Memorex 2010 Annual Report Download - page 35

Download and view the complete annual report

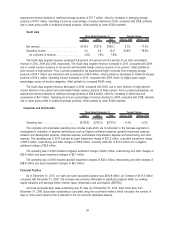

Please find page 35 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.establish a valuation allowance of $105.6 million related to our U.S. deferred tax assets. The valuation allowance charge is

included in income tax provision on our Consolidated Statement of Operations.

The accounting estimate for valuation allowances against deferred tax assets is a critical accounting estimate

because judgment is required in assessing the likely future tax consequences of events that have been recognized in our

financial statements or tax returns. Our accounting for deferred tax consequences represents our best estimate of future

events. A valuation allowance established or revised as a result of our assessment is recorded through income tax

provision (benefit) in our Consolidated Statements of Operations. Changes in our current estimates due to unanticipated

events, or other factors, could have a material effect on our financial condition and results of operations.

At December 31, 2010, our net deferred tax asset was $17.9 million. These deferred tax assets are net of valuation

allowance of $127.4 million. The valuation allowance relates to our U.S. deferred tax assets not expected to be utilized in

the future, and various worldwide operating loss carry forwards that we do not expect to realize.

Our income tax returns are subject to review by various U.S. and foreign taxing authorities. As such, we record

accruals for items that we believe may be challenged by these taxing authorities. The threshold for recognizing the benefit

of a tax return position in the financial statements is that the position must be more-likely-than-not to be sustained by the

taxing authorities based solely on the technical merits of the position. If the recognition threshold is met, the tax benefit is

measured and recognized as the largest amount of tax benefit that, in our judgment, is greater than 50 percent likely to be

realized.

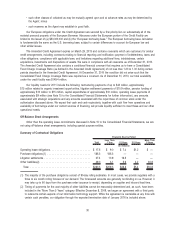

The total amount of unrecognized tax benefits as of December 31, 2010 was $14.9 million, excluding accrued interest

and penalties described below. If the unrecognized tax benefits were recognized in our Consolidated Financial Statements,

$4.3 million would ultimately affect income tax expense and our related effective tax rate. The other $10.6 million of

unrecognized tax benefit would reduce income tax expense, but would be offset by an increase in valuation allowance

against deferred tax assets.

Interest and penalties recorded for uncertain tax positions are included in our income tax provision. As of

December 31, 2010, $2.6 million of interest and penalties was accrued, excluding the tax benefit of deductible interest.

The reversal of accrued interest and penalties would affect income tax expense and our related effective tax rate.

Our U.S. federal income tax returns for 2006 through 2009 remain subject to examination by the Internal Revenue

Service. The years 2004 through 2009 remain subject to examination by foreign tax jurisdictions, and state and city tax

jurisdictions. In the event that we have determined not to file tax returns with a particular state or city, all years remain

subject to examination by the tax jurisdiction.

The ultimate outcome of tax matters may differ from our estimates and assumptions. Unfavorable settlement of any

particular issue may require the use of cash and could result in increased income tax expense. Favorable resolution could

result in reduced income tax expense. It is reasonably possible that our unrecognized tax benefits could increase or

decrease significantly during the next twelve months due to the resolution of certain U.S. and international tax uncertainties;

however it is not possible to estimate the potential change at this time.

Litigation. We record a liability when a loss from litigation is known or considered probable and the amount can be

reasonably estimated. Our current estimated range of liability related to pending litigation is based on claims for which we

can estimate the amount or range of loss. Based upon information presently available, we believe that accruals for these

claims are adequate. Due to uncertainties related to both the amount and range of loss on the remaining pending litigation,

we are unable to make a reasonable estimate of the liability that could result from an unfavorable outcome. While these

matters could materially affect operating results in future periods depending on the final resolution, it is our opinion that

after final disposition, any monetary liability to us beyond that provided in the Consolidated Balance Sheet as of

December 31, 2010, would not be material to our financial position. As additional information becomes available, the

potential liability related to pending litigation will be assessed and estimates will be revised as necessary.

Intangibles. We record all assets and liabilities acquired in purchase acquisitions, including intangibles, at fair value.

Intangible assets with a definite life are amortized based on a pattern in which the economic benefits of the assets are

consumed, typically with useful lives ranging from one to 30 years. The initial recognition of intangible assets, the

determination of useful lives and subsequent impairment analyses require management to make subjective judgments

concerning estimates of how the acquired assets will perform in the future using valuation methods including discounted

32