Nordstrom 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 45

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

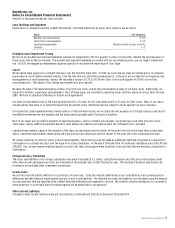

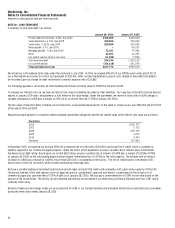

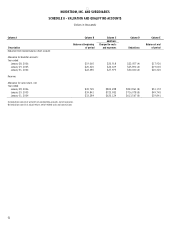

NOTE 15: SEGMENT REPORTING

We have four segments: Retail Stores, Credit, Direct, and Other.

• The Retail Stores segment derives its revenues from sales of high-quality apparel, shoes, cosmetics and accessories.

It includes our Full-Line and Rack stores.

• The Credit segment earns finance charges and securitization gains and losses through operation of the Nordstrom private label and

co-branded VISA credit cards. Intersegment revenues consist of interchange fees charged to our other segments.

• The Direct segment generates revenues from sales of high-quality apparel, shoes, cosmetics and accessories via catalogs and the

Nordstrom.com Web site.

• The Other segment includes our Façonnable stores, our product development group, which coordinates the design and production of

private label merchandise sold in our retail stores, and our distribution network. This segment also includes our corporate center operations.

This segment information for 2004 and 2003 has been adjusted from our previous disclosures as we now reflect Façonnable, Nordstrom Product

Group and the distribution network in “Other”; also, beginning in September 2005, we changed our internal method for recognizing returns of Direct

sales at Retail Stores. Previously, these returns were recognized in the Direct segment and now they are recognized in the Retail Store segment.

In general, we use the same measurements to compute earnings before income tax expense for reportable segments as we do for the consolidated

company. However, redemptions of our merchandise rewards certificates are included in net sales for our Retail Stores segment. The sales amount

in our Other segment eliminates these sales from our consolidated net sales. There is no impact to earnings before income tax expense for this

adjustment. In addition, our sales return reserve for our Retail Stores segment is recorded in the Other segment. Other than described above,

the accounting policies of the operating segments are the same as those described in the summary of significant accounting policies in Note 1.

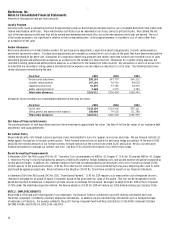

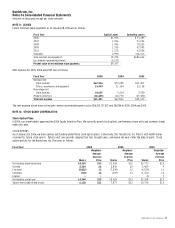

The following table summarizes the net sales by merchandise category:

Fiscal Year 2005 2004 2003

Women’s apparel $2,709,563 $2,577,489 $2,348,670

Shoes 1,590,877 1,454,415 1,302,257

Cosmetics and women’s accessories 1,567,725 1,403,359 1,235,445

Men’s apparel 1,388,713 1,250,546 1,071,135

Children’s apparel 266,225 246,079 235,667

Other 199,757 199,500 255,504

Total $7,722,860 $7,131,388 $6,448,678

The following table presents our sales by merchandise category as a percentage of net sales:

Fiscal Year 2005 2004 2003

Women’s apparel 35% 36% 36%

Shoes 21% 20% 20%

Cosmetics and women’s accessories 20% 20% 19%

Men’s apparel 18% 18% 17%

Children’s apparel 3% 3% 4%

Other 3% 3% 4%