Memorex 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

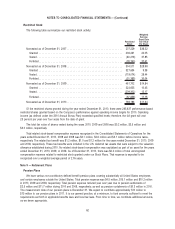

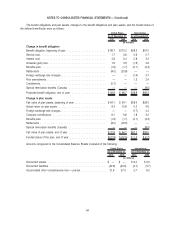

Restricted Stock

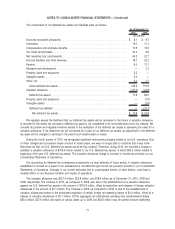

The following table summarizes our restricted stock activity:

Restricted

Stock

Weighted

Average

Grant Date

Fair Value

Per Share

Nonvested as of December 31, 2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 207,229 $38.52

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 206,261 24.05

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (80,219) 37.85

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (28,760) 37.61

Nonvested as of December 31, 2008. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 304,511 $28.98

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 327,654 9.38

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (119,074) 29.44

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (51,389) 30.04

Nonvested as of December 31, 2009. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 461,702 $14.84

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 524,655 10.45

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (209,302) 15.17

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (37,859) 11.15

Nonvested as of December 31, 2010. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 739,196 $11.34

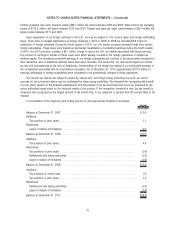

Of the restricted shares granted during the year ended December 31, 2010, there were 265,837 performance-based

restricted shares granted based on the Company’s performance against operating income targets for 2010. Operating

income (as defined under the 2010 Annual Bonus Plan) exceeded specified levels; therefore, the full grant will vest

25 percent per year over four years from the date of grant.

The total fair value of shares vested during the years 2010, 2009 and 2008 was $3.2 million, $3.5 million and

$3.0 million, respectively.

Total related stock-based compensation expense recognized in the Consolidated Statements of Operations for the

years ended December 31, 2010, 2009 and 2008 was $3.1 million, $2.6 million and $3.1 million before income taxes,

respectively. The related tax benefit was $1.2 million, $1.0 and $1.2 million for the years ended December 31, 2010, 2009

and 2008, respectively. These tax benefits were included in the U.S. deferred tax assets that were subject to the valuation

allowance established during 2010. No related stock-based compensation was capitalized as part of an asset for the years

ended December 31, 2010, 2009, or 2008. As of December 31, 2010, there was $6.2 million of total unrecognized

compensation expense related to restricted stock granted under our Stock Plans. That expense is expected to be

recognized over a weighted average period of 2.76 years.

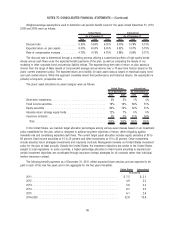

Note 9 — Retirement Plans

Pension Plans

We have various non-contributory defined benefit pension plans covering substantially all United States employees

and certain employees outside the United States. Total pension expense was $4.5 million, $15.1 million and $10.2 million

in 2010, 2009 and 2008, respectively. Total pension expense reduced year over year due to pension settlements of

$2.5 million and $11.7 million during 2010 and 2009, respectively, as well as pension curtailments of $0.3 million in 2010.

The measurement date of our pension plans is December 31. We expect to contribute approximately $10 million to

$15 million to our pension plans in 2011. It is our general practice, at a minimum, to fund amounts sufficient to meet the

requirements set forth in applicable benefits laws and local tax laws. From time to time, we contribute additional amounts,

as we deem appropriate.

62

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)