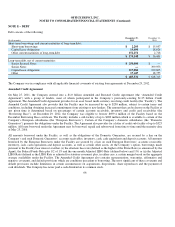

Office Depot 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

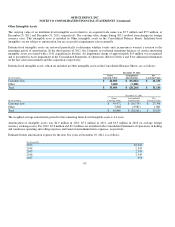

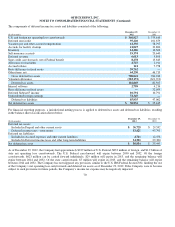

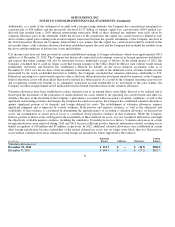

Other Intangible Assets

The carrying value of an indefinite-lived intangible asset related to an acquired trade name was $5.7 million and $5.5 million, at

December 29, 2012 and December 31, 2011, respectively. The carrying value change during 2012 resulted from changes in foreign

currency rates. This intangible asset is included in Other intangible assets in the Consolidated Balance Sheets. Indefinite-lived

intangibles are not subject to amortization, but are assessed for impairment at least annually.

Definite-lived intangible assets are reviewed periodically to determine whether events and circumstances warrant a revision to the

remaining period of amortization. In the third quarter of 2012, the Company re-evaluated remaining balances of certain amortizing

intangible assets associated with a 2011 acquisition in Sweden. An impairment charge of approximately $14 million was recognized

and is presented in Asset impairment in the Consolidated Statements of Operations. Refer to Notes I and P for additional information

on the fair value measurement and the acquisition, respectively.

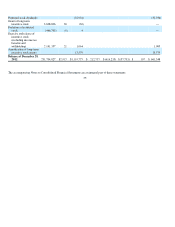

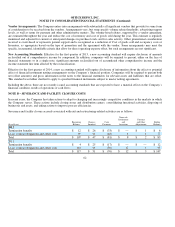

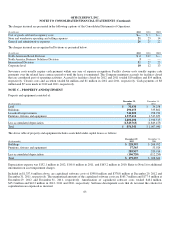

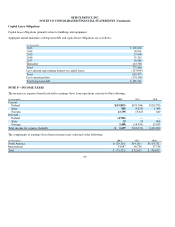

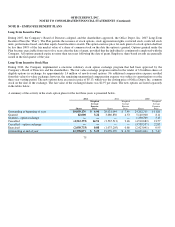

Definite-lived intangible assets, which are included in Other intangible assets in the Consolidated Balance Sheets, are as follows:

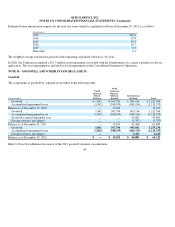

The weighted average amortization period for the remaining finite-lived intangible assets is 4.4 years.

Amortization of intangible assets was $4.9 million in 2012, $5.2 million in 2011, and $2.9 million in 2010 (at average foreign

currency exchange rates). For 2012, $2.6 million and $2.3 million are included in the Consolidated Statement of Operations in Selling

and warehouse operating and selling expenses and General and administrative expenses, respectively.

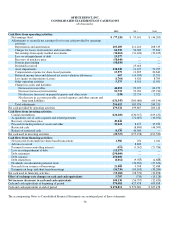

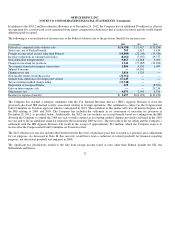

Estimated future amortization expense for the next five years at December 29, 2012 is as follows:

65

December 29, 2012

(In thousands)

Gross

Carrying Valu

e

Accumulated

Amortization

Net

Carrying Valu

e

Customer lists

$ 28,000

$(16,864)

$ 11,136

Other

3,40

0

(3,400)

—

Total

$31,40

0

$(20,264)

$11,136

December 31, 2011

(In thousands)

Gross

Carr

y

in

g

Value

Accumulated

Amortization

Net

Carr

y

in

g

Value

Customer lists

$ 43,972

$(16,174)

$ 27,798

Other

5,868

(3,987)

1,881

Total

$49,84

0

$(20,161)

$29,679

(In thousands)

2013

$2,545

2014

2,545

2015

2,545

2016

2,545

2017

956