Nordstrom 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 33

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

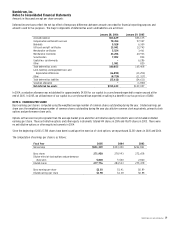

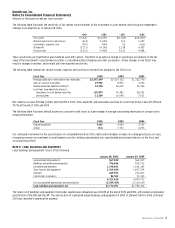

Stock Compensation

We apply APB No. 25, “Accounting for Stock Issued to Employees,” in measuring compensation costs under our stock-based compensation programs.

Stock options are issued at the fair market value of the stock at the date of grant. Accordingly, we recognized no compensation expense for the

issuance of our stock options.

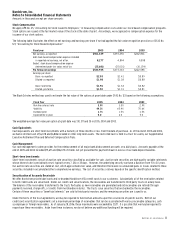

The following table illustrates the effect on net earnings and earnings per share if we had applied the fair value recognition provisions of SFAS No.

123, “Accounting for Stock-Based Compensation:”

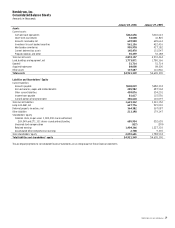

Fiscal year 2005 2004 2003

Net earnings, as reported $551,339 $393,450 $242,841

Add: stock-based compensation expense included

in reported net earnings, net of tax 8,277 4,894 9,898

Deduct: stock-based compensation expense

determined under fair value, net of tax (25,681) (25,001) (30,154)

Pro forma net earnings $533,935 $373,343 $222,585

Earnings per share:

Basic-as reported $2.03 $1.41 $0.89

Diluted-as reported $1.98 $1.38 $0.88

Basic-pro forma $1.96 $1.34 $0.82

Diluted-pro forma $1.92 $1.31 $0.81

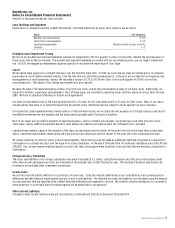

The Black-Scholes method was used to estimate the fair value of the options at grant date under SFAS No. 123 based on the following assumptions:

Fiscal Year 2005 2004 2003

Risk-free interest rate 3.9% 3.0% 2.9%

Volatility 44.3% 65.4% 70.6%

Dividend yield 1.7% 1.5% 1.5%

Expected life in years 5.0 6.0 5.0

The weighted-average fair value per option at grant date was $10, $11 and $5 in 2005, 2004 and 2003.

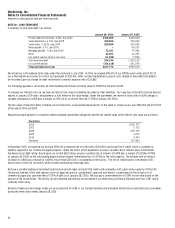

Cash Equivalents

Cash equivalents are short-term investments with a maturity of three months or less from the date of purchase. As of the end of 2005 and 2004,

we had restricted cash of $6,728 and $6,886 included in other long term assets. The restricted cash is held in a trust for use by our Supplemental

Executive Retirement Plan and Deferred Compensation Plans.

Cash Management

Our cash management system provides for the reimbursement of all major bank disbursement accounts on a daily basis. Accounts payable at the

end of 2005 and 2004 included $91,671 and $86,725 of checks not yet presented for payment drawn in excess of our bank deposit balances.

Short-term Investments

Short-term investments consist of auction rate securities classified as available-for-sale. Auction rate securities are high-quality variable rate bonds

whose interest rate is periodically reset, typically every 7, 28, or 35 days. However, the underlying security can have a duration from 15 to 30 years.

Our auction rate securities are stated at cost, which approximates fair value, and therefore there were no unrealized gains or losses related to these

securities included in accumulated other comprehensive earnings. The cost of securities sold was based on the specific identification method.

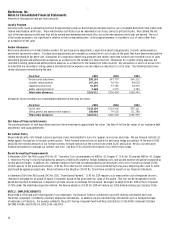

Securitization of Accounts Receivable

We offer Nordstrom private label cards and co-branded Nordstrom VISA credit cards to our customers. Substantially all of the receivables related

to both credit cards are securitized. Under our credit card securitizations, the receivables are transferred to third-party trusts on a daily basis.

The balance of the receivables transferred to the trusts fluctuates as new receivables are generated and old receivables are retired (through

payments received, charge-offs, or credits from merchandise returns). The trusts issue securities that are backed by the receivables.

Certain of these securities or “beneficial interests” are sold to third-party investors and the remaining securities are issued to us.

Under the terms of the trust agreements, we may be required to fund certain amounts upon the occurrence of specific events. Both of our

credit card securitization agreements set a maximum percentage of receivables that can be associated with various receivable categories, such

as employee or foreign receivables. As of January 28, 2006, these maximums were exceeded by $1,211. It is possible that we may be required to

repurchase these receivables. Aside from these instances, we do not believe any additional funding will be required.