Nordstrom 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 37

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

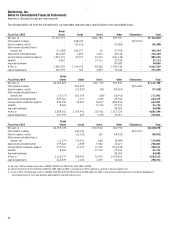

NOTE 3: POST-RETIREMENT BENEFITS

We have an unfunded Supplemental Executive Retirement Plan (“SERP”), which provides retirement benefits to certain officers and select

employees. This plan is non-qualified and does not have a minimum funding requirement.

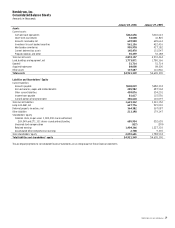

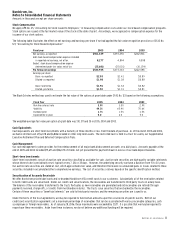

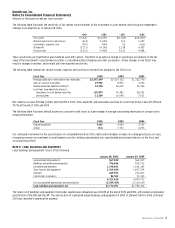

The following table provides a reconciliation of our accumulated benefit obligation:

January 28, 2006 January 29, 2005

Change in benefit obligation:

Accumulated benefit obligation at beginning of year $63,950 $59,613

Participant service cost 1,763 1,489

Interest cost 4,747 3,965

Amortization of net loss 2,615 1,543

Amortization of prior service cost 962 962

Change in additional minimum liability 12,623 (766)

Distributions (2,850) (2,856)

Accumulated benefit obligation at end of year $83,810 $63,950

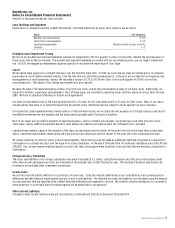

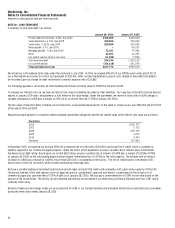

The following table details the change in plan assets, our projected benefit obligation, our funded status of the SERP, and a reconciliation

to amounts recognized in the consolidated balance sheets:

January 28, 2006 January 29, 2005

Change in plan assets:

Fair value of plan assets at beginning of year — —

Employer contribution $2,850 $2,856

Distributions (2,850) (2,856)

Fair value of plan assets at end of year — —

Projected benefit obligation 91,036 69,598

Underfunded status (91,036) (69,598)

Unrecognized prior service cost 5,198 5,266

Unrecognized loss 39,258 24,989

Accrued pension cost (46,580) (39,343)

Additional minimum liability (37,230) (24,607)

Total SERP liability $(83,810) $(63,950)

Amounts recognized in the balance sheets:

Accrued pension cost $46,580 $39,343

Intangible asset included in other assets 5,198 5,266

Deferred tax asset 12,492 7,543

Accumulated other comprehensive loss, net of tax 19,540 11,798

Net amount recognized $83,810 $63,950

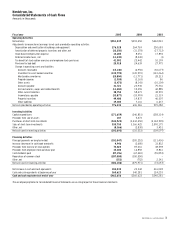

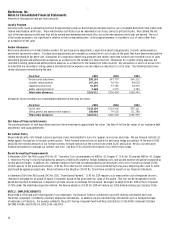

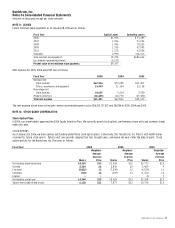

The components of SERP expense and a summary of significant assumptions are as follows:

Fiscal year 2005 2004 2003

Participant service cost $1,763 $1,489 $819

Interest cost 4,747 3,965 3,420

Amortization of net loss 2,615 1,543 751

Amortization of prior service cost 962 962 693

Total expense $10,087 $7,959 $5,683

Assumption percentages:

Discount rate 6.00% 6.25% 6.25%

Rate of compensation increase 4.00% 4.00% 4.00%

Measurement date 10/31/05 10/31/04 10/31/03

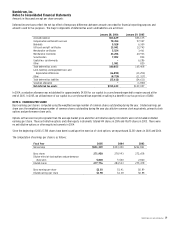

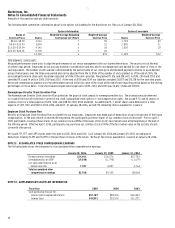

We use a discount rate that is determined by constructing a hypothetical bond portfolio based on bonds available on October 31, 2005 rated “AA” or

better by either Moody’s or Standard & Poor’s, which yield 6.077%. This assumption was built to match the expected benefit payments under the SERP.