Nissan 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004

Annual Report

Year Ended March 31, 2005

Table of contents

-

Page 1

Annual Report 2004 Year Ended March 31, 2005 -

Page 2

... include customers, shareholders, employees, dealers, suppliers, as well as the communities where we work and operate. PERFORMANCE Automobiles Sales Finance Industrial Machinery and Marine Business Renault-Nissan Alliance Our Work Planning Brand Design Marketing Communications Technology... -

Page 3

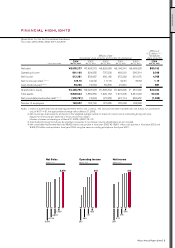

...exact yen and U.S. dollars. Number of shares outstanding as of March 31, 2005: 4,520,715,112. 3. Cash dividends during the full year by subsidiary companies to non-Nissan minority shareholders are not included. 4. Net consolidated automotive debt was ¥8,602 million cash positive in fiscal year 2002... -

Page 4

..., it builds trust between a company and its shareholders. And we believe transparency is the best way to encourage long-term investment in our company. But transparency is not yet universal. Nissan is still one of the few large corporations that publicly disclose future business plans, performance... -

Page 5

...next three years we will invest a further 5 percent of net sales annually, creating new and exciting technologies to benefit our customers. During NISSAN Value-Up we will pursue several key business opportunities: • Our Infiniti luxury brand will extend its reach into new markets such as China and... -

Page 6

... group. Toshiyuki Shiga Chief Operating Officer the brand, and are not afraid to speak out on issues and openly discuss challenges that face the business. Within the Nissan Management Way, we call that "healthy conflict"- and it strongly related to our belief in transparency and accountability... -

Page 7

..., Carlos Ghosn, Itaru Koeda, Hiroto Saikawa, Carlos Tavares BOARD OF DIRECTORS AND AUDITORS Representative Board Members Carlos Ghosn President and Co-Chairman Itaru Koeda Co-Chairman Toshiyuki Shiga Co-Chairman Board Members Tadao Takahashi Hiroto Saikawa Mitsuhiko Yamashita Carlos Tavares Shemaya... -

Page 8

.... • We committed to an 8 percent operating profit margin, and our margin has been at or above 10 percent for every year of NISSAN 180. • We committed to zero debt, and today we have more than ¥200 billion in net cash under the new and more demanding accounting standards. • Our only remaining... -

Page 9

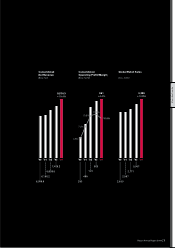

Consolidated Net Revenue (Billion Yen) Consolidated Operating Profit/Margin (Billion Yen/%) Global Retail Sales (Units: 1000s) PERFORMANCE 8,576.3 +15.4% 861 +4.4% 3,388 +10.8% 11.1% 10.8% 10.0% 7.9% 4.8% '00 '01 '02 '03 '04 '00 '01 '02 '03 '04 '00 '01 '02 '03 '04 7,429.2 6,828.6 6,... -

Page 10

... General Overseas Markets: 1,088,000 units, a 10.7 percent increase Our financial outlook Any new fiscal year brings risks and opportunities, and 2005 brings very high levels of uncertainty and risks-volatility in exchange rates, higher interest rates, higher commodity prices, higher energy prices... -

Page 11

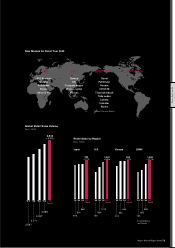

... Tiida sedan Lafesta Interstar Xterra *General Overseas Markets US/Canada PERFORMANCE Global Retail Sales Volume (Units: 1000s) 3,618 +6.8% Retail Sales by Region (Units: 1000s) Japan 933 U.S. 1,047 Europe 550 GOM* 1,088 +10% +3.3% +1.1% +10.7% '01 '02 '03 '04 '05 Forecast '02... -

Page 12

... elements that got us to this point-namely, more revenue, less cost, more quality and speed, and maximized Alliance benefit with Renault- and build upon them. NISSAN Value-Up has three critical commitments: Profit: Nissan will maintain the top level of operating profit margin among global automakers... -

Page 13

... Margin COP margin (%) NISSAN Value-Up Sales Volume (Units: 1000s) Return on Invested Capital (auto) (%) 11.1% 10.8% 10.0% Top level operating profit margin among global automakers Commitment 4,200 21.3% 19.8% 20.1%* ROIC average of 20% 7.9% 3,388 +812 2,597 +791 4.75% 12.7% PERFORMANCE... -

Page 14

FISCAL YEAR 2004 FINANCIAL REVIEW NISSAN REPORTED A RECORD YEAR IN TERMS OF REVENUES, OPERATING INCOME, NET INCOME, SALES AND PRODUCTION VOLUME IN FISCAL 2004. NISSAN ACHIEVED TWO OF ITS THREE COMMITMENTS FOR NISSAN 180: AN 8 PERCENT OPERATING PROFIT MARGIN AND ZERO NET AUTOMOTIVE DEBT. THE ... -

Page 15

... and 25 percent of total assets. Cash Flow Cash from operating activities was ¥369.4 billion, below the previous year's level of ¥797.4 billion. This drop was primarily caused by a ¥331.2 billion increase in finance FINANCIAL POSITION Balance Sheet In 2004, total consolidated assets increased by... -

Page 16

... of the NISSAN Value-up dividend policy, the Company plans to increase the per-share dividend to ¥29 in 2005. By the end of NISSAN Value-up in March 2008, Nissan plans to pay an annual dividend of no less than ¥40 per share. Return on Invested Capital (ROIC) Nissan's investments are made within... -

Page 17

...reflected in the share price. In addition, specific events relating directly to the company also had a negative impact. Later in this report, corporate officers will explain what actions Nissan has undertaken to ensure better performance. Payout Policy Nissan announced its NISSAN Value-Up three-year... -

Page 18

... BRAND STRENGTH AND INNOVATION INTO NEW BUSINESS OPPORTUNITIES. WE ARE NISSAN. WE ARE INFINITI. WE ARE NISSAN LIGHT COMMERCIAL VEHICLES, EXPANDING OUR RANGE. WE ARE NISSAN INDUSTRIAL MACHINERY, LEVERAGING OUR EXPERTISE TO BUILD FORKLIFTS AND MARINE PRODUCTS. AND WE ARE NISSAN FINANCIAL SERVICES... -

Page 19

WHO WE ARE Nissan Annual Report 2004 17 -

Page 20

... key concept in the Nissan Management Way is cross-functionality. Cross-functional teams-CFTs-and the V-Up program are powerful management tools, developed within Nissan, that reach across the functions and organizations of this global company. When employees are brought together across corporate... -

Page 21

...by open exchanges. New communications channels at Nissan now allow employees to access company information in a faster, more effective manner, and to swiftly share what they know with investors, shareholders, suppliers, the media and other interested parties. Third, we keep our management consistent... -

Page 22

...of the members of Nissan's management team. At Nissan, clear management objectives and policies are published for the benefit of the shareholders and investors, and achievements and results are announced early and with as much transparency as possible. The enhancement of corporate governance by full... -

Page 23

... rights. And the department has been performing various activities to protect and create Nissan Brand. Since the fiscal year beginning April 1, 2005, the scope of risk management has been expanded to address risks which are more strategic or those relate to business processes in addition to the... -

Page 24

... the Nissan automobile. Our vehicles are the most tangible expression of our brand and the values of our company. We make cars that both inspire passion and exceed the expectations of our customers. Through bold and thoughtful designs, innovative technologies, and a richer and more rewarding driving... -

Page 25

WHO WE ARE Nissan Annual Report 2004 23 -

Page 26

WHO WE ARE 24 Nissan Annual Report 2004 -

Page 27

... Infiniti global as part of the NISSAN Value-Up Plan. Currently available in North America, the Middle East and Taiwan, Infiniti took its first step toward becoming a truly world-class brand with its entry into South Korea in the summer of 2005. Exclusive Infiniti dealerships there will offer a full... -

Page 28

...think Nissan can profitably market LCVs in every segment and territory. Over the last two and a half years, for example, we've turned things around from a loss to an operating profit margin of 4 percent. That figure already exceeds the industry average. Now we're committed to bringing LCVs into line... -

Page 29

...our LCV strategy because we share a common goal with Renault, and that is to be the top LCV group in the world. The benefits of the Alliance include cross badging and sharing parts. We also have a CCT, or cross-company team, with Renault's LCV group, and share information and ideas every month." WHO... -

Page 30

...increased profit for the Group. All Nissan finance companies operate under strict risk management control policies and must balance the drive for profit with active sales support. In Japan, about fifty percent of customers use cash when buying a car. Corporate sales account for another 20 percent of... -

Page 31

... lease customers. Since we mainly contribute to President and CEO the Nissan global profit objective when a car is Nissan Motor Acceptance Corporation sold, we work closely with Nissan North America to support this sales process. Our overall market penetration-one of our key performance indicators... -

Page 32

... the powertrain of a forklift. However, we also benefit from other assets within Nissan, such as brand, quality, cost management, and marketing activities. The bottom line is that we contribute to the Company's total profitability. We had our highest sales and profit in fiscal 2004. We now lead the... -

Page 33

... sustainable growth at Nissan, and Alliance support is a key to attaining those objectives. While its role is not rigidly defined, the Alliance will nevertheless be an integral player in the process. A major change in the Alliance is that Carlos Ghosn now serves as CEO of Renault and Nissan. As the... -

Page 34

OUR WORK NISSAN IS A WORLD-CLASS AUTOMOBILE MANUFACTURER. TO ENVISION, PLAN, BUILD AND DISTRIBUTE MILLIONS OF AUTOMOBILES TO THE WORLD REQUIRES A CLEAR DEFINITION OF ROLES AND PROCESSES. AT NISSAN, OUR BUSINESS DIVISIONS COMMUNICATE IDEAS ACROSS COUNTRIES, CULTURES AND FUNCTIONS TO DEVISE THE ... -

Page 35

OUR WORK Nissan Annual Report 2004 33 -

Page 36

... Planning Group covers a great deal of corporate territory and handles a number of key responsibilities within Nissan. Our Corporate Planning division, for example, oversees strategy, setting the Company's long-term course under the Executive Committee's direction. The two creative divisions, Design... -

Page 37

... greater advantage of the Alliance. The value is there, in areas such as purchasing, development, benchmarking, sales networks, market knowledge and even financial strategy. Yet we must maintain both a balance and a clear separation between the brand identities of Renault and Nissan. Neither company... -

Page 38

... in Japan and Europe. Now, with new product launches rising from 44 during NISSAN 180 to 70 in NISSAN Value-Up, and with global expansion in markets outside our traditional OUR WORK The global expansion of the Infiniti brand is another example of building a brand. Developing and building Infiniti... -

Page 39

... advantageously. We're working on changing that focus, being more strategic and more opportunistic when thinking about growing our business rather than simply protecting existing assets. Some people mistake advertising or public relations, or the way you greet customers in the showroom as the brand... -

Page 40

...a visual message from the company. The brand's philosophy must be consistent, because brand value directly relates to profit. Automobiles are my main responsibility, but design-specifically visual brand identity-covers much more than that, including motor shows, showrooms, new car launch events, and... -

Page 41

..., management recognized that design was essential in building the cars that people long to own. That investment continues today. We will soon open the Imagination Factory design center in Japan. We have also expanded the Farmingham center, renovated the San Diego studio, and built the new Nissan... -

Page 42

... in all departments-even those not directly involved with sales and marketing-that customers are truly the center of our business. We work with different research experts and companies as our partners. They offer a variety of hightech techniques such as glasses with cameras that track eye movement... -

Page 43

... reflects Nissan's plans. We also gather customer feedback from the showroom to see how we can improve processes. Direct communication through online outlets is another new way of reaching out to customers. Although the total market in Japan was down in 2004, we managed to pick up market share. The... -

Page 44

... former factory foremen and engineers to various service workshops to analyze service staff performance. This will help cut repair times and improve customer satisfaction. The Nissan Sales and Service Way is also a tool used to increase the quality of service provided by all dealers. Its successful... -

Page 45

...giving back to society in a way that is consistent with the values of our company and employees. CSR and corporate citizenship are closely related because people naturally link the good works a company performs to its role in society. We want the company and its brands to touch everything we do, and... -

Page 46

... but we also have two major centers in North America and Europe, and smaller operations in Taiwan, China, Thailand, South Africa and Brazil. In the past, these entities were mostly standalone operations, but today there are many more joint projects off, of course, so it's difficult to evaluate our... -

Page 47

...the very early planning stages. This means we have to be much more open than before, but in return we will gain a great deal from the ideas our partners bring. The Alliance with Renault is another major strength for Nissan R&D. We identify areas of mutual interest and decide which party will develop... -

Page 48

...time taken for post-accident rescue. In the past, safety technology primarily focused on dealing with damage in and around the vehicle, such as airbags, body structure design, seatbelts and crumple zones. Now we are studying normal driving conditions and researching how we can keep car and driver in... -

Page 49

.... Nissan is developing new hybrid technology as well. However, we do not believe this technology is sufficiently mature enough yet for wide application in the market. It would be easy to sell 1,000 or 10,000 cars, but that is neither an effective solution for the environment nor a financially viable... -

Page 50

... the company." NISSAN Value-Up period, that focus evolves towards being the global cost leader. One of the key breakthrough strategies of NISSAN Value-Up is the focus on new and emerging markets. On the sales side, markets like China, India, Russia and ASEAN represent significant opportunities for... -

Page 51

... of the ways we express our brand. Quality builds the trust of our customers and stakeholders, so it is also a major element in promoting the brand. Quality was a major issue for us in 2004. We were unable to reach the global goals we set because a great deal of time was spent addressing issues that... -

Page 52

..., while Renault began building our Pickup and Xterra at its factory in Brazil. We also started production of common engines with Renault, with our subsidiary Aichi Kikai and the Yokohama plant producing the four-cylinder engines used in our new Tiida, Note and Lafesta models. In Japan, we launched... -

Page 53

...utilize the 'strike zone,' where supplies must be delivered within the reach of the factory workers, which improves quality and productivity. This is related to logistics, so we involve our production partners from the early stages of planning. OUR WORK MANUFACTURING IN NORTH AMERICA North America... -

Page 54

... great people working for us, the Nissan Production Way is what made this success possible. Europe is an incredibly competitive market, with 15 companies trying to gain market share. We decided not to compete directly in fundamental segments. Instead, we chose to build unique, profitable vehicles... -

Page 55

... importance, as they illustrate our capability to manage the relationship between volume objectives and profitability. In North America, incentives for the Nissan and Infiniti brands are at the lowest end of the market, yet global retail sales volumes are up 22 percent over the past three years. We... -

Page 56

... future negative impact on operating profit. Our funding came from a bond issue, which got a favorable response in the market despite bad market conditions. Transparent communication with investors worked. Nissan is currently rated a triple-B+ by the major international rating agencies. Our goal is... -

Page 57

...the sales finance companies, but that strategy will change after our rating improves. With a higher rating we can develop diversified sources of funding. We will strive to achieve a healthy balance between the diversification of funds and cost efficiencies by utilizing sound financial management. In... -

Page 58

... for all managers at Nissan. These efforts to promote diversity are transforming our corporate culture. One of the most interesting developments of NISSAN 180 was the advent of the Career Coach system, which we imported from our Alliance partner, Renault. In a modern business structure, HR is... -

Page 59

... Company. When this office started in October 2004, only 1.6 percent of all managers and 5.7 percent of the total workforce were women. By the end of NISSAN Value-Up, our target is to have 5 percent of qualified female managers. To accomplish this, we promote the career development of women and hold... -

Page 60

OUR WORLD NISSAN HAS A GLOBAL PRESENCE. BORN IN JAPAN, WE ARE PERFECTLY AT HOME IN THE U.S., THE UK, SPAIN, THAILAND, CHINA, EGYPT, BRAZIL AND WELL OVER 150 OTHER NATIONS WHERE NISSAN CARS AND THEIR COMPONENT PARTS ARE PRODUCED, SOLD AND DRIVEN. WITH NISSAN, DRIVING PLEASURE IS A SENSATION THAT ... -

Page 61

OUR WORLD Nissan Annual Report 2004 59 -

Page 62

...to develop a more efficient marketing strategy that is aligned with our quality products. The second is to build a more efficient dealership network, which will boost customer satisfaction. If we succeed at these, we can raise both our sales and our customer retention rate. Our dealers are reporting... -

Page 63

... other mature markets, an incentive war is raging in Europe. Nissan's position here, as elsewhere, is to use incentives selectively and to always protect profitability. Providing products which customers recognize and appreciate for their style and attributes rather than being the best deal is the... -

Page 64

... vehicles-very close to the transaction price, and with limited reliance on incentives. That's been our strategy for four years, and it works. Customers understand that we provide a great product at a fair price. The other key to our success has been a very consistent marketing message. The SHIFT_... -

Page 65

...upgrading Nissan dealer facilities up to 2004. This will continue to some degree in 2005 and 2006, while we've begun the same process for Infiniti. People see exciting change happening at Nissan and Infiniti. Over the long term, one minor risk for us is that we can no longer catch people by surprise... -

Page 66

..., KATSUMI NAKAMURA President & CEO, Dongfeng Motor Co., Ltd. of our products. We're also planning to export these models to Africa, South America, and the Middle East. Two or three years ago, the passenger vehicle market in China was a seller's market. That reversed during the last half of the year... -

Page 67

...level to nearly 80 percent. One of the reasons for DFL's success is that we manage the company based on mid- and long-term plans. In 2004, we developed and implemented strategies for DFL, such as brand building with the Teana. Based on that foundation, we brought more products to market, such as the... -

Page 68

... in each market. However, we've recently altered our strategy in an effort to unify the brand and OUR WORLD service level. Emphasizing the importance of consistency to the sales companies has made it much easier to promote the Nissan way of doing business. We have also increased our shares in local... -

Page 69

...to Nissan's performance in both volume expansion and profitability. And the operating profit margin for GOM is better than the corporate average. The strongest regions in my territory were several African nations, such as South Africa, and Latin America. Our success was due in part to general market... -

Page 70

FINANCIAL SECTION FINANCIAL SECTION 68 Nissan Annual Report 2004 -

Page 71

Contents Consolidated Five-Year Summary Business and Other Risks Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Auditors Non-... -

Page 72

...Figures for net income per share are in exact yen and U.S. dollars. Number of shares outstanding as of March 31, 2005: 4,520,715,112. 3. Cash dividends during the full year by subsidiary companies to non-Nissan minority shareholders are not included. Sales and Production (units) For the years ended... -

Page 73

... strict risk management policies. However, the sales financing companies have a high exposure to interest-rate risk, residual value risk, and credit risk, any one of which may adversely affect Nissan's financial position and results of operations. Counterparty Credit Risk Nissan does business with... -

Page 74

CONSOLIDATED BALANCE SHEETS Nissan Motor Co., Ltd. and Consolidated Subsidiaries Fiscal years 2004 and 2003 Millions of yen Thousands of U.S. dollars (Note 3) 2003 ASSETS Current assets: Cash and cash equivalents Short-term investments (Notes 8 and 19) Receivables, less allowance for doubtful ... -

Page 75

...,538,682 (2,494,289) 23,044,393 FINANCIAL SECTION Capital surplus Retained earnings Unrealized holding gain on securities Translation adjustments Less treasury common stock, at cost; 141,235,573 shares in 2004 and 122,116,426 shares in 2003 Total shareholders' equity (266,889) 2,465,750 (245,237... -

Page 76

... OF INCOME Nissan Motor Co., Ltd. and Consolidated Subsidiaries Fiscal years 2004, 2003 and 2002 2004 For the years ended Mar. 31, 2005 Millions of yen 2003 Mar. 31, 2004 Thousands of U.S. dollars (Note 3) Mar. 31, 2003 2002 2004 Mar. 31, 2005 Net sales Cost of sales Gross profit (Notes 6 and... -

Page 77

... at beginning of the year Net income Cash dividends paid Bonuses to directors and statutory auditors Other (Note 14) Balance at end of the year Unrealized holding gain on securities Balance at beginning of the year Net change during the year Balance at end of the year Translation adjustments... -

Page 78

... in the scope of consolidation Proceeds from sales of subsidiaries' stock resulting in changes in the scope of consolidation (Note 15) Additional acquisition of shares of consolidated subsidiaries Other Net cash used in investing activities Financing activities Increase (decrease) in short-term... -

Page 79

... based on general price-level accounting. The related revaluation adjustments made to reflect the effect of inflation in those countries in the accompanying consolidated financial statements have been charged or credited to operations and are directly reflected in retained earnings. Investments in... -

Page 80

...as well as to unify the accounting policy among the Nissan group considering the fact that shipping costs for export parts to be used for manufacture in overseas countries have increased due to the expansion of manufacturing activities outside Japan. FINANCIAL SECTION 78 Nissan Annual Report 2004 -

Page 81

... 2004 Mar. 31, 2005 As of Mar. 31, 2004 Finished products ...¥502,032 Work in process and other...206,030 ...¥708,062 ¥386,874 155,918 ¥542,792 $4,691,888 1,925,514 $6,617,402 FINANCIAL SECTION 6. PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment at March 31, 2005 and 2004 is... -

Page 82

... forth the acquisition costs and related accumulated amortization of assets recorded under finance leases included in the balances above: Millions of yen 2004 2003 Mar. 31, 2005 Thousands of U.S. dollars 2004 Mar. 31, 2005 As of Mar. 31, 2004 Buildings and structures ...Â¥ 20,530 Machinery and... -

Page 83

...: Millions of yen Thousands of U.S. dollars Short-term investments ...¥ 161 Receivables ...1,318,927 Property, plant and equipment, at net book value ...789,418 Other assets ...699 ¥2,109,205 $ 1,505 12,326,420 7,377,738 6,533 $19,712,196 FINANCIAL SECTION In addition to the above, at March 31... -

Page 84

...WPFPs as of the dates of approval for their exemption assuming that the transfer to the Japanese government of the substitutional portion of the benefit obligation and related pension plan assets had been completed as of those dates. As a result, the Company recognized a loss of ¥30,945 million for... -

Page 85

... Discount rates Expected return on assets Domestic companies ...Foreign companies...Domestic companies ...Foreign companies... 2.3% - 2.5% 2.5% - 9.5% Mainly 3.0% 2.2% - 9.5% 2.3% - 2.5% 5.0% - 7.0% Mainly 3.0% 7.0% - 9.0% 10. SHAREHOLDERS' EQUITY In accordance with the Commercial Code of Japan... -

Page 86

...Japan applicable to the Company and its domestic consolidated subsidiaries consist of corporation tax, inhabitants' taxes and enterprise tax, which, in the aggregate, resulted in a statutory rate...Deferred tax assets: Net operating loss carryforwards ...Â¥ 24,660 Accrued retirement benefits...172,379 ... -

Page 87

... (520,692) $ (718,318) The following is a summary of the assets and liabilities of Dongfeng Motor Co., Ltd., a newly consolidated subsidiary, as a result of transfer of all shares to the Company's consolidated subsidiary, Nissan China Investment Co., Ltd. for the year ended March 31, 2005. Millions... -

Page 88

... assets and liabilities, the relevant selling prices and the net cash inflows from sales of stock of Rhythm Corporation and two other companies in the year ended March 31, 2003. Millions of yen 2002 Mar. 31, 2003 For the year ended Current assets...Fixed assets ...Loss on sales of investment... -

Page 89

... rights. Amounts per share of net assets are computed based on net assets available for distribution to the shareholders and the number of shares of common stock outstanding at the year end. Cash dividends per share represent the cash dividends proposed by the Board of Directors as applicable to the... -

Page 90

Marketable other securities Millions of yen Fiscal year 2004 (As of Mar. 31, 2005) Acquisition cost Carrying value Unrealized gain (loss) Thousands of U.S. dollars Acquisition cost Carrying value Unrealized gain (loss) Securities whose carrying value exceeds their acquisition cost: Stock ...Â¥3,781... -

Page 91

..., the "Group") utilize derivative transactions for the purpose of hedging their exposure to fluctuation in foreign exchange rates, interest rates and market prices. However, based on an internal management rule on financial market risk (the "Rule") approved by the Company's Board of Directors, they... -

Page 92

... 31, 2005 and 2004: 1) Currency-related transactions Millions of yen Thousands of U.S. dollars Unrealized gain (loss) Notional amount Fair value Unrealized gain (loss) Fiscal year 2004 (As of Mar. 31, 2005) Notional amount Fair value Forward foreign exchange contracts Sell: US$ ...CAN$...ZAR... -

Page 93

...376 (-) ¥445,376 (-) - ¥ (851) 4,398 ¥ (851) 4,398 (4,219) 4,219 - (4,219) 4,219 ¥3,547 Note: The notional amounts of the interest rate swaps and options presented above exclude those for which the deferral hedge accounting has been applied. FINANCIAL SECTION Nissan Annual Report 2004 91 -

Page 94

...sales financing segment. These products, which are sold in Japan and overseas, principally in North America and Europe, include passenger cars, buses and trucks as well as the related components. Financial services include primarily leases and credits principally in Japan and North America. Business... -

Page 95

... their method of accounting for noncancelable lease transactions which transfer substantially all risks and rewards associated with the ownership of assets, from accounting for them as operating leases, to finance leases. The effect of this change was to decrease sales and operating expenses in the... -

Page 96

... for the sales financing subsidiaries in Japan, the United States, Canada and Mexico. Amounts for the automobile and Eliminations segment represent the differences between the consolidated totals and those for the sales financing segment. 1) Summarized consolidated balance sheets by business segment... -

Page 97

...) Automobile and Eliminations Sales Financing Consolidated total Cash and cash equivalents ...¥ 190,135 Short-term investments ...319 Receivables, less allowance for doubtful receivables ...246,310 Inventories ...536,172 Other current assets ...284,614 Total current assets ...1,257,550 ¥ 4,029... -

Page 98

... from third parties ...209,291 1,164,213 Internal loans to sales financing companies ...- - Long-term borrowings per the balance sheet ...209,291 1,164,213 Lease obligation ...153,960 916 Total interest bearing debt ...74,385 3,872,738 Cash and cash equivalents ...280,176 9,608 Net interest bearing... -

Page 99

... and Eliminations Sales Financing Consolidated total (4,623) (5,322) (5,754) Net sales ...¥6,432,720 ¥395,868 Cost of sales ...4,617,368 254,956 Gross profit ...1,815,352 140,912 Operating income ...677,348 59,882 Operating income as a percentage of net sales...10.5% 15.1% Net financial cost... -

Page 100

... sales finance receivables...Others ...Net cash provided by (used in) operating activities ...Investing activities Proceeds from sales of investment securities including shares of subsidiaries ...Proceeds from sales of property, plant and equipment...Purchases of fixed assets ...Purchases of leased... -

Page 101

... ...57,936 Net cash provided by (used in) operating activities ...1,042,441 Investing activities Proceeds from sales of investment securities including shares of subsidiaries ...40,488 Proceeds from sales of property, plant and equipment ...53,827 Purchases of fixed assets ...(422,326) Purchases... -

Page 102

... ...(115,097) Net cash provided by (used in) operating activities ...797,347 Investing activities Proceeds from sales of investment securities including shares of subsidiaries ...39,816 Proceeds from sales of property, plant and equipment ...94,828 Purchases of fixed assets ...(376,429) Purchases... -

Page 103

... segment information for the Company and its consolidated subsidiaries for the years ended March 31, 2005, 2004 and 2003 is as follows: Fiscal year 2004 (For the year ended Mar. 31, 2005) Japan North America Europe Other foreign countries Millions of yen Total Eliminations Consolidated Sales to... -

Page 104

...) North America Europe Other foreign countries Total Millions of yen FINANCIAL SECTION Overseas sales...¥2,785,334 Consolidated net sales...Overseas sales as a percentage of consolidated net sales ...40.8% ¥974,872 14.3% ¥763,368 11.1% ¥4,523,574 6,828,588 66.2% 102 Nissan Annual Report... -

Page 105

...280-21 of the Commercial Code of Japan and a resolution approved at the annual general meeting of the shareholders held on June 23, 2004, the Board of Directors of the Company resolved on April 15, 2005 to grant stock subscription rights free of charge to certain employees of the Company and certain... -

Page 106

... financial position of Nissan Motor Co., Ltd. and consolidated subsidiaries at March 31, 2005 and 2004, and the consolidated results of their operations and their cash flows for each of the three years in the period ended March 31, 2005 in conformity with accounting principles generally accepted... -

Page 107

...520,715,112. 3. Cash dividends paid represent the amounts proposed by the Board of Directors as applicable to the respective years, together with the interim cash dividends paid. 4. Cash dividends applicable to fiscal year 2004 is ¥24.00 per share. FINANCIAL SECTION Nissan Annual Report 2004 105 -

Page 108

... Services Co., Ltd. Autech Japan, Inc. Nissan Real Estate Development Corporation Nissan Finance Co., Ltd. Aichi Nissan Motor Co., Ltd. Tokyo Nissan Motor Sales Co., Ltd. Nissan Prince Tokyo Motor Sales Co., Ltd. Nissan Chuo Parts Sales Co., Ltd. US Nissan North America, Inc. Nissan Motor Acceptance... -

Page 109

... Management of European manufacturing and sales Financing for group companies Sales of automobiles and parts Sales of automobiles and parts Holding company for English subsidiaries Sales of automobiles and parts Manufacture and sales of automobiles and parts Research and development, testing Sales... -

Page 110

... and affiliates accounted for by the equity method As of Mar. 31, 2005 Company Japan Nissan Diesel Motor Co., Ltd. Kinugawa Rubber Industrial Co., Ltd. France Renault Location Principal business Capital (millions) Nissan share*(%) Ageo Saitama Chiba, Chiba Manufacture and sales of automobiles... -

Page 111

CORPORATE OFFICERS Carlos Ghosn Chief Executive Officer North American Operations (MC-NA & MC-US) Global Communications, CSR and IR Global Internal Audit Shiro Nakamura Senior Vice President Design Kazuhiko Toida Senior Vice President Japan Marketing & Sales MC-Dealer Dealer Network Div. Fleet ... -

Page 112

...Investor Relations Nissan Motor Co., Ltd. Global Communications, CSR and IR Division 17-1, Ginza 6-chome, Chuo-ku Tokyo 104-8023, Japan phone: +81(0)3-5565-2334 fax: +81(0)3-3546-2669 e-mail: [email protected] Corporate Information Website http://www.nissan-global.com/ Investor Relations... -

Page 113

This annual report is printed on recycled paper. Nissan Annual Report 2004 c3 -

Page 114