Nissan 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL SECTION

Nissan Annual Report 2004

86

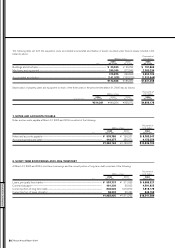

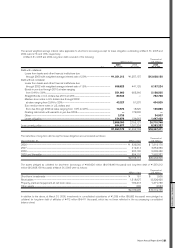

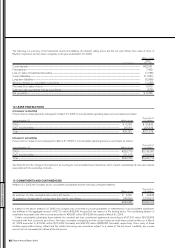

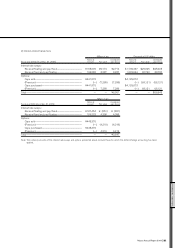

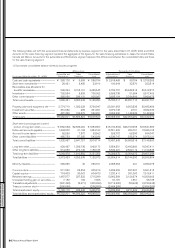

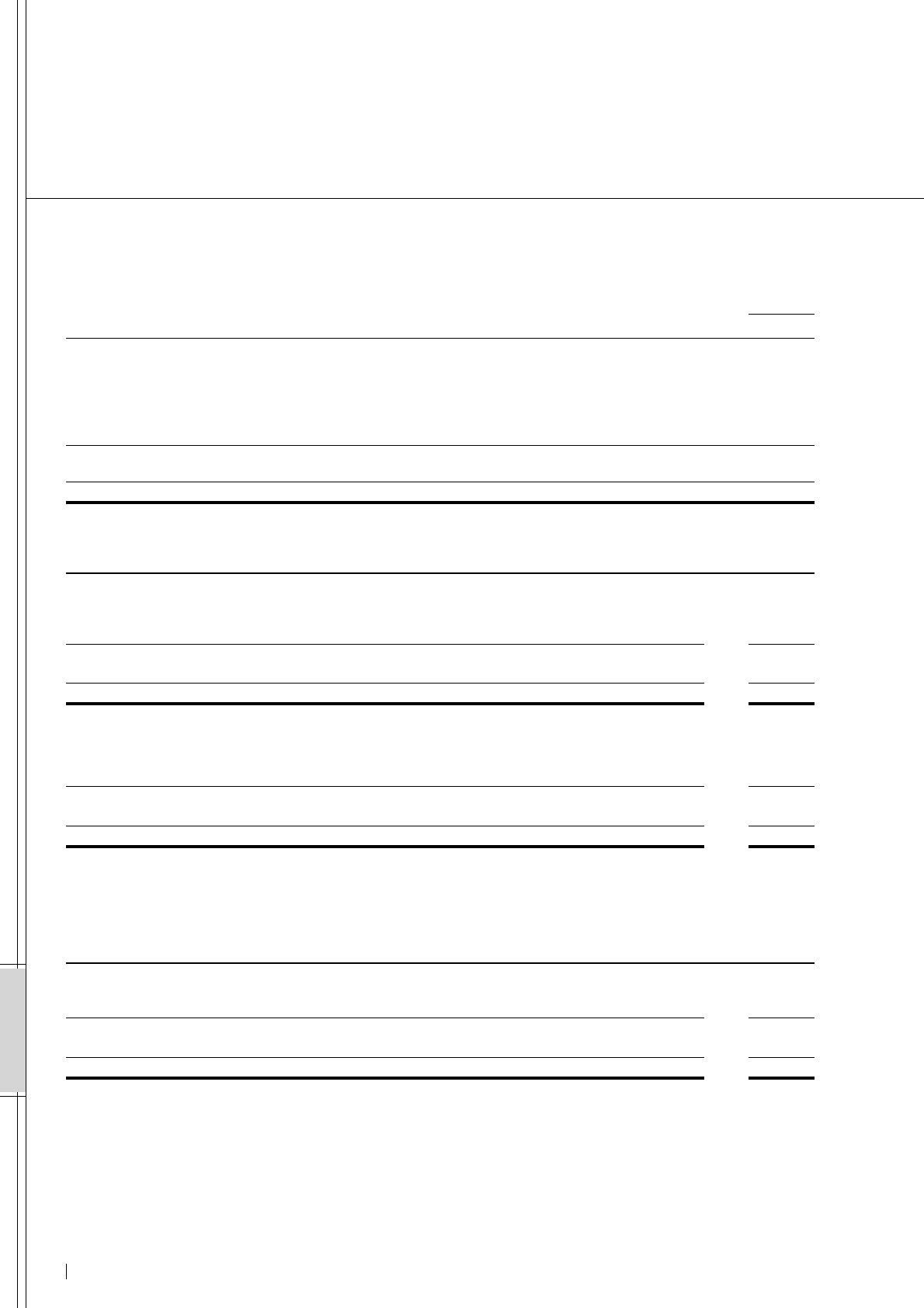

The following is a summary of the transferred assets and liabilities, the relevant selling prices and the net cash inflows from sales of stock of

Rhythm Corporation and two other companies in the year ended March 31, 2003.

Millions of yen

2002

For the year ended Mar. 31, 2003

Current assets............................................................................................................................................................................................................................................................................. ¥22,561

Fixed assets.................................................................................................................................................................................................................................................................................. 7,493

Loss on sales of investment securities .................................................................................................................................................................................................................. (1,765)

Current liabilities ....................................................................................................................................................................................................................................................................... (11,991)

Long-term liabilities................................................................................................................................................................................................................................................................ (5,366)

Minority interests in consolidated subsidiaries ................................................................................................................................................................................................ (1,962)

Proceeds from sales of stock ........................................................................................................................................................................................................................................ 8,970

Cash and cash equivalents held by subsidiaries ............................................................................................................................................................................................ (575)

Net proceeds ............................................................................................................................................................................................................................................................................... ¥ 8,395

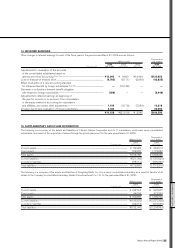

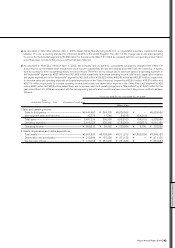

In addition to the above, at March 31, 2005, the Company was committed to provide guarantees of indebtedness of unconsolidated subsidiaries

and affiliates in the aggregate amount of ¥2,712 million ($25,346 thousand) at the request of the lending banks. The outstanding balance of

installment receivables sold with recourse amounted to ¥20,687 million ($193,336 thousand) at March 31, 2005.

Certain consolidated subsidiaries have entered into overdraft and loan commitment agreements amounting to ¥107,247 million ($1,002,308

thousand) with their customers and others. The loans receivable outstanding and the unused balances under these credit facilities as of March

31, 2005 amounted to ¥12,094 million ($113,028 thousand) and ¥95,153 million ($889,280 thousand), respectively. Since many of these

facilities expire without being utilized and the related borrowings are sometimes subject to a review of the borrowers’ credibility, any unused

amount will not necessarily be utilized at the full amount.

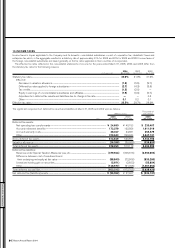

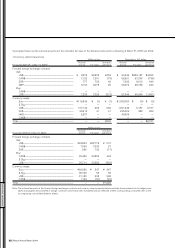

17. COMMITMENTS AND CONTINGENCIES

At March 31, 2005, the Company and its consolidated subsidiaries had the following contingent liabilities:

Thousands of

Millions of yen U.S. dollars

As endorser of notes receivable discounted with banks....................................................................................................................... ¥ 5,301 $ 49,542

As guarantor of employees’ housing loans from banks and others............................................................................................ 243,384 2,274,617

¥248,685 $2,324,159

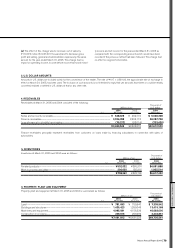

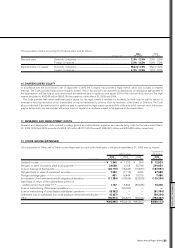

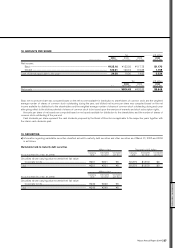

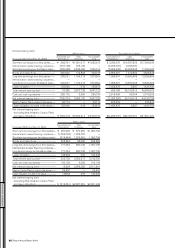

16. LEASE TRANSACTIONS

a) Lessees’ accounting

Future minimum lease payments subsequent to March 31, 2005 on noncancelable operating leases are summarized as follows:

Thousands of

Year ending Mar. 31, Millions of yen U.S. dollars

2006................................................................................................................................................................................................................................................. ¥ 5,729 $ 53,542

2007 and thereafter............................................................................................................................................................................................................ 24,004 224,336

Total................................................................................................................................................................................................................................................... ¥29,733 $277,878

b) Lessors’ accounting

Future minimum lease income subsequent to March 31, 2005 for noncancelable operating leases is summarized as follows:

Thousands of

Year ending Mar. 31, Millions of yen U.S. dollars

2006................................................................................................................................................................................................................................................. ¥228,770 $2,138,037

2007 and thereafter............................................................................................................................................................................................................ 311,015 2,906,682

Total................................................................................................................................................................................................................................................... ¥539,785 $5,044,719

See Note 2(c) for the change in the method of accounting for noncancelable lease transactions which transfer substantially all risks and rewards

associated with the ownership of assets.