Memorex 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

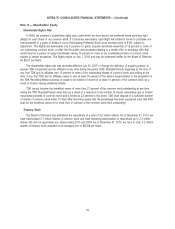

The following table sets forth the minimum rental payments under operating leases with non-cancelable terms in

excess of one year as of December 31, 2010:

2011 2012 2013 2014 2015 Thereafter Total

(In millions)

Minimum lease payments . . . . . . . . . . . . . . . . . . . . . . . . . $9.0 $5.2 $2.2 $0.9 $0.3 $— $17.6

Minimum payments have not been reduced by minimum sublease rentals of approximately $1.7 million due in the

future under non-cancelable lease agreements.

Environmental Matters

Our operations are subject to a wide range of federal, state and local environmental laws. Environmental remediation

costs are accrued when a probable liability has been determined and the amount of such liability has been reasonably

estimated. These accruals are reviewed periodically as remediation and investigatory activities proceed and are adjusted

accordingly. Compliance with environmental regulations has not had a material adverse effect on our financial results. As

of December 31, 2010, we had environmental-related accruals totaling $0.5 million recorded in other liabilities and we have

minor remedial activities underway at one of our facilities. We believe that our accruals are adequate, though there can be

no assurance that the amount of expense relating to remediation actions and compliance with applicable environmental

laws will not exceed the amounts reflected in our accruals.

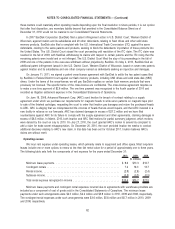

Note 16 — Related Party Transactions

As a result of the TDK Recording Media business acquisition, TDK became our largest shareholder and owned

approximately 20 percent of our shares as of December 31, 2010 and 2009. In connection with the acquisition we entered

into a Supply Agreement and a Transition Services Agreement with TDK. Under the Transition Services Agreement, TDK

provided certain services to assist in the transfer of the TDK Recording Media business to Imation.

In 2010, 2009 and 2008 we purchased products and services in the aggregate amounts of approximately $28 million,

$64 million and $80 million, respectively, from TDK or its affiliates. We did not sell products nor provide services to TDK or

its affiliates in 2010, 2009 or 2008. Fees under the Transition Services Agreement were approximately $3 million and

$10 million in 2009 and 2008, respectively. These transition services were completed in July 2009. Trade payables to TDK

or its affiliates were $6.2 million and $7.2 million at December 31, 2010 and 2009, respectively. We had $0.0 million and

$0.1 million trade receivables from TDK or its affiliates at December 31, 2010 and 2009, respectively.

On January 13, 2011, the Board of Directors approved a restructuring plan to discontinue tape coating operations at

our Weatherford, Oklahoma facility by April 2011 and subsequently close the facility. We signed a strategic agreement with

TDK to jointly develop and manufacture magnetic tape technologies. Under the agreement, we will collaborate on the

research and development of future tape formats in both companies’ research centers in the U.S. and Japan, while

consolidating tape coating operations to the TDK Group Yamanashi manufacturing facility. See Note 7 for additional details

regarding the restructuring costs.

83

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)