Nissan 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2004 13

1,100

1,000

900

800

700

FY03

OP FY04

OP

Forex

Scope of

consolidation

Volume

/mix Sales

expenses

Purchasing

cost

reduction

Product

enrichment

R&D

expenses

Manu-

facturing

expenses

Warranty

expenses G&A

and

others

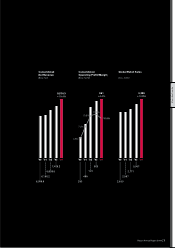

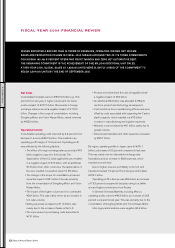

824.9 -78

+31

+284

–114

+131

–92

–44 –15 –41

–25.7 861.2

Impact on Operating Profit

(Billion Yen)

1,200

1,000

800

600

400

200

0

-200

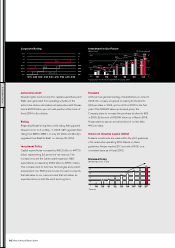

CashDebt

Net debt

at end

of FY03 Net debt

at the end

of FY04

Operating

activities

before tax Tax paid Investing

activities

Dividend

paid Other

financial

activities

FX rate

impact

+1,082.2

–203.0 –450.7

–26.0

–94.0 –99.1 +10.0 205.8

–13.6

Treasury

stock

Net Cash Flow (automotive)

(Billion Yen)

PERFORMANCE

Net Income

Net non-operating expenses totaled ¥5.5 billion, ¥9.7

billion lower than last year. This was primarily due to a ¥5.3

billion decrease in financial costs and a ¥5.3 billion

increase in equity in earnings of unconsolidated

subsidiaries and affiliates, thanks mainly to Renault. Net

extraordinary losses totaled ¥62.5 billion, ¥10.7 billion

lower than last year, mainly due to the sale of the site of

the former Murayama plant. Net income before taxes came

to ¥793.2 billion. Income taxes totaled ¥258.0 billion, with

an effective consolidated tax rate of 33 percent. Minority

interests amounted to ¥22.9 billion, mainly from Yulon

Nissan Motor. As a result, net income reached ¥512.3

billion, an increase of ¥8.6 billion.

FINANCIAL POSITION

Balance Sheet

In 2004, total consolidated assets increased by 25.3

percent to ¥9,848.5 billion.

Current assets increased by 36.4 percent, or ¥1,372.4

billion, to ¥5,139.4 billion. This increase included changes

in the scope of consolidation by ¥271.1 billion and an

increase in sales finance receivables by ¥840.6 billion

thanks to increased sales in the U.S. Fixed assets

increased by 15.1 percent, or ¥616.7 billion, to ¥4,708.0

billion. Property, plant and equipment valuation increased

by ¥593.6 billion, mainly due to capital expenditures of

¥477.5 billion and an increase in leased vehicles.

Current liabilities increased by 28.1 percent, or ¥872.2

billion, to ¥3,974.7 billion. This increase included changes

in the scope of consolidation of ¥144.4 billion and an

increase in short-term borrowings for sales financing of

¥558.5 billion.

In 2004, total shareholder equity increased from

¥2,024.0 billion to ¥2,465.8 billion. This gain was primarily

due to net income of ¥512.3 billion, offset by dividends

paid totaling ¥101.2 billion. Consolidated shareholder

equity represented 29 percent of total revenues and 25

percent of total assets.

Cash Flow

Cash from operating activities was ¥369.4 billion, below

the previous year’s level of ¥797.4 billion. This drop was

primarily caused by a ¥331.2 billion increase in finance

receivables in the U.S. and Japan. There were also

increases in inventory and income tax paid.

Cash used for investing activities increased by ¥108.9

billion to ¥865.0 billion. This increase was mainly due to an

increase of leased vehicles in the U.S.

Cash from financing activities totaled ¥521.0 billion,

including an increase in short-term borrowing of ¥666.2

billion, offset by ¥94 billion for the payment of dividends

and ¥26 billion for the acquisition of treasury stock.

In total, cash and cash equivalents increased by ¥95.6

billion to ¥289.8 billion from fiscal 2004.