Memorex 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

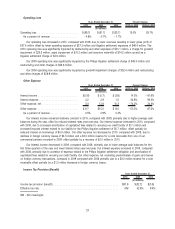

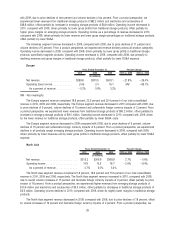

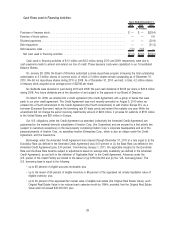

Operating Loss

2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended December 31, Percent Change

(In millions)

Operating loss. . . . . . . . . . . . . . . . . . . . . . . . . . . $(69.7) $(61.7) $(33.7) 13.0% 83.1%

As a percent of revenue . . . . . . . . . . . . . . . . . . ⫺4.8% ⫺3.7% ⫺1.7%

Our operating loss increased in 2010, compared with 2009, due to lower revenues resulting in lower gross profit of

$37.6 million offset by lower operating expenses of $27.2 million and litigation settlement expenses of $46.4 million. The

2010 operating loss was significantly impacted by restructuring and other expenses of $51.1 million, a charge for goodwill

impairment of $23.5 million, asset impairment of $31.2 million and inventory write-offs of $14.2 million as well as a

litigation settlement charge of $2.6 million.

Our 2009 operating loss was significantly impacted by the Philips litigation settlement charge of $49.0 million and

restructuring and other charges of $26.6 million.

Our 2008 operating loss was significantly impacted by goodwill impairment charges of $32.4 million and restructuring

and other charges of $28.9 million.

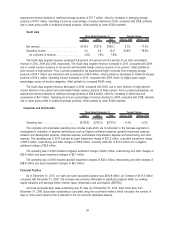

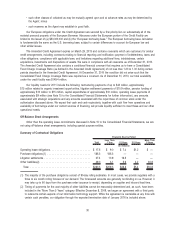

Other Expense

2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended December 31, Percent Change

(In millions)

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . $(0.8) $ (0.7) $ (3.8) 14.3% ⫺81.6%

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . 4.2 2.9 1.5 44.8% 93.3%

Other expense, net . . . . . . . . . . . . . . . . . . . . . . . 3.3 12.8 10.3 ⫺74.2% 24.3%

Other expense . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6.7 $15.0 $ 8.0 ⫺55.3% 87.5%

As a percent of revenue . . . . . . . . . . . . . . . . . . 0.5% 0.9% 0.4%

Our interest income remained relatively constant in 2010, compared with 2009, primarily due to higher average cash

balances during the year, offset by reduced interest rates year-over-year. Our interest expense increased in 2010, compared

with 2009, due to increased amortization of capitalized fees related to securing our credit facility of $1.1 million and

increased imputed interest related to our liability for the Philips litigation settlement of $0.7 million, offset partially by

reduced interest on borrowings of $0.5 million. Our other expense net decreased in 2010, compared with 2009, due to

declines in foreign currency losses of $4.5 million and a $3.0 million reserve for a note receivable from one of our

commercial partners recorded in 2009, offset partially by a recovery of $2.0 million in 2010.

Our interest income decreased in 2009, compared with 2008, primarily due to lower average cash balances for the

first three quarters of the year and lower interest rates year-over-year. Our interest expense increased in 2009, compared

with 2008, primarily due to accretion of expense related to the Philips litigation settlement obligation and amortization of

capitalized fees related to securing our credit facility. Our other expense, net consisting predominately of gains and losses

on foreign currency transactions, increased in 2009 compared with 2008 primarily due to a $3.0 million reserve for a note

receivable offset partially by a $1.5 million decrease in foreign currency losses.

Income Tax Provision (Benefit)

2010 2009 2008

Years Ended December 31,

(In millions)

Income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $81.9 $(32.7) $(3.9)

Effective tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NM 42.6% 9.4%

NM - Not meaningful

23