Nissan 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

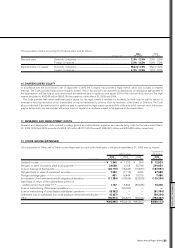

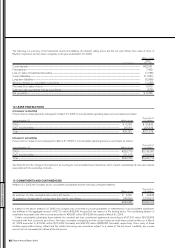

(k) Research and development costs

Research and development costs are charged to income when

incurred.

(l) Revenue recognition

Revenue is generally recognized on sales of products at the time of

shipment.

(m) Derivative financial instruments

The Company and certain consolidated subsidiaries have entered into

various derivative transactions in order to manage certain risks arising

from adverse fluctuations in foreign currency exchange rates, interest

rates, and stock and commodity prices. Derivative financial

instruments are carried at fair value with changes in unrealized gain

or loss charged or credited to operations, except for those which

meet the criteria for deferral hedge accounting under which

unrealized gain or loss is deferred as an asset or a liability.

Receivables and payables hedged by qualified forward foreign

exchange contracts are translated at the corresponding foreign

exchange contract rates.

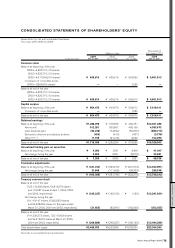

(n) Appropriation of retained earnings

Under the Commercial Code of Japan, the appropriation of retained

earnings with respect to a given financial year is made by resolution

of the shareholders at a general meeting held subsequent to the

close of such financial year. The accounts for that year do not,

therefore, reflect such appropriations. See Note 22.

(o) New Accounting Standards

A new Japanese accounting standard “Impairment of Fixed Assets”

was issued in August 2002 that is effective for fiscal years beginning

on or after April 1, 2005. The new standard requires that tangible and

intangible fixed assets be carried at cost less depreciation, and be

reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not

be recoverable. Companies would be required to recognize an

impairment loss in their income statement if certain indicators of

asset impairment exist and the book value of an asset exceeds the

undiscounted sum of future cash flows of the asset. The Company is

currently assessing the impact of this new accounting standard on its

financial position and operating results.

FINANCIAL SECTION

Nissan Annual Report 2004

78

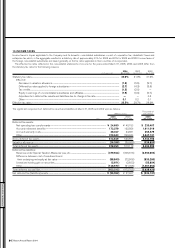

2. ACCOUNTING CHANGES

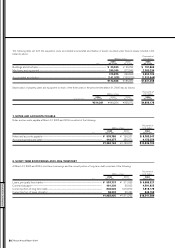

(a) Until the year ended March 31, 2003, finished goods, work in

process and purchased parts included in raw materials were stated at

the lower of average cost or market, and raw materials except for

purchased parts and supplies were stated at the lower of cost or

market, cost being determined by the last-in, first-out method.

Effective April 1, 2003, the Company and certain consolidated

subsidiaries began to value all inventories at the lower of cost or

market, cost being determined by the first-in, first-out method. This

change was made in order to establish a sound financial position by

reflecting the changes in the purchase prices in the valuation of

inventories considering the fact that there has been progress in

achieving a reduction in purchasing costs and that this trend is

anticipated to continue. This change is also intended to achieve a

better matching of revenue and expenses and more appropriate cost

management by applying an inventory valuation method which

reflects the actual inventory movements. The effect of this change

was immaterial for the year ended March 31, 2004.

(b) Effective April 1, 2003, Nissan Motor Manufacturing (UK) Ltd., a

consolidated subsidiary, implemented early adoption a new

accounting standard for retirement benefits in the United Kingdom.

The effect of this change was to increase retirement benefit

expenses by ¥2,178 million and to decrease operating income and

income before income taxes and minority interests by ¥1,686 million

and ¥2,178 million respectively, for the year ended March 31, 2004

as compared with the corresponding amounts which would have

been recorded if the previous method had been followed. Retained

earnings also decreased by ¥18,132 million since the net retirement

benefit obligation at transition and actuarial loss was charged directly

to retained earnings for the year ended March 31, 2004. The effect

of this change on segment information is explained in Note 21.

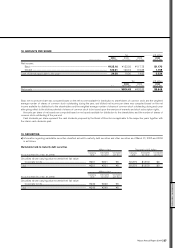

(c) Until the year ended March 31, 2003, noncancelable lease

transactions of the Company and its domestic consolidated

subsidiaries were accounted for as operating leases (whether such

leases were classified as operating or finance leases) except that

lease agreements which stipulated the transfer of ownership of the

leased assets to the lessee were accounted for as finance leases.

Effective April 1, 2003, the Company and its domestic consolidated

subsidiaries changed their method of accounting for noncancelable

lease transactions which transfer substantially all risks and rewards

associated with the ownership of assets, from accounting for them as

operating leases, to finance leases. This change was made in order to

achieve a better matching of revenue and expenses by calculating

manufacturing costs more accurately and to establish a better

presentation of the Company’s and its domestic consolidated

subsidiaries’ financial position by reflecting lease transactions more

appropriately in its consolidated financial statements, considering the

increasing materiality of these lease transactions as well as from an

international point of view. The effect of this change in method of

accounting was to decrease sales, cost of sales and selling, general

and administrative expenses by ¥17,943 million, ¥38,910 million and

¥624 million, respectively, and to increase operating income and

income before income taxes and minority interests by ¥21,591

million and ¥17,659 million respectively, for the year ended March

31, 2004 as compared with the corresponding amounts which would

have been recorded if the previous method had been followed. In

addition, trade and sales finance receivables, tangible fixed assets

and lease obligation increased by ¥70,670 million, ¥66,514 million

and ¥120,061 million respectively, at March 31, 2004 over the

corresponding amounts which would have been recorded if the

previous method had been followed. The effect of this change on

segment information is explained in Note 21.

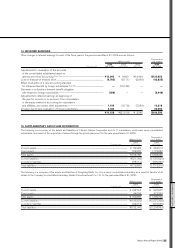

(d) Until the year ended March 31, 2004, freight and shipping costs

of the Company and certain consolidated subsidiaries were included

in selling, general and administrative expenses. Effective April 1,

2004, the Company and those consolidated subsidiaries began to

account for the freight and shipping costs as cost of sales. This

change was made in order to present gross profit more accurately by

including the freight and shipping costs in cost of sales and matching

them directly with sales as well as to unify the accounting policy

among the Nissan group considering the fact that shipping costs for

export parts to be used for manufacture in overseas countries have

increased due to the expansion of manufacturing activities outside

Japan.