Nissan 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2004

2

LETTER FROM THE PRESIDENT AND CEO

A public company has two key responsibilities to its

shareholders: transparency and value creation.

At Nissan, transparency is essential to our business.

Especially in uncertain times, it builds trust between a

company and its shareholders. And we believe

transparency is the best way to encourage long-term

investment in our company.

But transparency is not yet universal. Nissan is still one

of the few large corporations that publicly disclose future

business plans, performance indicators, commitments and

future dividends. We trust that these measures give

shareholders a clear view of our company’s future direction.

From the start of the Nissan Revival Plan (NRP) in

1999, we have created value by focusing on key value

drivers—particularly sales growth, operating profit margin,

and return on invested capital.

By the end of fiscal 2001 we exceeded our NRP

commitments by returning Nissan to profit one year ahead

of schedule, halving the company’s debt and over-delivering

on our commitment to achieve a 4.5 percent operating

profit margin.

Following NRP, we launched a three-year business

plan called NISSAN 180. By the end of the plan in fiscal

2004, we committed to achieve the following:

• An increase in global sales of 1 million units,

compared to the start of the plan. We are confident of

meeting this final commitment by the end of the

measurement period in September 2005.

• An 8 percent operating profit margin. For every year

of the NISSAN 180 plan our operating margin has

been at or above 10 percent topping the performance

of all global automakers.

• Zero net automotive debt. We now have more than

¥200 billion in net cash under the new and more

demanding accounting standards.

Review of 2004

Nissan lived up to its challenges in fiscal 2004, despite a

very challenging year in the global industry, full of risks

both anticipated and unexpected.

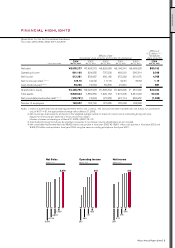

Consolidated net revenues reached ¥8 trillion 576.3

billion, up 15.4 percent from last year. Consolidated

operating profit improved by 4.4 percent to a record ¥861.2

billion. As a percentage of net revenue, our operating profit

margin came to 10 percent, which remains at the top level

among global automakers. And our net income reached

¥512.3 billion, or ¥125.16 per share, compared to ¥122.02

per share for the previous fiscal year.

NISSAN Value-Up

The Nissan revival story is now complete. Our next

three-year business plan, ‘NISSAN Value-Up,’ is focused,

as its name suggests, on delivering sustainable long-term

value to all our stakeholders. As such, it is evolutionary

not revolutionary.

As with our previous business plans, NISSAN Value-Up

establishes three core commitments. They are ambitious,

and will require us to stretch our capabilities. But they

are realistic.

Profit: Nissan will maintain the top level of operating

profit margin among global automakers for each of the

three years of the plan. Operating profit remains at the

center of our management system, as it is the most

accurate measure of business performance.

LETTER FROM CEO