Office Depot 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Merchandising

Our merchandising strategy is to meet our customers’ needs by offering a broad selection of nationally branded office products, as

well as our own brands products and services. Our selection of own brand products has increased in breadth and level o

f

sophistication over time. We currently offer general office supplies, computer supplies, business machines and related supplies, and

office furniture under various labels, including Office Depot , Viking Office Products , Foray , and Ativa .

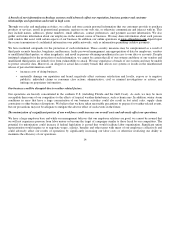

We classify our products into three categories: (1) supplies, (2) technology, and (3) furniture and other. The supplies category

includes products such as paper, binders, writing instruments, school supplies, and ink and toner. The technology category includes

products such as desktop and laptop computers, monitors, tablets, printers, cables, software, digital cameras, telephones, and wireless

communications products. The furniture and other category includes products such as desks, chairs, and luggage, sales in our copy

and print centers, and other miscellaneous items.

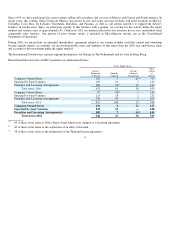

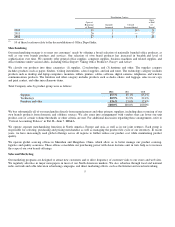

Total Company sales by product group were as follows:

We buy substantially all of our merchandise directly from manufacturers and other primary suppliers, including direct sourcing of ou

r

own brands products from domestic and offshore sources. We also enter into arrangements with vendors that can lower our unit

product costs if certain volume thresholds or other criteria are met. For additional discussion regarding these arrangements, refer to

“Critical Accounting Policies” in Part II—Item 7. MD&A.

We operate separate merchandising functions in North America, Europe and Asia as well as in our joint ventures. Each group is

responsible for selecting, purchasing and pricing merchandise as well as managing the product life cycle of our inventory. In recent

years, we have increasingly used global offerings across all regions to further reduce our product cost while maintaining product

quality.

We operate global sourcing offices in Shenzhen and Hangzhou, China, which allow us to better manage our product sourcing,

logistics and quality assurance. These offices consolidate our purchasing power with Asian factories and, in turn, help us to increase

the scope of our own brands offerings.

Sales and Marketing

Our marketing programs are designed to attract new customers and to drive frequency of customer visits to our stores and web sites.

We regularly advertise in major newspapers in most of our North American markets. We also advertise through local and national

radio, network and cable television advertising campaigns, and direct marketing efforts, such as the Internet and social networking.

5

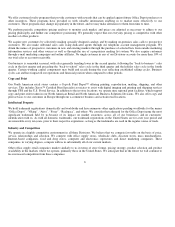

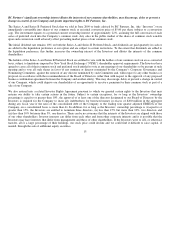

Distribution Centers

Open at

Beginning

of Period

Opened/

Ac

q

uired

Closed/

Deconsolidated

Open

at En

d

of

Period

201

0

39

1

14

26

2011

26

1

—

27

201

2

27

1

5

23

10 of these locations relate to the deconsolidation of Office De

p

ot India.

2012 2011 2010

Supplies

65.5%

65.1%

65.2%

Technolo

gy

20.9%

21.9%

22.4%

Furniture and other

13.6%

13.0%

12.4%

100.0%

100.0%

100.0%

(4)

(4)

®®®®