defer a portion of their salary, commissions and bonuses up to maximums and under restrictive conditions specified in this plan and to

participate in Company matching provisions. The matching contributions to the deferred compensation plan were allocated to

hypothetical investment alternatives selected by the participants. The compensation and benefits committee of the Board of Directors

amended the plan to eliminate the predetermined matching contributions effective with the first payroll period beginning in 2009. In

October 2009, the plan was amended the plan to no longer accept new deferrals.

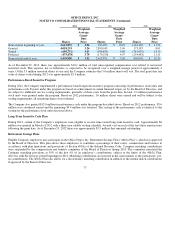

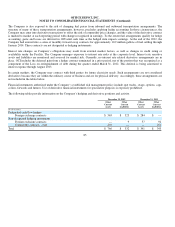

During 2012, 2011, and 2010, $7.3 million, $7.2 million and $80.2 thousand, respectively, was recorded as compensation expense fo

r

Company contributions to these programs and certain international retirement savings plans. Additionally, nonparticipating annuity

premiums were paid for benefits in certain European countries totaling $5.0 million, $5.0 million and $4.7 million in 2012, 2011, and

2010, respectively.

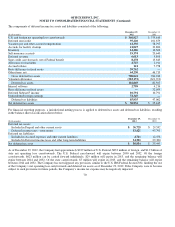

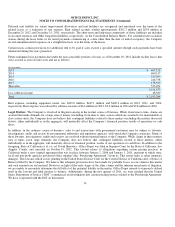

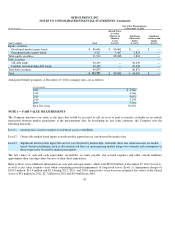

Pension Plan

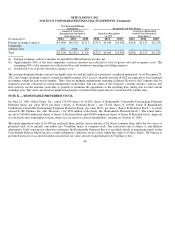

The Company has a defined benefit pension plan which is associated with a 2003 European acquisition and covers a limited numbe

r

of employees in Europe. During 2008, curtailment of that plan was approved by the trustees and future service benefits ceased for the

remaining employees.

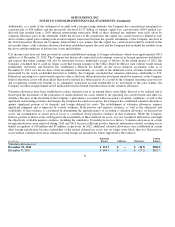

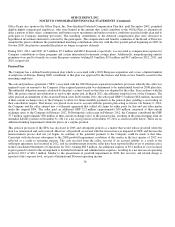

The sale and purchase agreement (“SPA”) associated with the 2003 European acquisition included a provision whereby the seller was

required to pay an amount to the Company if the acquired pension plan was determined to be underfunded based on 2008 plan data.

The unfunded obligation amount calculated by the plan’s actuary based on that data was disputed by the seller. In accordance with the

SPA, the parties entered into arbitration to resolve this matter and, in March 2011, the arbitrator found in favor of the Company. The

seller pursued an annulment of the award in French court. In November 2011, the seller paid GBP 5.5 million ($8.8 million, measured

at then-current exchange rates) to the Company to allow for future monthly payments to the pension plan, pending a court ruling on

their cancellation request. That money was placed in an escrow account with the pension plan acting as trustee. On January 6, 2012,

the Company and the seller entered into a settlement agreement that settled all claims by either party for this and any other matte

r

under the original SPA. The seller paid an additional GBP 32.2 million (approximately $50 million, measured at then-current

exchange rates) to the Company in February 2012. Following this cash receipt in February 2012, the Company contributed the GBP

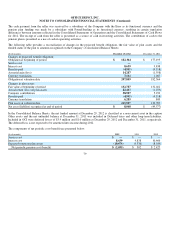

37.7 million (approximately $58 million at then-current exchange rates) to the pension plan, resulting in the plan changing from an

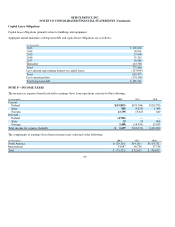

unfunded liability position at December 31, 2011 to a net asset position at December 29, 2012 as shown in table below. There are no

additional funding requirements while the plan is in a surplus position.

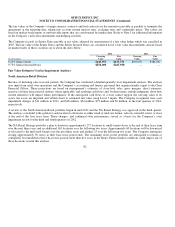

This pension provision of the SPA was disclosed in 2003 and subsequent periods as a matter that would reduce goodwill when the

plan was remeasured and cash received. However, all goodwill associated with this transaction was impaired in 2008, and because the

remeasurement process had not yet begun, no estimate of the potential payment to the Company could be made at that time.

Consistent with disclosures subsequent to the 2008 goodwill impairment, resolution of this matter in the first quarter of 2012 was

reflected as a credit to operating expense. The cash received from the seller, reversal of an accrued liability as a result of the

settlement agreement, fees incurred in 2012, and fee reimbursement from the seller have been reported in Recovery of purchase price

in the Consolidated Statements of Operations for 2012, totaling $68.3 million. An additional expense of $5.2 million of costs incurred

in prior periods related to this arrangement is included in General and administrative expenses, resulting in a net increase in operating

profit for 2012 of $63.1 million. Similar to the presentation of goodwill impairment in 2008, this recovery and related charge is

reported at the corporate level, not part of International Division operating income.

78