Nissan 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2004

12

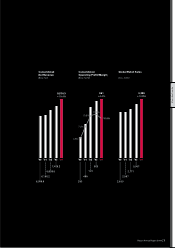

FISCAL YEAR 2004 FINANCIAL REVIEW

NISSAN REPORTED A RECORD YEAR IN TERMS OF REVENUES, OPERATING INCOME, NET INCOME,

SALES AND PRODUCTION VOLUME IN FISCAL 2004. NISSAN ACHIEVED TWO OF ITS THREE COMMITMENTS

FOR NISSAN 180: AN 8 PERCENT OPERATING PROFIT MARGIN AND ZERO NET AUTOMOTIVE DEBT.

THE REMAINING COMMITMENT IS THE ACHIEVEMENT OF ONE MILLION ADDITIONAL UNIT SALES.

AT MID-YEAR 2005, GLOBAL SALES AT 1,809,000 UNITS WERE SLIGHTLY AHEAD OF THE COMMITMENT TO

REACH 3,597,000 UNITS BY THE END OF SEPTEMBER 2005.

PERFORMANCE

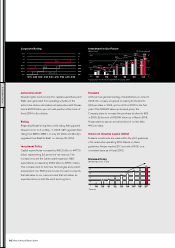

Net Sales

Consolidated net sales came to ¥8,576.3 billion, up 15.4

percent from last year. A higher volume and mix had a

positive impact of ¥707.0 billion. Movements in foreign

exchange rates produced a negative impact of ¥173.0

billion. Changes in the scope of consolidation, including

Dongfeng Motor and Yulon Nissan Motor, raised revenues

by ¥432.0 billion.

Operating Income

Consolidated operating profit improved by 4.4 percent from

last year to a record ¥861.2 billion. This resulted in an

operating profit margin of 10.0 percent. Operating profit

was affected by the following factors:

• The effect of foreign exchange rates produced a ¥78

billion negative impact for the full year. The

depreciation of the U.S. dollar against the yen resulted

in a negative impact of ¥74 billion, with an additional

¥13 billion from other currencies. The appreciation of

the euro resulted in a positive impact of ¥9 billion.

• The change in the scope of consolidation produced

a positive impact of ¥31 billion. This was primarily

from the consolidation of Dongfeng Motor and Yulon

Nissan Motor.

• The impact of the higher volume and mix contributed

¥284 billion. This was mainly driven by an increase in

U.S. sales volume.

• Selling expenses increased by ¥114 billion, also

mainly due to the increase of sales in the U.S.

• The improvement in purchasing costs amounted to

¥131 billion.

• Product enrichment and the cost of regulations had

a negative impact of ¥92 billion.

• An additional ¥44 billion was allocated to R&D to

reinforce product and technology development.

• Cost reductions from manufacturing efficiencies were

offset by costs associated with expanding the Canton

plant’s capacity, which resulted in a ¥15 billion

increase in manufacturing and logistics expenses.

• Warranty costs increased by ¥41 billion, partly due to

greater volume.

• General, administrative and other expenses increased

by ¥25.7 billion.

By region, operating profits in Japan came to ¥341.1

billion, a decrease of 3.2 percent compared to last year.

This was mainly due to unfavorable exchange rate

fluctuations and an increase in R&D expenses, which

reached a record level.

Due to higher volumes, profitability in the U.S. and

Canada increased 7.9 percent from last year and totaled

¥379.7 billion.

Operating profit in Europe was ¥56 billion, an increase

of 13.8 percent compared to last year, owing to a better

mix and higher contributions from Russia.

In General Overseas Markets, including Mexico,

operating profits came to ¥84.8 billion, an increase of 28.5

percent compared to last year. This was primarily due to the

consolidation of Dongfeng Motor and Yulon Nissan Motor.

Inter-regional eliminations were negative ¥0.4 billion.