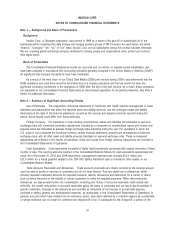

Memorex 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

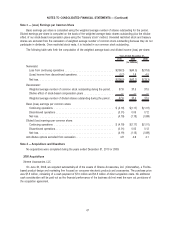

The following table summarizes the allocation of the excess purchase price over historical book value arising from the

acquisition:

Amount

(In millions)

Customer relationships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.8

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.4

Deferred tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.4)

Excess purchase price over historical book value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.9

The weighted average life of the customer relationships intangible asset is six years. The effects of the acquisition

did not materially impact our 2008 results of operations. Therefore, pro forma disclosures are not included.

The goodwill was written off during the year ended December 31, 2008.

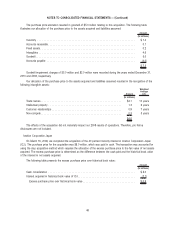

Divestiture Presented as Discontinued Operations

Discontinued operations are related to the wind down of the GDM joint venture. GDM was a joint venture created to

market optical media products with Moser Baer India Ltd. (MBI). Since the inception of the joint venture in 2003, we held a

51 percent ownership in the business. As the controlling shareholder, we have historically consolidated the results of the

joint venture in our financial statements. GDM was previously included partially in the Americas and Europe segments.

See Note 14 herein for additional detail regarding the impact of discontinued operations on the Americas and Europe

segments.

The results of discontinued operations were as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Net revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $74.5 $173.6

(Loss) income before income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(0.2) $ 2.1 $ 6.4

Income tax provision. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.3 1.9

Total discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(0.2) $ 1.8 $ 4.5

49

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)