Memorex 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

cash flow analysis. As of December 31, 2010, we had $320.4 million of definite-lived intangible assets subject to

amortization. While we believe that the current carrying value of these assets is not impaired, materially different

assumptions regarding future performance of our businesses could result in significant impairment losses.

Goodwill. We record all assets and liabilities acquired in purchase acquisitions, including goodwill at fair value. The

initial recognition of goodwill and subsequent impairment analyses require management to make subjective judgments

concerning estimates of how the acquired assets will perform in the future using valuation methods including discounted

cash flow analysis.

Goodwill is the excess of the cost of an acquired entity over the amounts assigned to assets acquired and liabilities

assumed in a business combination. Goodwill is not amortized.

During 2010 we realigned our corporate segments and reporting structure with how the business will be managed

going forward. As part of this reorganization, we combined our Electronic Products segment with our Americas segment,

and we separated our Asia Pacific segment into North Asia and South Asia regions.

Our reporting units for goodwill are our operating segments with the exception of the Americas segment which is

further divided between the Americas-Consumer and Americas-Commercial reporting units as determined by sales channel.

As a result of the segment change, the goodwill of $23.5 million which was previously allocated to the Electronics Products

segment was merged into the Americas-Consumer reporting unit. The Americas-Consumer reporting unit had a fair value

that was significantly less than its carrying amount prior to the combination, which is a triggering event for an interim

goodwill impairment test. Goodwill is considered impaired when its carrying amount exceeds its implied fair value. A two-

step impairment test was performed to identify a potential impairment and measure an impairment loss to be recognized.

Based on the goodwill test performed, we determined that the carrying amount of the reporting unit significantly exceeded

its fair value and that the goodwill was fully impaired.

The first step of the impairment test involves comparing the fair value of the reporting unit to which goodwill was

assigned to its carrying amount. In calculating fair value, we used a weighting of the valuations calculated using the

income approach and a market approach. The summation of our reporting units’ fair values is compared and reconciled to

our market capitalization as of the date of our impairment test.

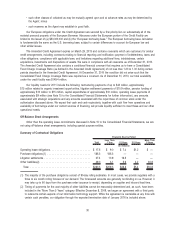

Based on the goodwill test performed, we determined that the carrying amount of the reporting unit significantly

exceeded its fair value. The indicated excess in carrying amount over fair value of the Americas-Consumer reporting unit

and goodwill is as follows:

Goodwill

Reporting unit

Carrying Amount

Excess of Carrying

Amount Over

Fair Value

Percentage of

Carrying Amount

Over Fair Value

(In millions)

Americas-Consumer . . . . . . . . . . . . . . . . . . . . . . . . $23.5 $336.5 $173.5 206%

The second step of the impairment test compares the implied fair value of the reporting unit’s goodwill with the

carrying amount of the reporting unit’s goodwill. If the carrying amount of the reporting unit’s goodwill is greater than the

implied fair value of the reporting unit’s goodwill an impairment loss must be recognized for the excess. This involves

measuring the fair value of the reporting unit’s assets and liabilities (both recognized and unrecognized) at the time of the

impairment test. The difference between the reporting unit’s fair value and the fair values assigned to the reporting unit’s

individual assets and liabilities is the implied fair value of the reporting unit’s goodwill. Based on this step of the impairment

test, we determined that the full amount of remaining goodwill, $23.5 million, was impaired.

Excess Inventory and Obsolescence. We write down our inventory for excess, slow moving and obsolescence to

the net realizable value based upon assumptions about future demand and market conditions. If actual market conditions

are less favorable than those we project, additional write downs may be required. As of December 31, 2010, the excess

inventory and obsolescence accrual was $42.4 million.

Rebates. We maintain an accrual for customer rebates that totaled $53.4 million as of December 31, 2010 included

in other current liabilities. This accrual requires a program-by-program estimation of outcomes based on a variety of factors

including customer unit sell-through volumes and end user redemption rates. In the event that actual volumes and

redemption rates differ from the estimates used in the accrual calculation, adjustments to the accrual, upward or

downward, may be necessary.

33