Memorex 2010 Annual Report Download - page 30

Download and view the complete annual report

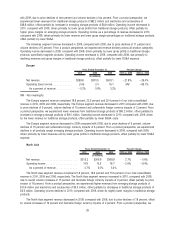

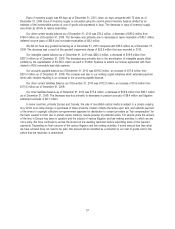

Please find page 30 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Days of inventory supply was 69 days as of December 31, 2010, down six days compared with 75 days as of

December 31, 2009. Days of inventory supply is calculated using the current period inventory balance divided by an

estimate of the inventoriable portion of cost of goods sold expressed in days. The decrease in days of inventory supply

was driven by efforts to reduce inventories.

Our other current assets balance as of December 31, 2010 was $74.2 million, a decrease of $90.2 million from

$164.4 million as of December 31, 2009. The decrease was primarily due to decreases in taxes receivable of $33.1 million,

deferred income taxes of $33.6 and non-trade receivables of $8.2 million.

We did not have any goodwill remaining as of December 31, 2010 compared with $23.5 million as of December 31,

2009. The decrease was a result of the goodwill impairment charge of $23.5 million that was recorded in 2010.

Our intangible assets balance as of December 31, 2010 was $320.4 million, a decrease of $16.9 million from

$337.3 million as of December 31, 2009. The decrease was primarily due to the amortization of intangible assets offset

partially by the capitalization of the $5.0 million we paid to ProStor Systems to extend our license agreement with them

related to RDX removable hard disk systems.

Our accounts payable balance as of December 31, 2010 was $219.2 million, an increase of $17.8 million from

$201.4 million as of December 31, 2009. The increase was due to our working capital initiatives which extended payment

terms with vendors resulting in an increase in the accounts payable balance.

Our other current liabilities balance as of December 31, 2010 was $172.3 million, an increase of $1.8 million from

$170.5 million as of December 31, 2009.

Our other liabilities balance as of December 31, 2010 was $77.8 million, a decrease of $16.9 million from $94.7 million

as of December 31, 2009. The decrease was due primarily to decreases in pension accruals of $9.4 million and litigation

settlement accruals of $6.7 million.

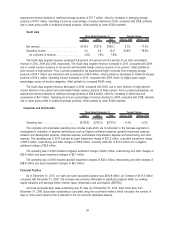

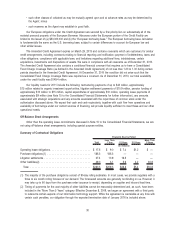

In some countries, primarily Europe and Canada, the sale of recordable optical media is subject to a private copying

levy, which is an extra charge on purchases of these products. Imation collects the levies upon sale, and submits payment

of the levies to copyright collective non-government agencies for distribution to content providers as “fair compensation” for

the harm caused to them due to private copies made by natural persons of protected works. For several years the amount

of the levy in Europe has been in question and the subject of various litigation and law making activities, to which we are

not a party. We have continued to accrue the levies but are awaiting resolution before submitting some of the required

payments. Depending on final outcome of the various litigation and law making activities, if some amount less than what

we have accrued does not need to be paid, this amount will be recorded as a reduction to our cost of goods sold in the

period that the resolution is determined.

27