Office Depot 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

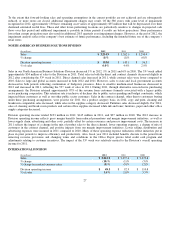

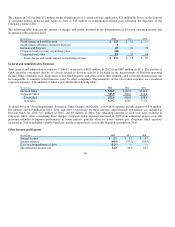

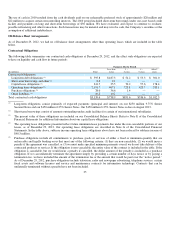

Additionally, our Consolidated Balance Sheet as of December 29, 2012 includes $431.5 million classified as Deferred income

taxes and other long-term liabilities. This caption primarily consists of net long-term deferred income taxes, deferred lease

credits, liabilities under our deferred compensation plans, and accruals for uncertain tax positions. These liabilities have been

excluded from the above table as the timing and/or the amount of any cash payment is uncertain. Refer to Note F of the

Consolidated Financial Statements for additional information regarding our deferred tax positions and accruals for uncertain tax

positions and Note H for a discussion of our employee benefit plans.

In addition to the above, we have outstanding letters of credit totaling $0.2 million at December 29, 2012.

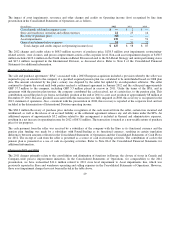

CRITICAL ACCOUNTING POLICIES

Our Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United

States of America. Preparation of these statements requires management to make judgments and estimates. Some accounting policies

have a significant impact on amounts reported in these financial statements. A summary of significant accounting policies can be

found in Note A of the Consolidated Financial Statements. We have also identified certain accounting policies that we conside

r

critical to understanding our business and our results of operations and we have provided below additional information on those

policies.

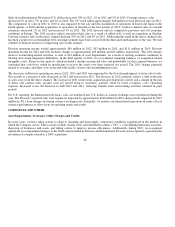

Vendor arrangements — Inventory purchases from vendors are generally under arrangements that automatically renew until

cancelled with periodic updates or annual negotiated agreements. Many of these arrangements require the vendors to make payments

to us or provide credits to be used against purchases if and when certain conditions are met. We refer to these arrangements as

“vendor programs.” Vendor programs fall into two broad categories, with some underlying sub-categories. The first category is

volume-based rebates. Under those arrangements, our product costs per unit decline as higher volumes of purchases are reached.

Certain of our vendor agreements provide that we pay higher per unit costs prior to reaching a predetermined tier, at which time the

vendor rebates the per unit differential on past purchases, and also applies the lower cost to future purchases until the next milestone

is reached. Current accounting rules provide that companies with a sound basis for estimating their full year purchases, and therefore

the ultimate rebate level, can use that estimate to value inventory and cost of goods sold throughout the year. We believe our history

of purchases with many vendors provides us with a basis for our estimates of purchase volume. If the anticipated volume of purchases

is not reached, however, or if we form the belief at any point in the year that it is not likely to be reached, cost of goods sold and the

remaining inventory balances are adjusted to reflect that change in our outlook. We review sales projections and related purchases

against vendor program estimates at least quarterly and adjust these balances accordingly. In recent years, we have reduced the

number of arrangements that contain this tiered purchase rebate mechanism in exchange for a lower product cost throughout the year.

Continued elimination of tiered arrangements could further reduce the potential variability in gross margin from changes in volume-

based estimates.

36

Other liabilities consist of dividends paid in January 2013 relating to the Redeemable Preferred Stock. Dividends payable i

n

future quarterly periods may be paid in-kind or in cash and are not determinable as of December 29, 2012. Refer to Note F of the

Consolidated Financial Statements for additional information.

(6)