Memorex 2010 Annual Report Download - page 48

Download and view the complete annual report

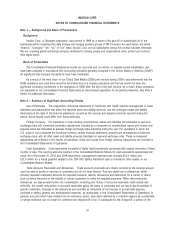

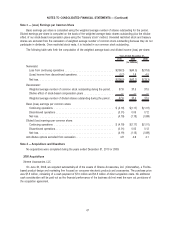

Please find page 48 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Rebates Received. We receive rebates from some of our inventory vendors if we achieve pre-determined

purchasing thresholds. These rebates are included as a reduction of our cost of goods sold in the period in which the

purchased inventory is sold, allocated using a systematic and rational method.

Restructuring Reserves. Employee-related severance charges are largely based upon distributed employment

policies and substantive severance plans. Generally, these charges are reflected in the period in which the Board approves

the associated actions, the actions are probable and the amounts are estimable. In the event that the Board approves the

associated actions after the balance sheet date, but ultimately confirms the existence of a probable liability as of the

balance sheet date, a reasonable estimate of these charges are recorded in the period in which the probable liability

existed. This estimate takes into account all information available as of the date the financial statements are issued.

Severance amounts for which affected employees were required to render service in order to receive benefits at their

termination dates were measured at the date such benefits were communicated to the applicable employees and

recognized as expense over the employees’ remaining service periods.

Income Taxes. We are required to estimate our income taxes in each of the jurisdictions in which we operate. This

process involves estimating our actual current tax obligations based on expected taxable income, statutory tax rates and

tax credits allowed in the various jurisdictions in which we operate. Tax laws require certain items to be included in our tax

returns at different times than the items are reflected in our results of operations. Some of these differences are

permanent, such as expenses that are not deductible in our tax returns, and some are temporary differences that will

reverse over time. Temporary differences result in deferred tax assets and liabilities, which are included within our

Consolidated Balance Sheets. We must assess the likelihood that our deferred tax assets will be realized and establish a

valuation allowance to the extent necessary. Significant judgment is required in evaluating our tax positions, and in

determining our provision for income taxes, our deferred tax assets and liabilities and any valuation allowance recorded

against our net deferred tax assets.

We record income taxes using the asset and liability approach. Under this approach, deferred tax assets and

liabilities are recognized for the expected future tax consequences of temporary differences between the book and tax

basis of assets and liabilities. We measure deferred tax assets and liabilities using the enacted statutory tax rates that are

expected to apply in the years in which the temporary differences are expected to be recovered or paid.

We regularly assess the likelihood that our deferred tax assets will be recovered in the future. A valuation allowance

is recorded to the extent we conclude a deferred tax asset is not considered to be more-likely-than-not to be realized. We

consider all positive and negative evidence related to the realization of the deferred tax assets in assessing the need for a

valuation allowance. If we determine we will not realize all or part of our deferred tax assets, an adjustment to the deferred

tax asset will be charged to earnings in the period such determination is made.

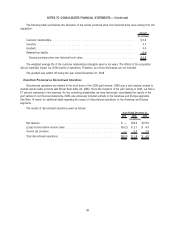

At December 31, 2010, our net deferred tax asset was $17.9 million. These deferred tax assets are net of valuation

allowance of $127.4 million.

Our income tax returns are subject to review by various U.S. and foreign taxing authorities. As such, we record

accruals for items that we believe may be challenged by these taxing authorities. The threshold for recognizing the benefit

of a tax return position in the financial statements is that the position must be more-likely-than-not to be sustained by the

taxing authorities based solely on the technical merits of the position. If the recognition threshold is met, the tax benefit is

measured and recognized as the largest amount of tax benefit that, in our judgment, is greater than 50 percent likely to be

realized. Interest and penalties recorded for uncertain tax positions are included in our income tax provision.

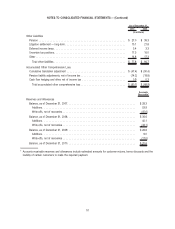

Treasury Stock. Our repurchases of shares of common stock are recorded as treasury stock and are presented as

a reduction of shareholders’ equity. When treasury shares are reissued, we use a last-in, first-out method and the

difference between repurchase cost and fair value at reissuance is treated as an adjustment to equity.

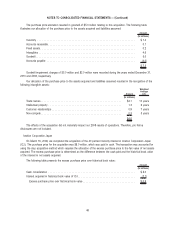

Stock-Based Compensation. Share-based compensation awards are measured at fair value at the date of grant

and expensed over their vesting or service periods.

The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation

model. Expected volatilities are based on historical volatility of our stock. The risk-free rate for the contractual life of the

45

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)