Office Depot 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

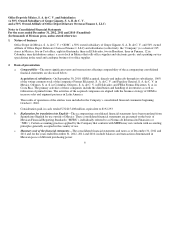

The accompanying consolidated financial statements have been prepared in conformity with MFRS, which require that

management make certain estimates and use certain assumptions that affect the amounts reported in the consolidated financial

statements and their related disclosures; however, actual results may differ from such estimates. The Company’s management,

upon applying professional judgment, considers that estimates made and assumptions used were adequate under the

circumstances. The significant accounting policies of the Company are as follows:

Beginning January 1, 2012, the Company adopted the following new NIF:

NIF C-6, Property, Plant and Equipment.—This standard establishes the obligation to separately depreciate

significant components that comprise a single item of property, plant and equipment.

NIF C-15, Impairment of Long-Lived Assets—Eliminates a) the restriction that an asset should not be in use to be

classified as available for sale and b) the reversal of impairment losses of goodwill. It also establishes that

impairment losses of long-lived assets should be presented in the statements of income as costs or operating

expenses depending where they correspond to and not within other income or expenses.

The adoption of these new standards did not have material effects in the accompanying consolidated financial

statements.

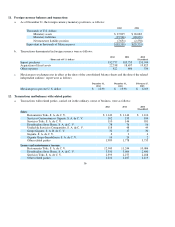

Depreciation is calculated using the straight-line method based on the useful lives of the related assets, as follows:

The useful lives of fixed assets are reviewed at least annually to determine whether events and circumstances warrant a

revision.

9

3. Summary of significant accounting policies

a.

A

ccounting changes -

b.

R

ecognition of the effects of inflation

—

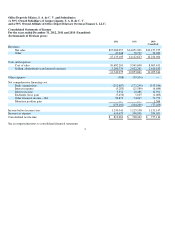

Beginning on January 1, 2008, the Company discontinued recognition of the

effects of inflation in its consolidated financial statements for those entities that do not operate in an inflationary

environment, as that term is defined in MFRS. However, assets and stockholders’ equity include the restatement effects

recognized by those entities through December 31, 2007. The cumulative inflation rate in Mexico for the three fiscal years

prior to those ended December 31, 2012, 2011 and 2010 was 12.26%, 15.19% and 14.48%, respectively, for which reason

the economic environment continued to be considered non-inflationary in all periods. Inflation rates for the years ended

2012, 2011 and 2010 were 3.57%, 3.82% and 4.40%, res

p

ectivel

y

.

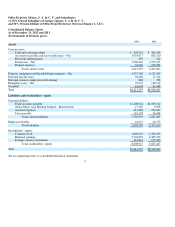

c. Cash and cash equivalents

—

Cash and cash equivalents consist mainly of bank deposits in checking accounts and readily

available daily investments of cash surpluses. Cash and cash equivalents are stated at nominal value plus accrued yields,

which are recognized in results as they accrue. The Company considers all short-term highly-liquid debt instruments

p

urchased with an ori

g

inal maturit

y

of three months or less to be cash e

q

uivalents.

d. Concentration of credit risk—The Company sells products to customers primarily in the retail trade in Mexico. The

Company conducts periodic evaluations of its customers’ financial condition and generally does not require collateral. The

Company does not believe that significant risk of loss from a concentration of credit risk exists given the large number of

customers that comprise its customer base and their geographical dispersion. The Company also believes that its potential

credit risk is ade

q

uatel

y

covered b

y

the allowance for doubtful accounts.

e.

I

nventories and cost of sales

—

Inventories are stated at the lower of cost or realizable value. Cost is determined using the

avera

g

e cost method.

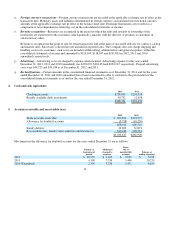

f.

P

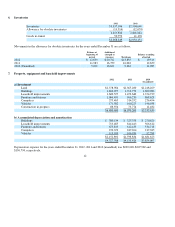

roperty, equipment and leasehold improvements

—

Property, equipment and leasehold improvements are recorded at

acquisition cost. Balances from acquisitions made through December 31, 2007, were restated for the effects of inflation by

a

pp

l

y

in

g

factors derived from the NCPI (National Consumer Price Index) throu

g

h that date.

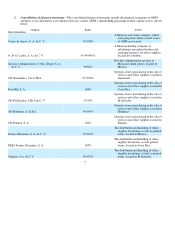

Avera

g

e

y

ears

Buildin

g

s

40

Leasehold im

p

rovements

9-25

Furniture and fixtures

4-10

Com

p

uters

4

Vehicles

4-8