Memorex 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

experienced revenue declines in traditional storage products of $17.7 million, offset by increases in emerging storage

products of $15.7 million. Operating income as a percentage of revenue declined in 2009, compared with 2008, primarily

due to lower gross profits in traditional storage products, offset partially by lower SG&A expense.

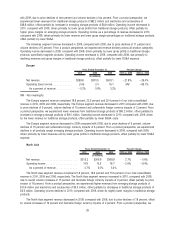

South Asia

2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended December 31, Percent Change

(In millions)

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . $143.0 $137.9 $166.1 3.7% ⫺17.0%

Operating income . . . . . . . . . . . . . . . . . . . . 4.0 2.6 12.9 53.8% ⫺79.8%

As a percent of revenue. . . . . . . . . . . . . . 2.8% 1.9% 7.8%

The South Asia segment revenue comprised 9.8 percent, 8.4 percent and 8.4 percent of our total consolidated

revenue in 2010, 2009 and 2008, respectively. The South Asia segment revenue increased in 2010, compared with 2009,

due to overall volume increases of six percent and favorable foreign currency impacts of six percent, offset partially by

price erosion of eight percent. From a product perspective, we experienced higher revenues from emerging storage

products of $14.7 million and electronics and accessories of $4.9 million, offset partially by decreases in traditional storage

products of $14.2 million. Operating income increased in 2010, compared with 2009, driven by higher gross margin

percentages across all product categories, offset partially by increased SG&A costs.

The South Asia segment revenue decreased in 2009, compared with 2008, due to price declines of eight percent,

volume declines of six percent and unfavorable foreign currency impacts of three percent. From a product perspective, we

experienced revenue declines in traditional storage products of $34.8 million, offset by increases in electronics and

accessories of $6.1 million. Operating income as a percentage of revenue declined in 2009, compared with 2008, primarily

due to lower gross profits in traditional storage products, offset partially by lower SG&A expense.

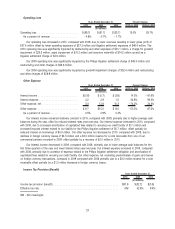

Corporate and Unallocated

2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended December 31, Percent Change

(In millions)

Operating loss . . . . . . . . . . . . . . . . . . . . . . $(124.8) $(130.3) $(137.5) ⫺4.2% ⫺5.2%

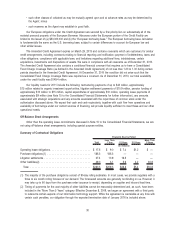

The corporate and unallocated operating loss includes costs which are not allocated to the business segments in

management’s evaluation of segment performance such as litigation settlement expense, goodwill impairment expense,

research and development expense, corporate expense, stock-based compensation expense and restructuring and other

expense. The operating loss in 2010 included an asset impairment charge of $31.2 million, a goodwill impairment charge

of $23.5 million, restructuring and other charges of $19.9 million, inventory write-offs of $14.2 million and a litigation

settlement charge of $2.6 million.

The operating loss in 2009 included a litigation settlement charge of $49.0 million, restructuring and other charges of

$26.6 million and asset impairment charges of $2.7 million.

The operating loss in 2008 included goodwill impairment charges of $32.4 million, restructuring and other charges of

$28.9 million and asset impairment charges of $5.0 million.

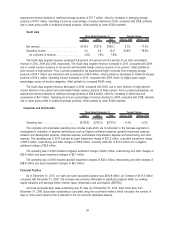

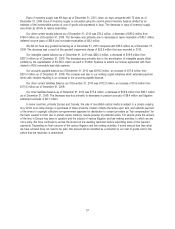

Financial Position

As of December 31, 2010, our cash and cash equivalents balance was $304.9 million, an increase of $141.5 million

compared with December 31, 2009. The increase was primarily attributable to significant progress within our working

capital initiatives and earnings before interest, taxes, depreciation and amortization (EBITDA).

Accounts receivable days sales outstanding was 57 days as of December 31, 2010, down three days from

December 31, 2009. Days sales outstanding is calculated using the count-back method, which calculates the number of

days of most recent revenue that is reflected in the net accounts receivable balance.

26