Nordstrom 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 31

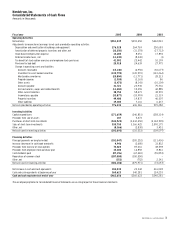

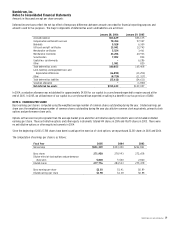

Nordstrom, Inc.

Consolidated Statements of Cash Flows

Amounts in thousands

Fiscal year 2005 2004 2003

Operating Activities

Net earnings $551,339 $393,450 $242,841

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization of buildings and equipment 276,328 264,769 250,683

Amortization of deferred property incentives and other, net (33,350) (31,378) (27,712)

Stock-based compensation expense 13,285 8,051 17,894

Deferred income taxes, net (11,238) (8,040) (1)

Tax benefit of stock option exercises and employee stock purchases 41,092 25,442 10,199

Provision for bad debt 20,918 24,639 27,975

Change in operating assets and liabilities:

Accounts receivable (15,140) (2,950) (30,677)

Investment in asset backed securities (135,790) (149,970) (141,264)

Merchandise inventories (20,804) (11,771) 28,213

Prepaid expenses (1,035) (3,163) 86

Other assets (3,473) (8,143) (10,109)

Accounts payable 31,721 23,930 75,736

Accrued salaries, wages and related benefits (11,284) 15,055 42,885

Other current liabilities 38,755 58,471 38,970

Income taxes payable (33,877) (18,999) 21,319

Property incentives 49,480 19,837 46,007

Other liabilities 19,305 7,116 6,237

Net cash provided by operating activities 776,232 606,346 599,282

Investing Activities

Capital expenditures (271,659) (246,851) (258,314)

Proceeds from sale of assets 107 5,473 —

Purchases of short-term investments (542,925) (3,232,250) (2,144,909)

Sales of short-term investments 530,750 3,366,425 2,090,175

Other, net (8,366) (2,830) 3,451

Net cash used in investing activities (292,093) (110,033) (309,597)

Financing Activities

Principal payments on long-term debt (101,047) (205,252) (111,436)

Increase (decrease) in cash book overdrafts 4,946 (2,680) 33,832

Proceeds from exercise of stock options 73,023 87,061 48,598

Proceeds from employee stock purchase plan 15,600 12,892 8,861

Cash dividends paid (87,196) (67,240) (55,853)

Repurchase of common stock (287,080) (300,000) —

Other, net (352) (752) 2,341

Net cash used in financing activities (382,106) (475,971) (73,657)

Net increase in cash and cash equivalents 102,033 20,342 216,028

Cash and cash equivalents at beginning of year 360,623 340,281 124,253

Cash and cash equivalents at end of year $462,656 $360,623 $340,281

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.