Memorex 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

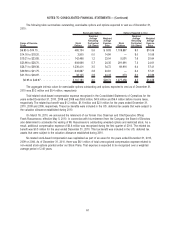

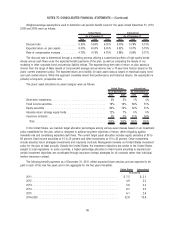

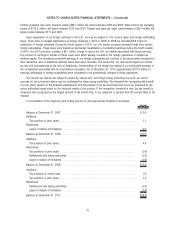

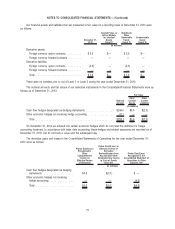

The income tax provision from continuing operations differs from the amount computed by applying the statutory

United States income tax rate (35 percent) because of the following items:

2010 2009 2008

Years Ended December 31,

(In millions)

Tax at statutory U.S. tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (26.8) $(26.9) $(14.2)

State income taxes, net of federal benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.7) (5.6) (1.0)

Net effect of international operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.8) (7.2) (2.6)

Valuation allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105.2 1.4 2.1

U.S. tax on foreign earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.1 0.6 6.9

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 3.7

Uncertain tax positions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.3 3.5 1.0

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.6 1.5 0.2

Income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 81.9 $(32.7) $ (3.9)

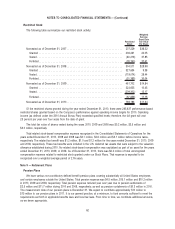

In comparing our 2010 tax provision of $81.9 million to our 2009 tax benefit of $32.7, the primary change was due to

the establishment of a valuation allowance on our U.S. deferred tax assets. Other items that had an impact on the 2010

tax provision included a change in the state tax effective rate, reserves for uncertain tax positions, foreign earnings subject

to U.S. taxation, and changes in the mix of income/loss by jurisdiction.

The 2008 tax benefit included the impact of a non-cash goodwill impairment charge and the distribution of foreign

dividends. There was no such activity in 2009. Other items that had an impact on the 2009 tax benefit included an

increase in the state tax effective rate, additional reserves for uncertain tax positions and the change in proportion of

income by jurisdiction.

In 2010 and 2009, the net cash received for income taxes, relating to both continuing and discontinued operations,

was $6.4 million and $14.8 million, respectively. In 2008, the net cash paid for income taxes, relating to both continuing

and discontinued operations, was $26.5 million.

Tax laws require certain items to be included in our tax returns at different times than the items are reflected in our

results of operations. Some of these items are temporary differences that will reverse over time. We record the tax effect

of temporary differences as deferred tax assets and deferred tax liabilities in our Consolidated Balance Sheets.

70

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)