Nordstrom 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 43

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Amounts in thousands except per share amounts

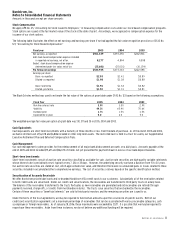

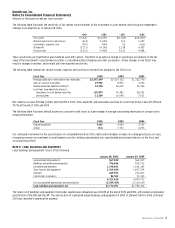

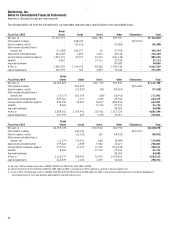

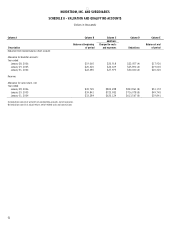

NOTE 11: LEASES

Future minimum lease payments as of January 28, 2006 are as follows:

Fiscal Year Capital Leases Operating Leases

2006 $1,946 $ 73,389

2007 1,946 73,296

2008 1,946 70,525

2009 1,376 67,892

2010 1,270 63,524

Thereafter 6,990 332,016

Total minimum lease payments 15,474 $680,642

Less amount representing interest (6,137)

Present value of net minimum lease payments $9,337

Rent expense for 2005, 2004 and 2003 was as follows:

Fiscal Year 2005 2004 2003

Minimum rent:

Store locations $62,036 $79,285 $61,451

Offices, warehouses and equipment 15,493 21,104 23,158

Percentage rent:

Store locations 10,607 9,214 7,920

Property incentives: (46,645) (46,737) (37,380)

Total rent expense $41,491 $62,866 $55,149

The rent expense above does not include common area maintenance costs of $16,105, $17,527 and $16,906 in 2005, 2004 and 2003.

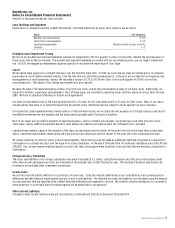

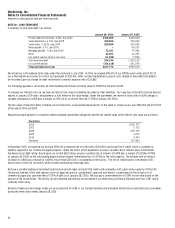

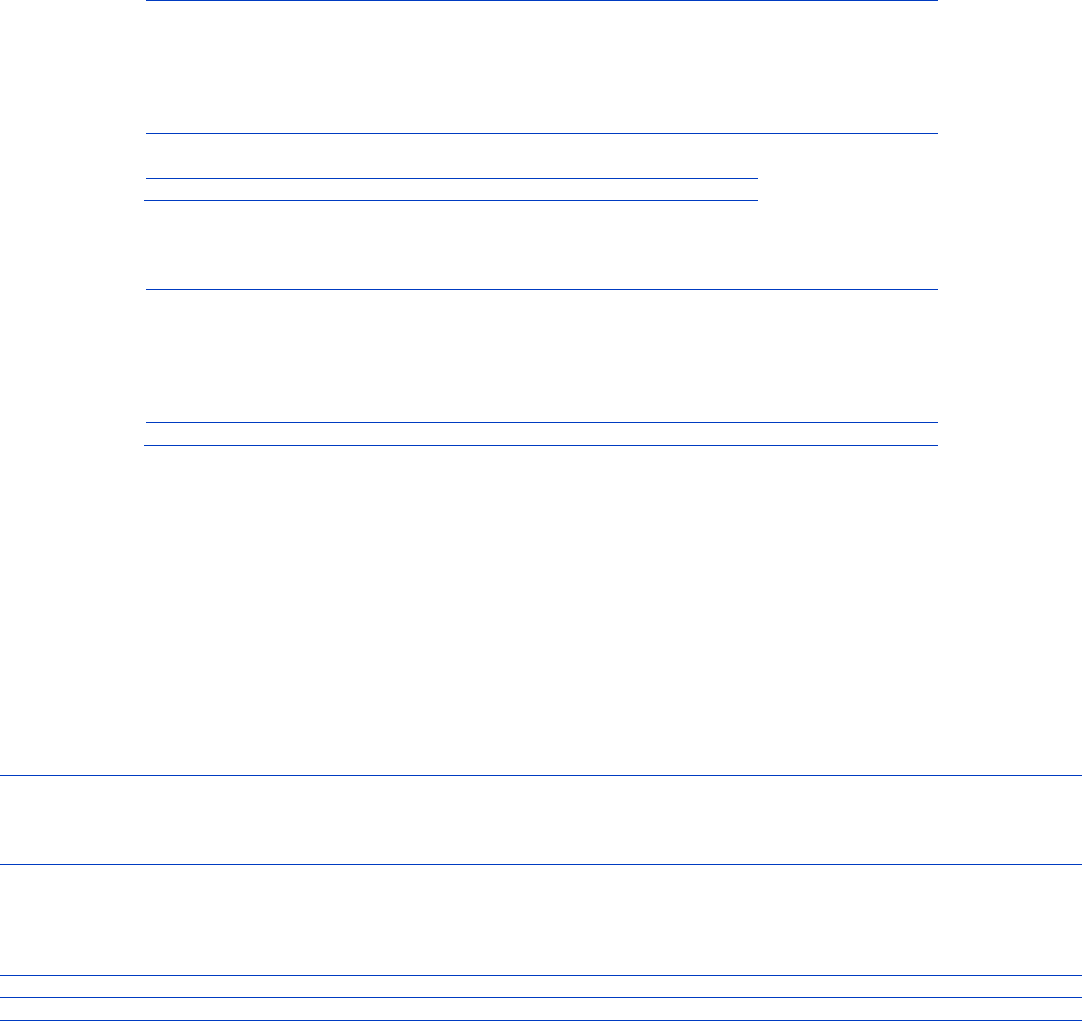

NOTE 12: STOCK-BASED COMPENSATION

Stock Option Plans

In 2004, our shareholders approved the 2004 Equity Incentive Plan. We currently grant stock options, performance share units and common shares

under this plan.

STOCK OPTIONS

As of January 28, 2006, we have options outstanding under three stock option plans, (collectively, the “Nordstrom, Inc. Plans”) with 16,189 shares

reserved for future stock grants. Options vest over periods ranging from four to eight years, and expire ten years after the date of grant. Stock

option activity for the Nordstrom, Inc. Plans was as follows:

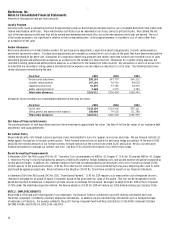

Fiscal Year 2005 2004 2003

Weighted- Weighted- Weighted-

Average Average Average

Exercise Exercise Exercise

Shares Price Shares Price Shares Price

Outstanding, beginning of year 18,320 $13 23,368 $12 23,773 $12

Granted 2,564 26 2,830 20 5,429 9

Exercised (5,822) 13 (7,239) 12 (4,520) 11

Cancelled (718) 16 (639) 13 (1,311) 12

Expired — — — — (3) 7

Outstanding, end of year 14,344 $15 18,320 $13 23,368 $12

Options exercisable at end of year 6,128 $12 7,877 $13 10,714 $13