Memorex 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

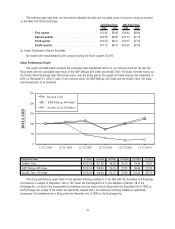

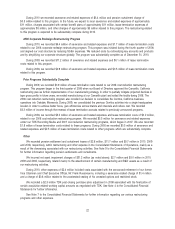

Item 6. Selected Financial Data.*

2010 2009 2008 2007 2006

(Dollars in millions, except per share data)

Statement of Operations Data:

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,460.9 $1,649.5 $1,981.0 $1,895.8 $1,373.0

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 226.4 264.0 338.8 345.8 327.4

Selling, general and administrative . . . . . . . . . . . . . . . . . 202.5 229.7 287.6 218.9 170.0

Research and development . . . . . . . . . . . . . . . . . . . . . . 16.4 20.4 23.6 38.2 50.0

Litigation settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.6 49.0 — — —

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.5 — 32.4 94.1 —

Restructuring and other . . . . . . . . . . . . . . . . . . . . . . . . . 51.1 26.6 28.9 33.3 11.9

Operating (loss) income. . . . . . . . . . . . . . . . . . . . . . . . . (69.7) (61.7) (33.7) (38.7) 95.5

(Loss) income from continuing operations . . . . . . . . . . . . (158.3) (44.0) (37.8) (56.4) 62.0

Net (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (158.5) (42.2) (33.3) (50.4) 76.4

(Loss) earnings per common share from continuing

operations:

Basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.19) (1.17) (1.01) (1.52) 1.79

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.19) (1.17) (1.01) (1.52) 1.76

Net (loss) earnings per common share:

Basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.19) (1.13) (0.89) (1.36) 2.21

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.19) (1.13) (0.89) (1.36) 2.17

Balance Sheet Data:

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . $ 304.9 $ 163.4 $ 96.6 $ 135.5 $ 252.5

Accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . 258.8 314.9 378.3 507.1 308.1

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 203.3 235.7 363.2 366.1 258.0

Property, plant and equipment, net . . . . . . . . . . . . . . . . . 66.9 109.8 122.4 171.5 178.0

Intangible assets, net. . . . . . . . . . . . . . . . . . . . . . . . . . . 320.4 337.3 357.0 371.0 230.2

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,251.0 1,393.8 1,540.0 1,751.0 1,382.9

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 219.2 201.4 296.1 350.1 227.3

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — 21.3 —

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 469.3 466.6 595.4 697.2 436.6

Total shareholders’ equity. . . . . . . . . . . . . . . . . . . . . . . . 781.7 927.2 944.6 1,053.8 946.3

Other Information:

Current ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.1 2.4 2.0 1.8 2.2

Days sales outstanding(1) . . . . . . . . . . . . . . . . . . . . . . . 57 60 63 64 56

Days of inventory supply(1) . . . . . . . . . . . . . . . . . . . . . . 69 75 112 94 90

Return on average assets(2) . . . . . . . . . . . . . . . . . . . . . (11.8) % (3.1) % (2.4) % (3.6) % 4.8%

Return on average equity(2) . . . . . . . . . . . . . . . . . . . . . . (18.0) % (4.8) % (3.7) % (5.4) % 6.8%

Dividends per common share . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 0.56 $ 0.62 $ 0.54

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8.3 $ 11.0 $ 13.6 $ 14.5 $ 16.0

Number of employees . . . . . . . . . . . . . . . . . . . . . . . . . . 1,115 1,210 1,570 2,250 2,070

* See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, for additional

information regarding the financial information presented in this table. The acquisitions of Xtreme Accessories, LLC on

June 30, 2008, TDK Recording Media on July 31, 2007, Memcorp, Inc. on July 9, 2007, and Memorex International

Inc. on April 28, 2006 may affect the comparability of financial information in this table. See Note 4 in the Consolidated

Financial Statements for further information.

16