Memorex 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerging storage products include flash memory and hard disk drive products, including USB flash drives, external hard

disk drives, removable hard disk drives and solid state drives. Electronics and accessories products include primarily audio

electronics such as portable CD players and iPod clock radios, video electronics, and accessories such as CD and DVD

jewel cases and headphones.

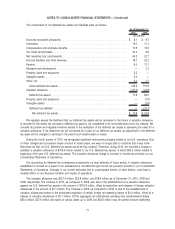

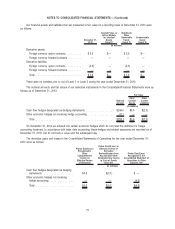

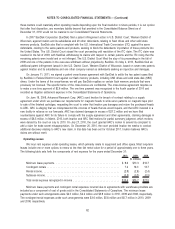

Net revenue by product category was as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Optical products . . . . . . . . ........................................ $ 619.3 $ 738.0 $ 851.7

Magnetic products . . . . . . . ........................................ 347.8 406.0 548.7

Other traditional storage . . . ........................................ 62.8 77.7 106.2

Total traditional storage . . . . ........................................ 1,029.9 1,221.7 1,506.6

Emerging storage. . . . . . . . ........................................ 207.5 165.4 151.3

Electronics & accessories . . ........................................ 223.5 262.4 323.1

Total . ..................................................... $1,460.9 $1,649.5 $1,981.0

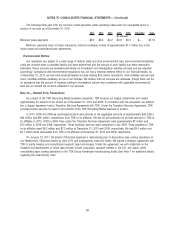

The following tables present net revenue and long-lived assets by geographical region:

2010 2009 2008

Years Ended December 31,

(In millions)

Net Revenue

United States . . . . . . . . ........................................ $ 633.1 $ 726.9 $ 840.6

International . . . . . . . . . ........................................ 827.8 922.6 1,140.4

Total . . . . . . . . . . . . ........................................ $1,460.9 $1,649.5 $1,981.0

2010 2009 2008

As of December 31,

(In millions)

Long-Lived Assets

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $62.4 $105.1 $116.9

International. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 4.7 5.5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $66.9 $109.8 $122.4

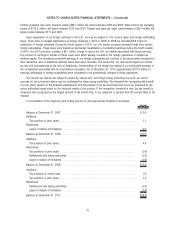

Note 15 — Commitments and Contingencies

Litigation

In the normal course of business, we periodically enter into agreements that incorporate general indemnification

language. Performance under these indemnities would generally be triggered by a breach of terms of the contract or by a

third-party claim. There has historically been no material losses related to such indemnifications. In accordance with

accounting principles generally accepted in the United States of America, we record a liability in our Consolidated Financial

Statements for these actions when a loss is known or considered probable and the amount can be reasonably estimated.

We are the subject of various pending or threatened legal actions in the ordinary course of our business. All such

matters are subject to many uncertainties and outcomes that are not predictable with assurance. Additionally, our

electronics and accessories business is subject to allegations of patent infringement by our competitors as well as by non-

practicing entities (NPEs), sometimes referred to as “patent trolls,” who may seek monetary settlements from us, our

competitors, suppliers and resellers. Consequently, as of December 31, 2010, we are unable to ascertain the ultimate

aggregate amount of any monetary liability or financial impact that we may incur with respect to these matters. While

81

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)