Memorex 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

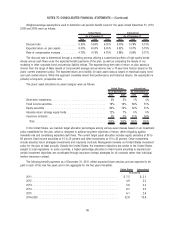

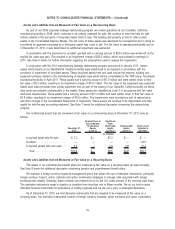

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis

As part of our 2008 corporate redesign restructuring program, we ended operations at our Camarillo, California

manufacturing facility in 2009, which continues to be actively marketed for sale. We continue to meet the held for sale

criteria outlined in the provisions of long-lived assets held for sale. The building and property is held in other current

assets in the Consolidated Balance Sheets. The fair value of these assets was developed by management and in doing so

considered an appraisal completed by a third-party expert less costs to sell. The fair value is assessed periodically and as

of December 31, 2010, it was determined no additional impairment was warranted.

In accordance with the provisions for goodwill, goodwill with a carrying amount of $23.5 million was written-off as the

implied fair value was zero. This resulted in an impairment charge of $23.5 million, which was included in earnings in

2010. See Note 6 herein for further information regarding the assumptions used to assess this impairment.

In conjunction with the 2011 manufacturing redesign restructuring program announced in January 2011, certain

assets held primarily at our Weatherford, Oklahoma facility were determined to be impaired in accordance with the

provisions of impairment of long-lived assets. These long-lived assets held and used include the property, building and

equipment primarily related to the manufacturing of magnetic tape which will be consolidated to the TDK Group Yamanashi

manufacturing facility in April 2011. These assets had a carrying amount of $17.0 million and were written down to their

fair value of $2.3 million, resulting in an impairment charge of $14.7 million. The fair value of the equipment was assessed

based upon sales proceeds from similar equipment sold as part of the closing of our Camarillo, California facility. As these

data points are primarily unobservable in the market, these assets are classified as Level 3 in accordance with fair value

disclosure requirements. These assets had a carrying amount of $17.4 million and were written down to their fair value of

$0.9 million, resulting in an impairment charge of $16.5 million. The impairments were recorded as part of restructuring

and other charges in the Consolidated Statements of Operations. These assets will continue to be depreciated until they

qualify for held-for-sale accounting treatment. See Note 7 herein for additional discussion concerning this restructuring

program.

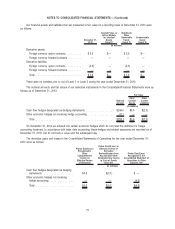

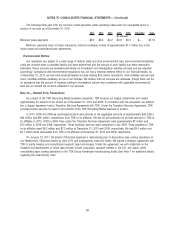

Our nonfinancial assets that are measured at fair value on a nonrecurring basis at December 31, 2010 were as

follows:

December 31,

2010

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Total Losses

Included in

Earnings

(In millions)

Long-lived asset held for sale . . . . $ 7.2 $— $7.2 $ — $ —

Goodwill . . . . . . . . . . . . . . . . . . . — — — — 23.5

Long-lived assets held and used . . 3.2 — 2.3 0.9 31.2

Total . . . . . . . . . . . . . . . . . . . . $10.4 $— $9.5 $0.9 $54.7

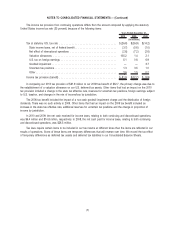

Assets and Liabilities that are Measured at Fair Value on a Recurring Basis

The assets in our postretirement benefit plans are measured at fair value on a recurring basis (at least annually).

See Note 9 herein for additional discussion concerning pension and postretirement benefit plans.

We maintain a foreign currency exposure management policy that allows the use of derivative instruments, principally

foreign currency forward, option contracts and option combination strategies to manage risks associated with foreign

exchange rate volatility. Generally, these contracts are entered into to fix the U.S. dollar amount of the eventual cash flows.

The derivative instruments range in duration at inception from less than one to fifteen months. We do not hold or issue

derivative financial instruments for speculative or trading purposes and we are not a party to leveraged derivatives.

As of December 31, 2010, we held derivative instruments that are required to be measured at fair value on a

recurring basis. Our derivative instruments consist of foreign currency forwards, option contracts and option combination

75

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)