Nordstrom 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

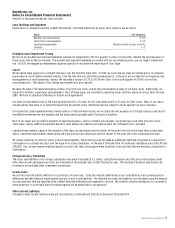

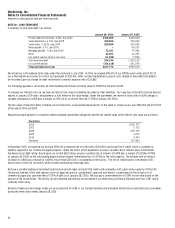

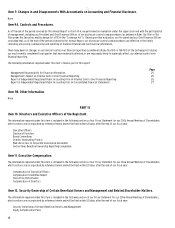

In 2005, we updated the post-retirement mortality table to better anticipate future experience and granted additional years of service for

purposes of enhancing the SERP benefit for certain mid-career new hires. In addition, we updated our assumptions relating to bonus payments.

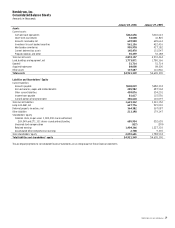

The expected future benefit payments based upon the same assumptions as of October 31, 2005 and including benefits attributable for future

employee service for the following periods are as follows:

Fiscal year

2006 $4,365

2007 4,361

2008 4,367

2009 4,428

2010 4,597

2011-2015 28,455

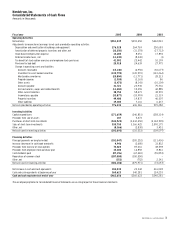

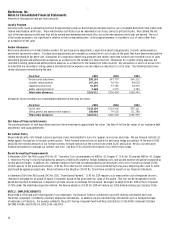

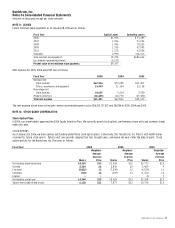

NOTE 4: INTEREST EXPENSE, NET

The components of interest expense, net are as follows:

Fiscal Year 2005 2004 2003

Interest expense on long-term debt $63,378 $88,518 $100,518

Less:

Interest income (13,273) (7,929) (5,981)

Capitalized interest (4,805) (3,161) (3,585)

Interest expense, net $45,300 $77,428 $90,952

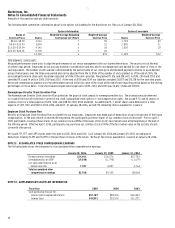

NOTE 5: INCOME TAXES

Income tax expense consists of the following:

Fiscal Year 2005 2004 2003

Current income taxes:

Federal $311,996

$282,430 $118,559

State and local 38,100

45,091 15,516

Total current income tax expense 350,096 327,521 134,075

Deferred income taxes:

Current (7,208) (15,259) (7,904)

Non-current (9,002) (58,431) 29,129

Total deferred income tax (benefit) expense (16,210) (73,690) 21,225

Total income tax expense $333,886 $253,831 $155,300

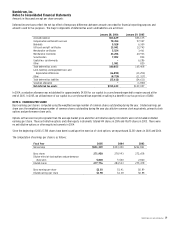

A reconciliation of the statutory Federal income tax rate to the effective tax rate on earnings before income tax expense is as follows:

Fiscal Year 2005 2004 2003

Statutory rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal

income taxes 3.2 3.5 3.1

Change in valuation allowance (0.1) 0.3 —

Other, net (0.4) 0.4 0.9

Effective tax rate 37.7% 39.2% 39.0%