Memorex 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

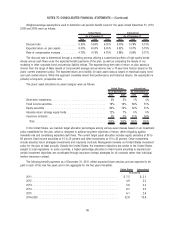

Federal operating loss carry forwards totaling $90.7 million will expire between 2029 and 2030. State income tax operating

losses of $173.2 million, will expire between 2013 and 2030. Federal and state tax credit carryforwards of $20.4 million will

largely expire between 2011 and 2030.

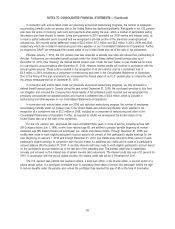

Upon repatriation of our foreign earnings to the U.S., we may be subject to U.S. income taxes and foreign withholding

taxes. There were no taxable distributions of foreign dividends in 2010 or 2009. In 2008 we recorded $6.9 million for

distribution of foreign dividends. During the fourth quarter of 2010, our U.S. parent company borrowed funds from certain

foreign subsidiaries. These loans were treated as permanent repatriations of unremitted earnings during the fourth quarter

of 2010. Our 2010 provision includes a $5.1 million charge to record the U.S. tax liability associated with these earnings.

Any amount of earnings in excess of these loans were either already invested in the foreign operations or needed as

working capital. The remaining unremitted earnings of our foreign subsidiaries will continue to be permanently reinvested in

their operations, and no additional deferred taxes have been recorded. The actual U.S. tax cost would depend on income

tax law and circumstances at the time of distribution. Determination of the related tax liability is not practicable because of

the complexities associated with the hypothetical calculation. As of December 31, 2010, approximately $127.5 million of

earnings attributable to foreign subsidiaries were considered to be permanently invested in those operations.

Our income tax returns are subject to review by various U.S. and foreign taxing authorities. As such, we record

accruals for items that we believe may be challenged by these taxing authorities. The threshold for recognizing the benefit

of a tax return position in the financial statements is that the position must be more-likely-than-not to be sustained by the

taxing authorities based solely on the technical merits of the position. If the recognition threshold is met, the tax benefit is

measured and recognized as the largest amount of tax benefit that, in our judgment, is greater than 50 percent likely to be

realized.

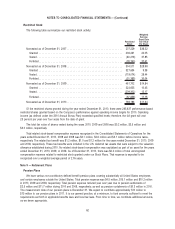

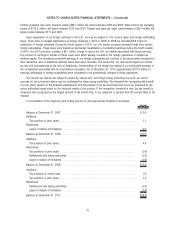

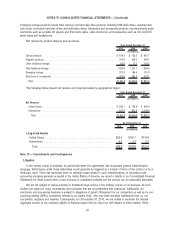

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Amount

(In millions)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9.5

Additions:

Tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1

Reductions:

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.1)

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10.5

Additions:

Tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.4

Reductions:

Tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.6)

Settlements with taxing authorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2)

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.3)

Balance at December 31, 2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13.8

Additions:

Tax positions of current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.3

Tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.3

Reductions:

Settlements with taxing authorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2)

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.3)

Balance at December 31, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $14.9

72

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)