Nordstrom 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Nordstrom, Inc.

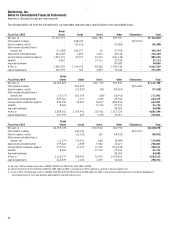

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

Loyalty Program

Customers who reach a cumulative purchase threshold when using our Nordstrom private label cards or our co-branded Nordstrom VISA credit cards

receive merchandise certificates. These merchandise certificates can be redeemed in our stores similar to gift certificates. We estimate the net

cost of the merchandise certificates that will be earned and redeemed and record this cost as the merchandise certificates are earned. The cost

of the loyalty program is not significant in relation to the corresponding sales, so the program expense is recorded in cost of sales rather than

as a reduction of net sales.

Vendor Allowances

We receive allowances from merchandise vendors for purchase price adjustments, cooperative advertising programs, cosmetic selling expenses,

and vendor sponsored contests. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been earned and the

related merchandise has been sold. Allowances for cooperative advertising programs and vendor sponsored contests are recorded in cost of sales

and selling, general and administrative expenses as a reduction to the related cost when incurred. Allowances for cosmetic selling expenses are

recorded in selling, general and administrative expenses as a reduction to the related cost when incurred. Any allowances in excess of actual costs

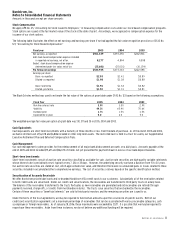

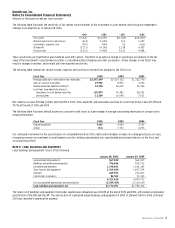

incurred that are recorded in selling, general and administrative expenses are recorded as a reduction to cost of sales. The following table shows

vendor allowances earned during the year:

Fiscal Year 2005 2004 2003

Purchase price adjustments $58,103 $47,707 $49,312

Cosmetic selling expenses 107,166 96,936 88,518

Cooperative advertising 57,575 57,786 44,939

Vendor sponsored contests 3,668 3,975 4,180

Total vendor allowances $226,512 $206,404 $186,949

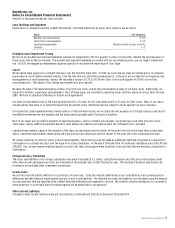

Allowances were recorded in our consolidated statement of earnings as follows:

Fiscal Year 2005 2004 2003

Cost of sales $118,104 $106,902 $55,161

Selling, general and administrative expenses 108,408 99,502 131,788

Total vendor allowances $226,512 $206,404 $186,949

Fair Value of Financial Instruments

The carrying amounts of cash equivalents and short term-investments approximate fair value. See Note 10 for the fair values of our long-term debt

and interest rate swap agreements.

Derivatives Policy

We periodically enter into foreign currency purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to

hedge against fluctuations in foreign currency prices. These forward contracts do not qualify for derivative hedge accounting. At the end of 2005

and 2004, the notional amounts of our foreign currency forward contracts at the contract rates were $6,127 and $2,644. We also use derivative

financial instruments to manage our interest rate risks. See Note 10 for a further description of our interest rate swaps.

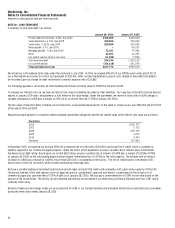

Recent Accounting Pronouncements

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs an amendment of ARB No. 43, Chapter 4.” SFAS No. 151 amends ARB No. 43, Chapter

4, “Inventory Pricing” to clarify that abnormal amounts of idle facility expense, freight, handling costs, and wasted material should be recognized as

current period charges. In addition, this statement requires that fixed overhead production be allocated to the costs of conversion based on the

normal capacity of the production facilities. SFAS No. 151 is effective for inventory costs incurred during fiscal years beginning after June 15, 2005,

and should be applied prospectively. We do not believe the adoption of SFAS No. 151 will have a material impact on our financial statements.

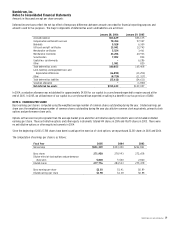

In December 2004, the FASB issued SFAS No. 123R, “Share-Based Payment.” SFAS No. 123R requires us to measure the cost of employee services

received in exchange for an award of equity instruments based on the grant-date fair value of the award. That cost will be recognized over the

period during which an employee is required to provide services in exchange for the award. We expect to adopt SFAS No. 123R in the first quarter

of 2006 under the modified prospective method. We believe adoption of SFAS No. 123R will reduce our 2006 diluted earnings per share by $0.06.

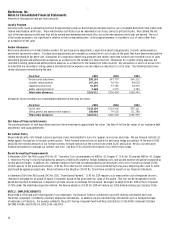

NOTE 2: EMPLOYEE BENEFITS

We provide a 401(k) and profit sharing plan for our employees. Our Board of Directors establishes our profit sharing contribution each year.

The 401(k) component is funded by voluntary employee contributions. In addition, we provide matching contributions up to a fixed percentage

of employee contributions. Our expense related to the profit sharing component and matching contributions to the 401(k) component totaled

$67,088, $54,186, and $51,720 in 2005, 2004, and 2003.