Nissan 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL SECTION

Nissan Annual Report 2004

82

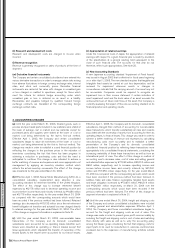

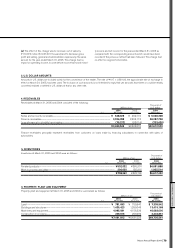

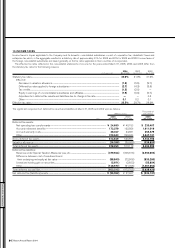

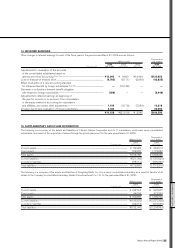

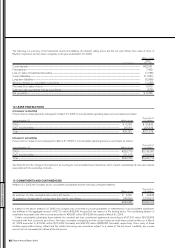

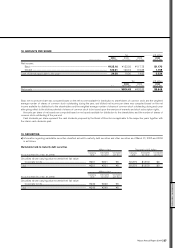

9. RETIREMENT BENEFIT PLANS

The Company and its domestic consolidated subsidiaries have defined benefit plans, i.e., welfare pension fund plans (“WPFP”), tax-qualified

pension plans and lump-sum payment plans, covering substantially all employees who are entitled to lump-sum or annuity payments, the amounts

of which are determined by reference to their basic rates of pay, length of service, and the conditions under which termination occurs. Certain

foreign consolidated subsidiaries have defined benefit and contribution plans.

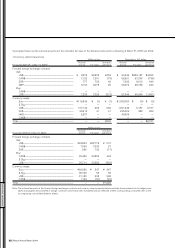

The following table sets forth the funded and accrued status of the plans, and the amounts recognized in the consolidated balance sheets as

of March 31, 2005 and 2004 for the Company’s and the consolidated subsidiaries’ defined benefit plans:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

As of Mar. 31, 2005 Mar. 31, 2004 Mar. 31, 2005

Retirement benefit obligation....................................................................................................................................... ¥(1,217,260) ¥(1,041,483) $(11,376,262)

Plan assets at fair value.................................................................................................................................................... 500,815 377,169 4,680,514

Unfunded retirement benefit obligation............................................................................................................... (716,445) (664,314) (6,695,748)

Unrecognized net retirement benefit obligation at transition ........................................................... 120,718 131,666 1,128,206

Unrecognized actuarial gain or loss........................................................................................................................ 154,689 152,867 1,445,691

Unrecognized prior service cost................................................................................................................................. (66,720) (61,833) (623,551)

Net retirement benefit obligation .............................................................................................................................. (507,758) (441,614) (4,745,402)

Prepaid pension cost........................................................................................................................................................... 445 652 4,159

Accrued retirement benefits.......................................................................................................................................... ¥ (508,203) ¥ (442,266) $ (4,749,561)

The substitutional portion of the benefits under the WPFP has been included in the amounts shown in the above table.

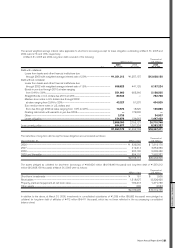

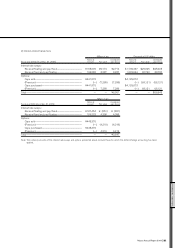

The Company received the approval from the Minister of Health, Labor and Welfare (“MHLW”) in the year ended March 31, 2003 with respect

to its application for exemption from the obligation for benefits related to future employee services under the substitutional portion of the WPFP.

Certain domestic consolidated subsidiaries received the same approval from MHLW during the year ended March 31, 2004. In accordance with

the transitional provision stipulated in “Practical Guidelines for Accounting for Retirement Benefits,” the Company and the domestic consolidated

subsidiaries accounted for the separation of the substitutional portion of the benefit obligation from the corporate portion of the benefit obligation

under their WPFPs as of the dates of approval for their exemption assuming that the transfer to the Japanese government of the substitutional

portion of the benefit obligation and related pension plan assets had been completed as of those dates. As a result, the Company recognized a

loss of ¥30,945 million for the year ended March 31, 2003 and the domestic consolidated subsidiaries recognized an aggregate gain of ¥3,669

million and an aggregate loss of ¥1,587 million for the year ended March 31, 2004. The pension assets to be transferred were calculated at

¥35,770 million for the domestic consolidated subsidiaries at March 31, 2004 and ¥241,203 million for the Company at March 31, 2003.

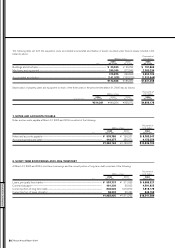

The components of retirement benefit expenses for the years ended March 31, 2005, 2004 and 2003 are outlined as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2002 2004

For the years ended Mar. 31, 2005 Mar. 31, 2004 Mar. 31, 2003 Mar. 31, 2005

Service cost....................................................................................................................................................................... ¥47,802 ¥48,418 ¥ 51,543 $446,748

Interest cost ...................................................................................................................................................................... 33,288 33,012 45,269 311,103

Expected return on plan assets........................................................................................................................ (17,999) (15,523) (26,708) (168,215)

Amortization of net retirement benefit obligation at transition................................................ 12,009 14,169 24,280 112,234

Amortization of actuarial gain or loss........................................................................................................... 12,298 18,689 11,464 114,934

Amortization of prior service cost.................................................................................................................... (5,431) (7,049) (7,762) (50,757)

Other....................................................................................................................................................................................... 179 57 5 1,673

Retirement benefit expenses ............................................................................................................................. 82,146 91,773 98,091 767,720

(Gain) loss on return of the substitutional portion of

welfare pension fund plans............................................................................................................................... (1,107) (5,594) 30,945 (10,346)

Total......................................................................................................................................................................................... ¥81,039 ¥86,179 ¥129,036 $757,374