Nordstrom 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 17

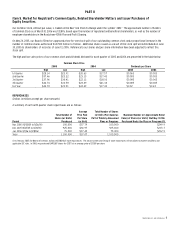

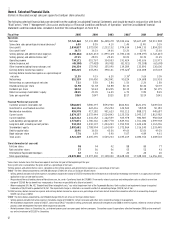

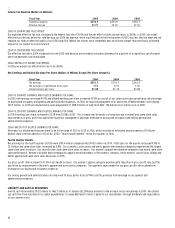

Interest Expense, Net (Dollars in Millions)

Fiscal Year 2005 2004 2003

Interest expense, net $45.3 $77.4 $91.0

2005 VS 2004 INTEREST EXPENSE, NET

Interest expense, net decreased $32.1 million in 2005 compared to 2004. The decrease is primarily due to debt prepayment costs of $20.9 million

incurred in 2004 in connection with a $198.2 million debt buyback. We did not incur similar costs in 2005.

2004 VS 2003 INTEREST EXPENSE, NET

We prepaid debt of $198.2 million in 2004 and $105.7 million in 2003. We incurred debt prepayment costs of $20.9 million in 2004 and $14.3 million

in 2003. The decrease in our interest expense, net in 2004 was due to the reduction in our 2004 average outstanding debt, partially offset by the

increase in the prepayment costs.

2006 FORECAST OF INTEREST EXPENSE, NET

We expect a reduction in interest expense, net of approximately $8 to $10 million due to higher interest income. This forecasted interest expense

can vary based upon the rate of our share repurchases, which affects our cash on hand and the related interest income, and the variable portion

of our long-term debt. Although the majority of our debt has fixed interest rates, we currently hold an interest rate swap agreement on our $250.0

million 5.625% senior notes due in January 2009, where we receive a fixed rate of 5.625% and pay a variable rate based on LIBOR plus a margin of

2.3% set at six-month intervals (7.09% at January 28, 2006).

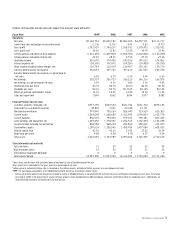

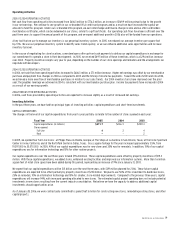

Other Income Including Finance Charges, Net (Dollars in Millions)

Fiscal Year 2005 2004 2003

Other income including finance charges, net $196.4 $172.9 $155.1

Other income including finance charges, net as a

percentage of net sales 2.5% 2.4% 2.4%

2005 VS 2004 OTHER INCOME INCLUDING FINANCE CHARGES, NET

Other income including finance charges, net increased $23.4 million, due to earnings growth in the Nordstrom fsb co-branded VISA credit card program

and our gift card breakage income of $8.0 million. The principal balances of receivables in the VISA credit card, which are held by a separate trust in

which we hold a certificated interest, increased 20.6% during 2005. The receivables growth increase, which is mostly funded by our operating cash

flows, produces an increase in the trust’s earnings. Our income from the program increased primarily because of this growth in the co-branded

receivables program.

Gift card breakage income is a new component of income in 2005. Unclaimed property legislation changed in 2004 to allow us to retain unused

balances on gift cards. We analyzed the experience of our program since it was introduced in 1999, and we determined that balances remaining on

cards issued five years ago are unlikely to be redeemed. The breakage income recognized in 2005 includes $2.6 million and $5.4 million for cards

issued in 1999 and 2000; in both cases, the breakage income is 3.4% of the amount issued as gift cards in those years.

2004 VS 2003 OTHER INCOME INCLUDING FINANCE CHARGES, NET

Our overall other income including finance charges, net increased $17.9 million, primarily from our co-branded VISA credit card program growth.

Since 2002, we marketed this credit card to our in-store customers and the inactive Nordstrom private label credit card holders. These marketing

efforts showed success in 2004, as the co-branded VISA credit card holders used the cards more extensively in 2004, resulting in a 45.7%

volume increase.

2006 FORECAST OF OTHER INCOME INCLUDING FINANCE CHARGES, NET

In 2006, other income including finance charges, net is expected to increase approximately $25 to $30 million as we continue to see growth in our

VISA credit card program and corresponding income.