Nordstrom 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

SHORT-TERM INVESTMENTS

We reduced our holdings of our short-term investments in 2004 when we repurchased $198.2 million of long-term debt. In 2005, our short-term

investment balances have been more consistent. We evaluate a number of short-term investment options, with a variety of yields and liquidity

restrictions. Consistent with our investment policy, we invest our excess cash in high quality short-term investments. Some of these investments

are classified as cash equivalents while others are classified as short-term investments; changes in the investment mix, while not significant to our

overall short-term investing activities, can impact our net cash flows from investing activities.

Financing Activities

Over the past three years, our net operating cash flows have exceeded our net investing activities, and we used this excess cash flow to repay long-

term debt, pay dividends, and to repurchase our common stock in 2004 and 2005. Over this three-year period, the price of our common stock has

increased, which spurred stock option exercises that also increased our net cash. We have not utilized our short-term borrowing facilities during

the past three years.

DEBT REPURCHASE

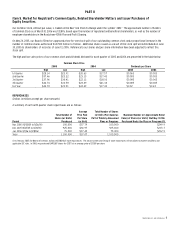

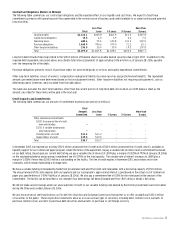

The following table outlines our debt retirement activity (in millions):

Fiscal Year 2005 2004 2003

Principal repaid or retired:

Senior notes, 8.95%, due 2005 — $196.8 $103.2

Notes payable, 6.7%, due 2005 $96.0 $1.5 $2.5

Total $96.0 $198.3 $105.7

Total cash payment $96.0 $220.1

$120.8

We repaid the remaining $96.0 million of our 6.7% medium-term notes when they matured in 2005. The cash payments in 2004 and 2003 that

exceeded the principal retired represent early prepayment premiums.

In October 2006, our $300.0 million 4.82% Private Label Securitization will mature. We intend to borrow the funds necessary to repay the Securitization

with a combination of our existing borrowing capacity and additional borrowing capacity that we expect to put in place before October 2006. In the

first quarter of 2007, we intend to establish a new securitization program that includes the private label and co-branded Visa cards.

SHARE REPURCHASE

In August 2004, our Board of Directors authorized $300.0 million of share repurchases, replacing a previous share repurchase authorization.

By the end of 2004, we purchased 13.8 million shares in the open market for the entire authorized amount of $300.0 million at an average price

of $21.71 per share.

In February 2005, our Board of Directors authorized an additional $500.0 million of share repurchases. The actual number and timing of share

repurchases will be subject to market conditions and applicable SEC rules. We entered into an accelerated share repurchase agreement with Goldman,

Sachs & Co. in September 2005 to repurchase shares of our common stock for an aggregate purchase price of $100.0 million. We purchased 2.6

million shares of our common stock on September 8, 2005 at $38.77 per share. Under the terms of the agreement, we received 0.1 million additional

shares in March 2006 based on the volume weighted average price of our common stock from September 8, 2005 to March 3, 2006. Overall for 2005,

we purchased 8.5 million shares for $287.1 million at an average price of $33.80 per share. We expect to utilize the remaining authorization of $212.9

million in the first half of 2006.

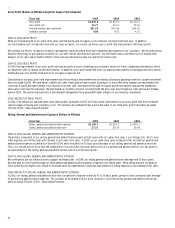

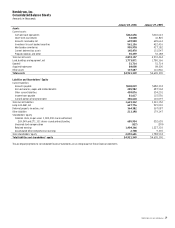

Debt-to-Capital Ratio

Our recent favorable operating results increased our shareholders’ equity and allowed us to reduce our long-term debt, which contributed to a

decrease in our debt-to-capital ratio from 43.0% at the end of 2003 to 30.9% at the end of 2005. We believe that a debt-to-capital ratio in the range

of 25% to 40% results in favorable debt ratings and provides appropriate flexibility and a reasonable cost of capital.

Off-Balance Sheet Financing

We transfer our Nordstrom co-branded VISA credit card receivables to a third-party trust that issued $200 million of VISA receivable backed

securities to third parties in 2002; those securities mature in April 2007. The outstanding balance of the co-branded VISA credit card receivables

exceeds the receivable backed securities balance. As a result, we hold securities that represent our beneficial interests in the trust, recorded as

investment in asset backed securities in our consolidated balance sheets. We do not record the $200.0 million of VISA receivable backed securities

or the co-branded Nordstrom VISA credit card receivables transferred to the trust on our consolidated balance sheets.

In the past, this off-balance sheet financing provided us a cost-effective source of capital. See Note 8 for a further description of our off-balance

sheet financing activities, including the amounts of income and cash flows arising from the arrangement and the amounts of our beneficial interests.

Interest Rate Swaps

To manage our interest rate risk, we entered into an interest rate swap agreement in 2003, which had a $250.0 million notional amount expiring in

January 2009. Under the agreement, we receive a fixed rate of 5.63% and pay a variable rate based on LIBOR plus a margin of 2.3% set at six-month

intervals (7.09% at January 28, 2006). The interest rate swap agreement had a fair value of $(11.1) million and $(7.8) million at the end of 2005 and 2004.