Office Depot 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

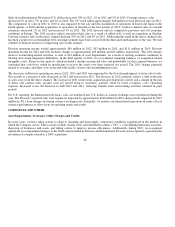

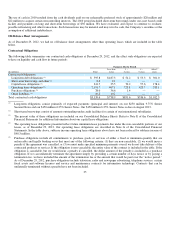

Closed store accruals

—

We regularly assess the performance of each retail store against historical patterns and projections of future

profitability. These assessments are based on management’s estimates for sales levels, gross margin attainments, and cash flow

generation. If, as a result of these evaluations, management determines that a store will not achieve certain operating performance

targets, we may decide to close the store prior to the end of its lease term. At the point of closure, we recognize a liability for the

remaining costs related to the property, reduced by an estimate of any sublease income. The calculation of this liability requires us to

make assumptions and to apply judgment regarding the remaining term of the lease (including vacancy period), anticipated sublease

income, and costs associated with vacating the premises. Lease commitments with no economic benefit to the Company are

discounted at the credit-adjusted discount rate at the time of each location closure. With assistance from independent third parties to

assess market conditions, we periodically review these judgments and estimates and adjust the liability accordingly. Future

fluctuations in the economy and the market demand for commercial properties could result in material changes in this liability.

Generally, costs associated with facility closures are included in Store and warehouse operating and selling expenses in ou

r

Consolidated Statements of Operations.

Goodwill and other intangible assets — We review goodwill and indefinite lived intangible assets for impairment annually in the

fourth quarter of the year, or sooner if indicators of potential impairment are identified. For 2012, we have elected to quantitatively

test for impairment of goodwill and indefinite lived intangible assets. This test compares the book value of net assets to the fair value

of the reporting units. If the fair value is determined to be less than the book value or qualitative factors indicate that it is more likely

than not that goodwill is impaired, a second step is performed to compute the amount of impairment as the difference between the

estimated fair value of goodwill and the carrying value. We estimate the fair value of the reporting units using discounted cash flow

and certain market value data. Fair value of the indefinite lived trade name is obtained using a discounted cash flow analysis. These

fair value methods require significant judgment assumptions and estimates, including industry economic factors and future

profitability.

The discounted cash flow analysis for goodwill testing begins with the ensuing year’s business plan and requires estimates of future

sales, profitability, capital expenditures and related cash flows. We include a residual value and discount the aggregate cash flow at an

estimated cost of capital for the related unit. We also review the results against a measurement of market capitalization and, to the

extent available, market data. Of the goodwill recognized at December 29, 2012, approximately $44.9 million was in the International

Division’s European reporting unit and $19.4 million was in the North American Business Solutions Division’s direct reporting unit.

The European reporting unit has the greatest sensitivity to potential changes in economic conditions, Company performance and the

related impacts on estimated fair value. This reporting unit is comprised of wholly-owned entities and ownership of the joint venture

in Mexico. At December 29, 2012, the fair value estimate of the reporting unit, including assumed control premiums, exceeded its

carrying value by approximately 30%. A significant portion of this excess is associated with the joint venture operations in Mexico. I

f

the joint venture were to be removed from the composition of the reporting unit, it is likely that all of the existing goodwill would be

impaired. Additionally, even if there is no change in the composition of the reporting unit, if future performance is below ou

r

projections, goodwill and other intangible asset impairment charges can result. The estimated fair value of the direct reporting unit

was significantly in excess of its carrying value.

I

ncome taxes — Income tax accounting requires management to make estimates and apply judgments to events that will be

recognized in one period under rules that apply to financial reporting and in a different period in our tax returns. In particular,

j

udgment is required when estimating the value of future tax deductions, tax credits, and the realizability of net operating loss

carryforwards (NOLs), as represented by deferred tax assets. When we believe the realization of all or a portion of a deferred tax asset

is not likely, we establish a valuation allowance. Changes in judgments that increase or decrease these valuation allowances impact

current earnings.

Because of the downturn in our performance in recent years, as well as the restructuring activities and charges we have taken in

response, we established significant valuation allowances during 2009. A portion of those valuation allowances were offset in 2012

when we recorded deferred tax liabilities related to removing the permanent reinvestment assumption of certain foreign investments.

Valuation allowances remain in certain foreign jurisdictions. Judgment is required in projecting when operations will be sufficiently

positive to allow a conclusion that utilization of the deferred tax assets will once again be more likely than not. Positive performance

in subsequent periods and projections of future positive performance will need to be evaluated against existing negative evidence.

Valuation allowances in certain foreign jurisdictions were removed during 2010 and 2011 because sufficient positive financial

information existed, resulting in tax benefit recognition of $10 million and $9 million, respectively. In 2012, additional valuation

allowances were established in certain foreign jurisdictions because realizability of the related deferred tax assets was no longer more

likely than not. Our effective tax rate in future periods may be positively or negatively impacted by changes in related judgments

about valuation allowances or pre-tax operations.

38