Office Depot 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

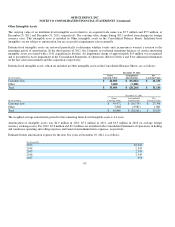

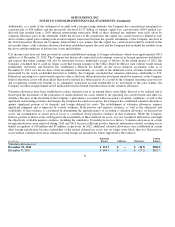

Vendor Arrangements: The Company enters into arrangements with substantially all significant vendors that provide for some for

m

of consideration to be received from the vendors. Arrangements vary, but some specify volume rebate thresholds, advertising support

levels, as well as terms for payment and other administrative matters. The volume-based rebates, supported by a vendor agreement,

are estimated throughout the year and reduce the cost of inventory and cost of goods sold during the year. This estimate is regularly

monitored and adjusted for current or anticipated changes in purchase levels and for sales activity. Other promotional consideration

received is event-based or represents general support and is recognized as a reduction of Cost of goods sold and occupancy costs o

r

Inventory, as appropriate based on the type of promotion and the agreement with the vendor. Some arrangements may meet the

specific, incremental, identifiable criteria that allow for direct operating expense offset, but such arrangements are not significant.

New Accounting Standards: Effective for the first quarter of 2013, a new accounting standard will require disclosure of amounts

reclassified out of comprehensive income by component. In addition, companies will be required to present, either on the face o

f

financial statements or in a single note, significant amounts reclassified out of accumulated other comprehensive income and the

income statement line item affected by the reclassification.

Effective for the first quarter of 2014, a new accounting standard will require disclosure of information about the effect or potential

effect of financial instrument netting arrangements on the Company’s financial position. Companies will be required to present both

net (offset amounts) and gross information in the notes to the financial statements for relevant assets and liabilities that are offset.

This standard was further clarified to apply to specified financial instruments subject to master netting agreements.

Including the above, there are no recently issued accounting standards that are expected to have a material effect on the Company’s

financial condition, results of operations or cash flows.

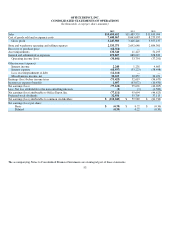

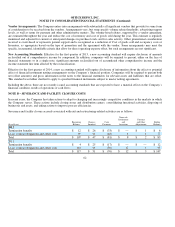

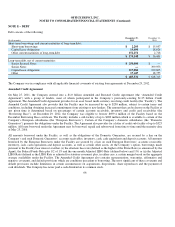

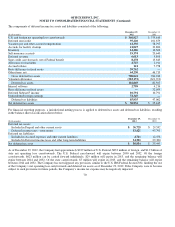

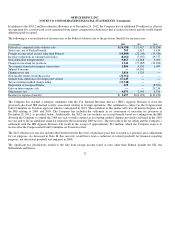

NOTE B – SEVERANCE AND FACILITY CLOSURE COSTS

In recent years, the Company has taken actions to adapt to changing and increasingly competitive conditions in the markets in which

the Company serves. These actions include closing stores and distribution centers, consolidating functional activities, disposing o

f

businesses and assets, and taking actions to improve process efficiencies.

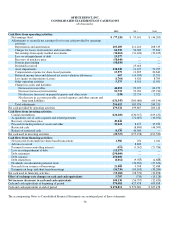

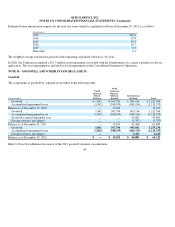

Severance and facility closure accruals associated with exit and restructuring-related activities are as follows:

62

(In millions)

Beginning

Balance

Charges

Incurre

d

Cash

Payments

Non-cash

Settlements

and

Accretion

Currency

and Other

Adjustments

Ending

Balance

201

2

Termination benefits

$12

$26

$ (33) $

—

$1

$6

Lease, contract obli

g

ations and, other costs

95

21

(48) 8

1

77

Total

$107

$47

$ (81)

$8

$2

$83

2011

Termination benefits

$4

$25

$ (17)

$

—

$

—

$12

Lease, contract obli

g

ations and, other costs

113

26

(59) 12

3

95

Total

$117

$51

$ (76)

$12

$3

$ 107