Nordstrom 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 7

HUMAN RESOURCE REGULATIONS

Our policies and procedures are designed to comply with human resource laws such as wage and hour, meal and rest period, and commissions.

Federal and state wage and hour laws are complex, and the related enforcement is increasingly aggressive, particularly in the state of California.

Failure to comply with these laws could result in damage to our reputation, class action lawsuits, and dissatisfied employees.

EMPLOYMENT AND DISCRIMINATION LAWS

State and federal employment and discrimination laws and the related case law continue to evolve, making ongoing compliance in this area a

challenge. Failure to comply with these laws may result in damage to our reputation, legal and settlement costs, disruption of our business, and loss

of customers and employees, which would result in a loss of net sales and increased employment costs, low employee morale and attendant harm to

our business and results of operations.

TECHNOLOGY STRATEGY

We make investments in information technology to sustain our competitive position. We spend on average approximately $150 million each year

on information technology operations and system development, and this spending is key to our growth strategy. We must monitor and choose

the right investments and implement them at the right pace. Targeting the wrong opportunities, failing to make the best investment, or making

an investment commitment significantly above or below the requirements of the business opportunity may result in the loss of our competitive

position. In addition, an inadequate investment in maintaining our current systems may result in a loss of system functionality and increased future

costs to bring our systems up to date.

We may implement too much technology, or change too fast, which could result in failure to adopt the new technology if the business is not ready or

capable of accepting it. Excessive technological change affects the effectiveness of adoption, and could adversely affect the realization of benefits

from the technology. However, not implementing enough technology could compromise our competitive position.

REGULATORY COMPLIANCE

Our policies and procedures are designed to comply with all applicable laws and regulations, including those imposed by the SEC, NYSE, the banking

industry, and foreign countries. With recent high profile business failures on accounting-related issues, additional legal and regulatory requirements

such as the Sarbanes-Oxley Act have increased the complexity of the regulatory environment. In addition, foreign laws may conflict with domestic

laws. Failure to comply with the various regulations may result in damage to our reputation, civil and criminal liability, fines and penalties, increased

cost of regulatory compliance, and restatements of financial statements.

ANTI-TAKEOVER PROVISIONS

We are incorporated in the state of Washington and subject to Washington state law. Some provisions of Washington state law could interfere with

or restrict takeover bids or other change in control events affecting us. For example, one statutory provision prohibits us, except under specified

circumstances, from engaging in any significant business transaction with any shareholder who owns 10% or more of our common stock (which

shareholder, under the statute, would be considered an “acquiring person”) for a period of five years following the time that such shareholder

became an acquiring person.

Item 1B. Unresolved Staff Comments.

None.

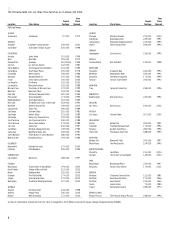

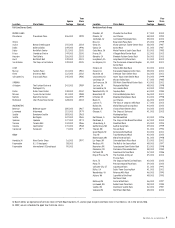

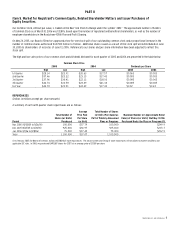

Item 2. Properties.

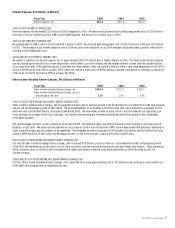

The following table summarizes the number of retail stores owned or leased by us, and the percentage of total store square footage represented

by each listed category at January 28, 2006:

Number of Stores

% of total store

square footage

Owned stores 32 25.5%

Leased stores 108 30.8%

Owned on leased land 44 42.2%

Partly owned and partly leased 3 1.5%

Total 187 100.0%

We also own six merchandise distribution centers located in Portland, Oregon; Dubuque, Iowa; Ontario, California; Newark, California; Upper Marlboro,

Maryland; and Gainesville, Florida, which are utilized by the Retail Stores segment. The Direct segment utilizes one fulfillment center in Cedar Rapids,

Iowa, which is owned on leased land. Our administrative offices in Seattle, Washington are a combination of leased and owned space. For one of our

corporate office buildings in Seattle, we own a 49% interest in a limited partnership which constructed the office building in which we are the primary

tenant. During 2002, the limited partnership refinanced its construction loan obligation with a mortgage secured by the property. This mortgage is

included in our long-term debt and is amortized as we make rental payments to the limited partnership over the life of the mortgage. We also lease

an office building in the Denver, Colorado metropolitan area that serves as an office of Nordstrom fsb and Nordstrom Credit, Inc.