Nordstrom 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

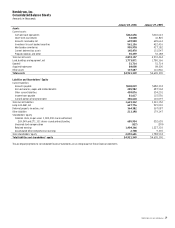

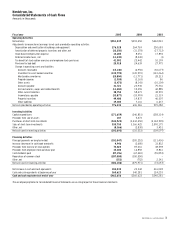

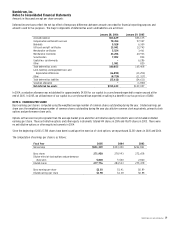

Nordstrom, Inc.

Consolidated Statements of Shareholders’ Equity

Amounts in thousands except per share amounts

Accumulated

Unearned Other

Common Stock Stock Retained Comprehensive

Shares Amount Compensation Earnings Earnings Total

Balance at January 31, 2003 270,888 $358,069 $(2,010) $1,014,105 $2,700 $1,372,864

Net earnings — — — 242,841 — 242,841

Other comprehensive earnings:

Foreign currency translation adjustment — — — — 7,379 7,379

Unrecognized loss on SERP, net of tax

of $3,304 — — — — (5,168) (5,168)

Fair value adjustment to investment in

asset backed securities, net of tax

of $(2,530) — — — — 3,957 3,957

Comprehensive net earnings — — — — — 249,009

Cash dividends paid ($0.205 per share) — — — (55,853) — (55,853)

Issuance of common stock for:

Stock option plans 4,519 57,981 — — — 57,981

Employee stock purchase plan 1,295 9,677 — — — 9,677

Stock-based compensation 51 (1,082) 1,413 — — 331

Balance at January 31, 2004 276,753 424,645 (597) 1,201,093 8,868 1,634,009

Net earnings — — — 393,450 — 393,450

Other comprehensive earnings:

Foreign currency translation adjustment — — — — 493 493

Unrecognized loss on SERP, net of tax

of $76 — — — — (119) (119)

Fair value adjustment to investment in

asset backed securities, net of tax

of $(59) — — — — 93 93

Comprehensive net earnings — — — — — 393,917

Cash dividends paid ($0.24 per share) — — — (67,240) — (67,240)

Issuance of common stock for:

Stock option plans 7,238 111,315 — — — 111,315

Employee stock purchase plan 977 14,081 — — — 14,081

Stock-based compensation 178 2,614 298 — — 2,912

Repurchase of common stock (13,815) — — (300,000) — (300,000)

Balance at January 29, 2005 271,331 552,655 (299) 1,227,303 9,335 1,788,994

Net earnings — — — 551,339 — 551,339

Other comprehensive earnings:

Foreign currency translation adjustment — — — — (1,815) (1,815)

Unrecognized loss on SERP, net of tax

of $4,950 — — — — (7,742) (7,742)

Fair value adjustment to investment in

asset backed securities, net of tax

of $(1,875) — — — — 2,930 2,930

Comprehensive net earnings — — — — — 544,712

Cash dividends paid ($0.32 per share) — — — (87,196) — (87,196)

Issuance of common stock for:

Stock option plans 5,820 112,948 — — — 112,948

Employee stock purchase plan 757 16,767 — — — 16,767

Stock-based compensation 136 3,564 (28) — — 3,536

Repurchase of common stock (8,495) — — (287,080) — (287,080)

Balance at January 28, 2006 269,549 $685,934 $(327) $1,404,366 $2,708 $2,092,681

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.