Nissan 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2004

14

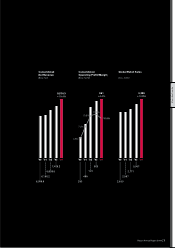

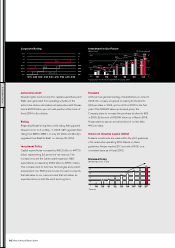

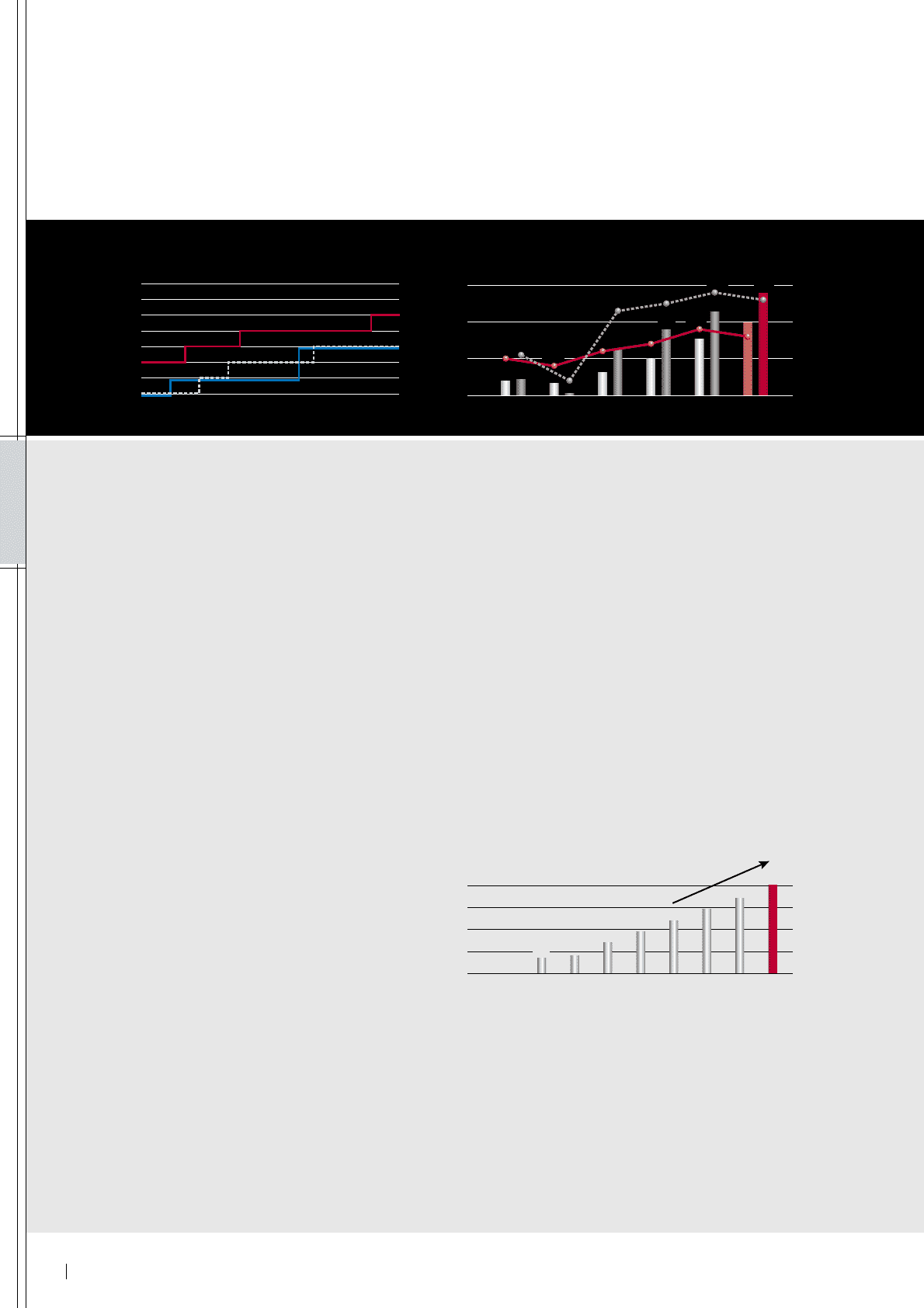

Moody’s

S&P

R&I

A+

AA–

A

A–

BBB+

BBB

BBB–

BB+

Aa3

A1

A2

A3

Baa1

Baa2

Baa3

Ba1

9/01 4/02 9/02 4/03 9/03 4/04 9/04 4/05 5/05

Corporate Rating

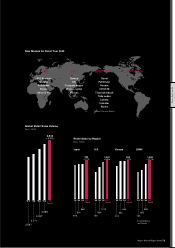

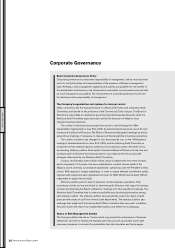

Canton plant investment included from fiscal year 2001

239 244 232

206

262

326 300

378

354

427

398

478

4.0% 3.8%

5.3% 5.5% 5.8%

5.6%

4.2% 4.4%

4.8%

4.6%

3.4%

4.1%

500

400

300

200

6

5

4

3

’99 ’00 ’01 ’02 ’03 ’04

Investment in Our Future

(Billion Yen) (% of net revenue)

40

30

20

10

0’00 ’01 ’02 ’03 ’04 ’05* ’06* ’07*’99

*Forecast

0

8

14 19

24 29 34

40

7

Dividend Policy

(Dividend per share, in yen)

PERFORMANCE

Automotive Debt:

Despite higher levels incurred for capital expenditures and

R&D, cash generated from operating activities in the

automotive division eliminated net automotive debt. Nissan

held a ¥205.8 billion yen net cash position at the close of

fiscal 2004 in this division.

Rating

Regarding Nissan’s long-term credit rating, R&I upgraded

Nissan from A- to A on May 11, 2005. S&P upgraded their

rating from BBB to BBB+ on July 20, 2004, and Moody’s

upgraded from Baa3 to Baa1 on January 29, 2004.

Investment Policy

Capital expenditures increased by ¥50.2 billion to ¥477.5

billion, representing 5.6 percent of net revenue. This

increase included the Canton plant expansion. R&D

expenditures increased by ¥43.8 billion to ¥398.1 billion.

This increase went to fund new technologies and product

development. Our R&D resources are focused on projects

that add value to our customers and that will deliver an

expected return, in both the short and long term.

Dividend

At the annual general meeting of shareholders on June 21,

2005, the company proposed increasing its dividend to

¥24 per share in 2004, up from ¥19 in 2003. In the first

year of the NISSAN Value-up dividend policy, the

Company plans to increase the per-share dividend to ¥29

in 2005. By the end of NISSAN Value-up in March 2008,

Nissan plans to pay an annual dividend of no less than

¥40 per share.

Return on Invested Capital (ROIC)

Nissan’s investments are made within the strict guidelines

of its automotive operating ROIC. Based on these

guidelines, Nissan reached 20.1 percent of ROIC on a

consistent basis as of fiscal 2003.