Nordstrom 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

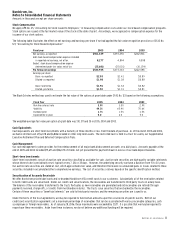

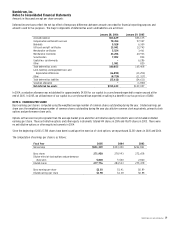

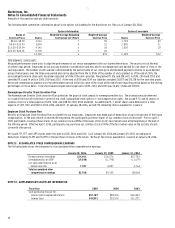

NOTE 10: LONG-TERM DEBT

A summary of long-term debt is as follows:

January 28, 2006 January 29, 2005

Private Label Securitization, 4.82%, due 2006 $300,000 $300,000

Senior debentures, 6.95%, due 2028 300,000 300,000

Senior notes, 5.625%, due 2009 250,000 250,000

Notes payable, 6.7%, due 2005 — 96,027

Mortgage payable, 7.68%, due 2020 72,633 75,406

Other 22,811 16,495

Fair market value of interest rate swap (11,050) (7,821)

Total long–term debt 934,394 1,030,107

Less current portion (306,618) (101,097)

Total due beyond one year $627,776 $929,010

We retired our 6.7% medium-term notes when they matured in July 2005. In 2004, we prepaid $196,770 of our 8.95% senior notes and $1,473 of

our 6.7% medium-term notes for a total cash payment of $220,106. After considering deferred issuance costs related to these debt retirements,

we recorded a pre-tax charge for debt retirements in interest expense, net of $20,862.

Our mortgage payable is secured by an office building which had a net book value of $78,943 at the end of 2005.

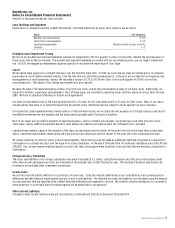

To manage our interest rate risk, we have an interest rate swap outstanding recorded in other liabilities. Our swap has a $250,000 notional amount,

expires in January 2009 and is designated as a fully effective fair value hedge. Under the agreement, we receive a fixed rate of 5.63% and pay a

variable rate based on LIBOR plus a margin of 2.3% set at six-month intervals (7.09% at January 28, 2006).

The fair value of long-term debt, including current maturities, using quoted market prices of the same or similar issues, was $963,092 and $1,105,302

at the end of 2005 and 2004.

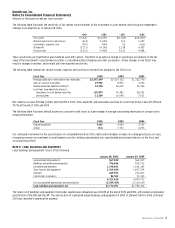

Required principal payments on long-term debt, excluding capital lease obligations and the fair market value of the interest rate swap, are as follows:

Fiscal Year

2006 $305,797

2007 5,752

2008 255,739

2009 6,270

2010 4,743

Thereafter 357,806

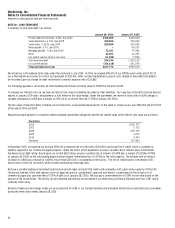

In November 2005, we replaced our existing $350,000 unsecured line of credit with a $500,000 unsecured line of credit, which is available as

liquidity support for our commercial paper program. Under the terms of the agreement, we pay a variable rate of interest and a commitment

fee based on our debt rating. Based upon our current debt rating, we pay a variable rate of interest of LIBOR plus a margin of 0.225% (4.793%

at January 28, 2006) on the outstanding balance and an annual commitment fee of 0.075% on the total capacity. The variable rate of interest

increases to LIBOR plus a margin of 0.325% if more than $250,000 is outstanding on the facility. The line of credit expires in November 2010,

and contains restrictive covenants, which include maintaining a leverage ratio.

We have a variable funding note backed by Nordstrom private label card and VISA credit card receivables with a borrowing capacity of $150,000.

The annual renewal of this note requires both our approval and our issuing bank’s approval and interest is paid based on the actual cost of

commercial paper plus specified fees of 0.15% (4.66% as of January 28, 2006). We also pay a commitment fee of 0.15% for the note based on the

amount of the commitment. The facility can be cancelled and renewal can be denied if our debt ratings fall below Standard and Poor’s BB+ rating

or Moody’s Ba1 rating.

We did not make any borrowings under our unsecured line of credit or our variable funding note backed by Nordstrom private label card receivables

during the three years ended January 28, 2006.