Nordstrom 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

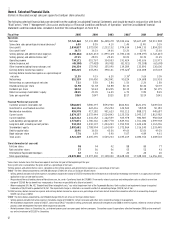

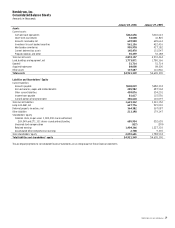

Debt Ratings

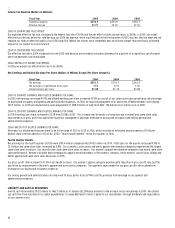

The following table shows our credit ratings at the date of this report:

Credit Ratings Moody’s

Standard

and Poor’s

Senior unsecured debt Baa1 A-

Commercial paper P-2 A-2

Outlook Stable Positive watch

These ratings could change depending on our performance and other factors. Our outstanding debt is not subject to termination or interest rate

adjustments based on changes in our credit ratings.

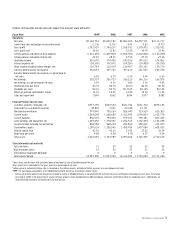

Dividends

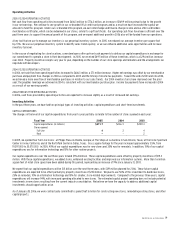

In 2005, we paid dividends of $0.32 per share, the ninth consecutive year that our annual dividends increased. We paid dividends of $0.24 and $0.205

in 2004 and 2003. In determining the amount of dividends to pay, we analyze our dividend payout ratio and our dividend yield and balance the dividend

payment with our operating performance and capital resources. We target a dividend payout ratio of approximately 18% to 20% of net income, although

the ratio has been slightly lower the last two years as a result of the significant increase in our net earnings. For the dividend yield, which is calculated

as our dividends per share divided by our stock price, we target a 1% long-term yield. While we plan to increase dividends over time, we will balance

future increases with our operating performance and available capital resources.

Liquidity

We maintain a level of liquidity to allow us to cover our seasonal cash needs and to minimize our need for short-term borrowings. We believe

that our operating cash flows, existing cash and available credit facilities are sufficient to finance our cash requirements for the next 12 months.

In October 2006, we plan to repay our $300.0 million 4.82% Private Label Securitization with proceeds from a combination of our existing borrowing

capacity and additional borrowing capacity that we expect to put in place before October 2006.

Over the long term, we manage our cash and capital structure to maximize shareholder return, strengthen our financial position and maintain

flexibility for future strategic initiatives. We continuously assess our debt and leverage levels, capital expenditure requirements, principal debt

payments, dividend payouts, potential share repurchases, and future investments or acquisitions. We believe our operating cash flows, existing

cash and available credit facilities, as well as any potential future borrowing facilities will be sufficient to fund these scheduled future payments

and potential long term initiatives.

CRITICAL ACCOUNTING POLICIES

The preparation of our financial statements requires that we make estimates and judgments that affect the reported amounts of assets, liabilities,

revenues and expenses, and disclosure of contingent assets and liabilities. We base our estimates on historical experience and on other assumptions

that we believe to be reasonable under the circumstances. Actual results may differ from these estimates. The following discussion highlights the

policies we feel are critical.

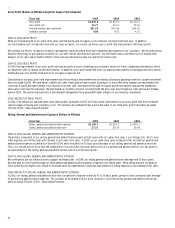

Off-Balance Sheet Financing

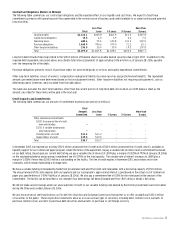

Our co-branded Nordstrom VISA credit card receivables are transferred to a third-party trust on a daily basis. The balance of the receivables

transferred to the trust fluctuates as new receivables are generated and old receivables are retired (through payments received, charge-offs,

or credits from merchandise returns). The trust issues securities that are backed by the receivables. Certain of these securities or “beneficial

interests” are sold to third-party investors and those remaining securities are issued to us.

We recognize gains or losses on the sale of the co-branded Nordstrom VISA receivables to the trust based on the difference between the face value of

the receivables sold and the estimated fair value of the assets created in the securitization process. The fair value of the assets is calculated as the

present value of their expected cash flows. The discount rate used to calculate fair value represents the volatility and risk of the assets. Assumptions

and judgments are made to estimate the fair value of our investment in asset backed securities. We have no other off-balance sheet transactions.

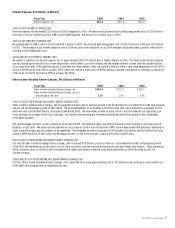

Inventory

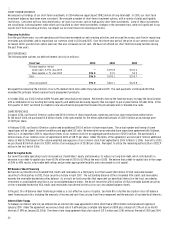

Our inventory is stated at the lower of cost or market using the retail inventory method (first-in, first-out basis). Under the retail method, the

valuation of inventories and the resulting gross margins are determined by applying a calculated cost-to-retail ratio to the retail value of ending

inventory. To determine if the retail value of our inventory should be marked down, we considered current and anticipated demand, customer

preferences, age of the merchandise and fashion trends. As our inventory retail value is adjusted regularly to reflect market conditions, our

inventory is valued at the lower of cost or market.

We also reserve for obsolescence based on historical trends and specific identification. Shrinkage is estimated as a percentage of net sales for

the period from the most recent semi-annual inventory count based on historical shrinkage results.