Memorex 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

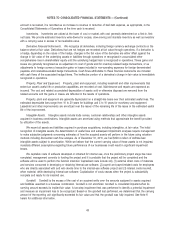

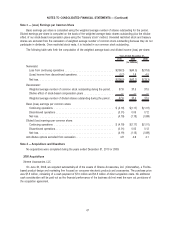

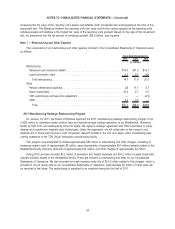

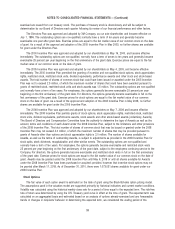

Goodwill

The following table presents the changes in goodwill allocated to our reportable segments:

Americas Europe North Asia South Asia

Electronic

Products Total

(In millions)

Balance as of December 31, 2008:

Goodwill . . . . . . . . . . . . . . . . . . . . $ 64.3 $ 39.2 $ 10.2 $— $ 38.6 $ 152.3

Accumulated impairment losses . . . . (64.3) (39.2) (10.2) — (15.1) (128.8)

— — — — 23.5 23.5

Balance as of December 31, 2009:

Goodwill . . . . . . . . . . . . . . . . . . . . $ 64.3 $ 39.2 $ 10.2 $— $ 38.6 $ 152.3

Accumulated impairment losses . . . . (64.3) (39.2) (10.2) — (15.1) (128.8)

— — — — 23.5 23.5

Operating segment reclassification:

Goodwill . . . . . . . . . . . . . . . . . . . . 38.6 — — — (38.6) —

Accumulated impairment losses . . . . (15.1) — — — 15.1 —

Goodwill impairment. . . . . . . . . . . . . . (23.5) — — — — (23.5)

Balance as of December 31, 2010:

Goodwill . . . . . . . . . . . . . . . . . . . . $ 102.9 $ 39.2 $ 10.2 $— $ — $ 152.3

Accumulated impairment losses . . . . (102.9) (39.2) (10.2) — — (152.3)

$ — $— $— $— $— $ —

During 2010 we realigned our corporate segments and reporting structure with how the business will be managed

going forward. As part of this reorganization, we combined our Electronic Products segment with our Americas segment,

and we separated our Asia Pacific segment into North Asia and South Asia regions.

Our reporting units for goodwill are our operating segments with the exception of the Americas segment which is

further divided between the Americas-Consumer and Americas-Commercial reporting units as determined by sales channel.

As a result of the segment change, the goodwill of $23.5 million which was previously allocated to the Electronics Products

segment was merged into the Americas-Consumer reporting unit. The Americas-Consumer reporting unit had a fair value

that was significantly less than its carrying amount prior to the combination, which is a triggering event for an interim

goodwill impairment test. Goodwill is considered impaired when its carrying amount exceeds its implied fair value. A two-

step impairment test was performed to identify a potential impairment and measure an impairment loss to be recognized.

The first step of the impairment test involves comparing the fair value of the reporting unit to which goodwill was

assigned to its carrying amount. In calculating fair value, we used a weighting of the valuations calculated using the

income approach and a market approach. The summation of our reporting units’ fair values is compared and reconciled to

our market capitalization as of the date of our impairment test.

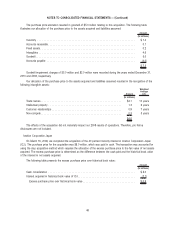

Based on the goodwill test performed, we determined that the carrying amount of the reporting unit significantly

exceeded its fair value. The indicated excess in carrying amount over fair value of the Americas-Consumer reporting unit

and goodwill is as follows:

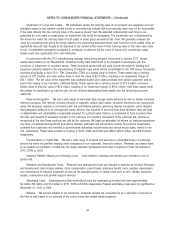

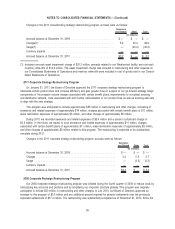

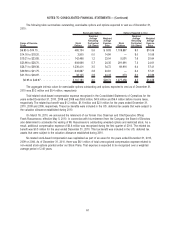

Goodwill

Reporting Unit

Carrying Amount

Excess of Carrying

Amount Over

Fair Value

Percentage of

Carrying Amount

Over Fair Value

(In millions)

Americas-Consumer . . . . . . . . . . . . . . . . . $23.5 $336.5 $173.5 206%

The second step of the impairment test compares the implied fair value of the reporting unit’s goodwill with the

carrying amount of the reporting unit’s goodwill. If the carrying amount of the reporting unit’s goodwill is greater than the

implied fair value of the reporting unit’s goodwill an impairment loss must be recognized for the excess. This involves

53

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)