Memorex 2010 Annual Report Download - page 20

Download and view the complete annual report

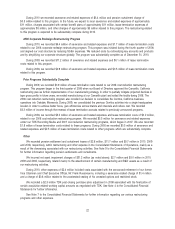

Please find page 20 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(1) These operational measures, which we regularly use, are provided to assist in the investor’s further understanding of

our operations. Days sales outstanding is calculated using the count-back method, which calculates the number of

days of most recent revenue that are reflected in the net accounts receivable balance. Days of inventory supply is cal-

culated using the current period inventory balance divided by an estimate of the inventoriable portion of cost of goods

sold expressed in days.

(2) Return percentages are calculated using (loss) income from continuing operations.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion is intended to be read in conjunction with Item 1. Business, the Consolidated Financial

Statements and related notes that appear elsewhere in this Annual Report on Form 10-K.

Overview

We are a leading global technology company dedicated to helping people and organizations store, protect and

connect their digital world. Our portfolio of data storage and security products, electronics and accessories reaches

customers in more than 100 countries through a powerful global distribution network. We seek to differentiate our products

through unique designs, product positioning, packaging, merchandising and branding.

Strategy

Our vision, as a technology company focusing on targeted applications, will leverage our deep data storage core

while addressing opportunities for growth in emerging storage, electronics and accessories.

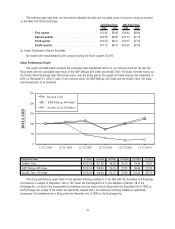

•Financial Goals. In the near-term, we do not expect revenues to rise in 2011 due to declines in traditional

storage products and our intent to rationalize low-margin products. We also expect that earnings, excluding

charges, will decline in 2011 partially due to organic investments needed to drive long-term growth. However, we

will continue our focus on cash and continued margin improvement in 2011. Looking forward, our mid-term financial

goals include double-digit earnings growth in 2012 and a return to top-line growth by the end of 2012. Longer

term, we have a return on invested capital (ROIC) target of 10 percent or more, operating income profitability

target of 4 to 5 percent, and an expectation of product gross margins moving toward 20 percent.

•Corporate Strategies. We intend to use a disciplined, end-to-end product life cycle management process

designed to deliver products with higher gross margins while phasing out low-margin businesses. In 2011, this

process is expected to drive new product launches with at least 20 percent gross margin as an entry target. We

also plan to invest in four core product technology areas: secure storage, scalable storage, wireless/connectivity

and magnetic tape. These investments will include organic research activities already underway, with an increase of

more than 30 percent in research, development, and engineering (RD&E) resources expected in 2011. We also

anticipate investments through small to medium acquisitions each in the range of several million dollars up to

$50 million.

•Product Strategies. In our traditional storage products, which include magnetic tape media and optical media,

our strategy is to optimize profitability, returns and cash in a declining market. In emerging storage, including flash

and removable hard disk drives, we plan to invest in higher growth and margin opportunities, such as our award-

winning Defender

TM

line of secure removable storage products and scalable storage offerings for small to medium

size businesses, including removable hard disk systems such as RDX. In electronics and accessories, our strategy

is to launch differentiated, higher margin products such as the new XtremeMac and TDK Life on Record premium

audio lines. Lastly, our strategy includes rationalizing low-margin businesses across product categories.

•Investment Strategies. In 2011, we expect incremental organic investment of $15 million, focused on technology;

expanded sales and marketing coverage for the value-added reseller and OEM channels; improved decision-

support tools in IT; and international expansion, focused on China. We also intend to grow through acquisitions

focused on data protection, storage hardware, removable hard drive systems, and related software, with the

potential for several small to medium acquisitions during 2011.

17