Memorex 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sudden disruptions to the availability of freight lanes could have an impact on our operations. We generally

ship our products to our customers, and receive shipments from our suppliers, via air or ocean freight. The sudden

unavailability or disruption of cargo operations or freight lanes, such as due to labor difficulties or disputes, severe weather

patterns or other natural disasters, or political instability, terrorism or civil unrest, could impact our operating results by

impairing our ability to timely and efficiently deliver our products.

A material change in customer relationships or in customer demand for products could have a significant

impact on our business. Our success is dependent on our ability to successfully offer trade terms that are acceptable

to our customers and that are aligned with our pricing and profitability targets. Our business could suffer if we cannot

reach agreements with key customers based on our trade terms and principles. In addition, our business would be

negatively impacted if key customers were to significantly reduce the range or inventory level of our products.

Our success depends in part on our ability to obtain and protect our intellectual property rights, including

the Imation, TDK Life on Record, Memorex and XtremeMac brands and to defend ourselves against intellectual

property infringement claims of others. Claims may arise from time to time alleging that we infringe on the intellectual

property rights of others. If we are not successful in defending ourselves against those claims, we could incur substantial

costs in implementing remediation actions, such as redesigning our products or processes, paying for license rights or

paying to settle disputes. The related costs or the disruption to our operations could have a material adverse effect on our

results.

In addition, we utilize valuable non-patented technical know-how and trade secrets in our product development and

manufacturing operations. There can be no assurance that confidentiality agreements and other measures we utilize to

protect such proprietary information will be effective, that these agreements will not be breached or that our competitors

will not acquire the information as a result of or through independent development. We enforce our intellectual property

rights against others who infringe those rights.

Additionally, our electronic products segment is subject to allegations of patent infringement by our competitors as

well as by non-practicing entities (NPEs), sometimes referred to as “patent trolls,” who may seek monetary settlements

from the U.S. consumer electronics industry.

If our long-lived assets or any goodwill that we acquire become impaired, it may adversely affect our

operating results. Negative or uncertain global economic conditions could result in circumstances, such as a sustained

decline in our stock price and market capitalization or a decrease in our forecasted cash flows such that they are

insufficient, indicating that the carrying value of our long-lived assets or any acquired goodwill may be impaired. If we are

required to record a significant charge to earnings in our Consolidated Financial Statements because an impairment of our

long-lived assets or any acquired goodwill is determined, our results of operations will be adversely affected.

Significant litigation matters could result in large costs. We are subject to various pending or threatened legal

actions in the ordinary course of our business, especially regarding patents related to our consumer electronics products.

We are generally indemnified by our suppliers; litigation, however, is always subject to many uncertainties and outcomes

that are not predictable. We cannot ascertain the ultimate aggregate amount of any monetary liability or financial impact

that may be incurred by us in litigation.

We may be affected by legal, regulatory, or market responses to actual or perceived global climate change.

Concern over climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting

greenhouse gas (GHG) emissions. For example, proposals that would impose mandatory requirements on GHG emissions

continue to be considered by policy makers in the territories that we operate. Laws enacted that directly or indirectly affect

our production, distribution, packaging, cost of raw materials, fuel, ingredients, and water could impact our business and

financial results.

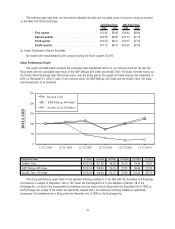

The market price of our common stock is volatile. The market price of our common stock has been, and may

continue to be, volatile. Factors such as the following may significantly affect the market price of our common stock:

• actual or anticipated fluctuations in our operating results;

• announcements of technological innovations by us or our competitors which may decrease the volume and

profitability of sales of our existing products and increase the risk of inventory obsolescence;

12