Memorex 2010 Annual Report Download - page 76

Download and view the complete annual report

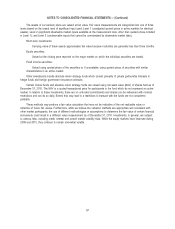

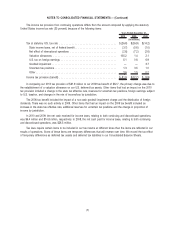

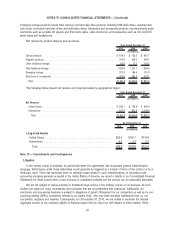

Please find page 76 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The total amount of unrecognized tax benefits as of December 31, 2010 was $14.9 million, excluding accrued interest

and penalties described below. If the unrecognized tax benefits were recognized in our consolidated financial statements,

$4.3 million would ultimately affect income tax expense and our related effective tax rate. The other $10.6 million of

unrecognized tax benefit would reduce income tax expense, but would be offset by an increase in valuation allowance

against deferred tax assets.

Interest and penalties recorded for uncertain tax positions are included in our income tax provision. During the years

ended December 31, 2010, 2009, and 2008, we recognized approximately $0.5 million, $0.5 million, and $0.7 million,

respectively, in interest and penalties. We had approximately $2.6 million, $2.2 million and $1.7 million accrued, excluding

the tax benefit of deductible interest, for the payment of interest and penalties at December 31, 2010, 2009 and 2008,

respectively. The reversal of accrued interest and penalties would affect income tax expense and our related effective tax

rate.

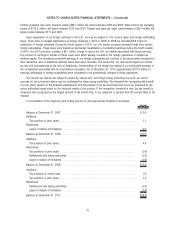

It is reasonably possible that our unrecognized tax benefits could increase or decrease significantly during the next

twelve months due to the resolution of certain U.S. and international tax uncertainties; however it is not possible to

estimate the potential change at this time.

Our federal income tax returns for 2006 through 2009 remain subject to examination by the Internal Revenue Service

(IRS). The IRS completed its field work for the 2006 through 2008 examination in the second quarter of 2010, and the

matter is currently in IRS Appeals. The years 2004 through 2009 remain subject to examination by foreign tax jurisdictions

and state and city tax jurisdictions. In the event that we have determined not to file tax returns with a particular state or

city, all years remain subject to examination by the tax jurisdiction.

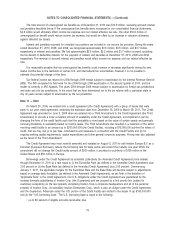

Note 11 — Debt

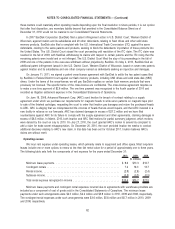

On March 30, 2006, we entered into a credit agreement (the Credit Agreement) with a group of banks that were

party to our prior credit agreement, extending the expiration date from December 15, 2006 to March 29, 2011. The Credit

Agreement was amended on June 3, 2009 when we entered into a Third Amendment to the Credit Agreement (the Third

Amendment) to provide a more consistent amount of availability under the Credit Agreement, accomplished in part by

changing the form of the credit facility such that the availability is now based on the value of certain assets and generally

removing limitations to availability based on income levels. The Third Amendment also resulted in a reduction of the senior

revolving credit facility to an amount up to $200,000,000 (the Credit Facility), including a $75,000,000 sub-limit for letters of

credit, that we may use (i) to pay fees, commissions and expenses in connection with the Credit Facility and (ii) for

ongoing working capital requirements, capital expenditures and other general corporate purposes. Pricing was also adjusted

as the result of the Third Amendment.

The Credit Agreement was most recently amended and restated on August 3, 2010 to add Imation Europe B.V. as a

borrower (European Borrower), reduce the borrowing rate 50 basis points and extend the maturity one year. While the

amendment did not change the Credit facility amount of $200 million, it provides for sub-limits of $150 million in the

United States and $50 million in Europe.

Borrowings under the Credit Agreement as amended (collectively the Amended Credit Agreement) bore interest

through December 31, 2010 at a rate equal to (i) the Eurodollar Rate (as defined in the Amended Credit Agreement) plus

3.00 percent or (ii) the Base Rate (as defined in the Amended Credit Agreement) plus 2.00 percent. Commencing

January 1, 2011, the applicable margins for the Eurodollar Rate and the Base Rate will become subject to adjustments

based on average daily Availability (as defined in the Amended Credit Agreement), as set forth in the definition of

“Applicable Rate” in the Credit Agreement. Our U.S. obligations under the Credit Agreement are guaranteed by the

material domestic subsidiaries of Imation Corp. (the Guarantors) and are secured by a first priority lien (subject to

customary exceptions) on the real property comprising Imation Corp.’s corporate headquarters and all of the personal

property of Imation Corp., its subsidiary Imation Enterprises Corp., which is also an obligor under the Credit Agreement,

and the Guarantors. Advances under the U.S. portion of the Credit Facility are limited to the lesser of (a) $150,000,000

and (b) the “U.S. borrowing base.” The U.S. borrowing base is equal to the following:

•up to 85 percent of eligible accounts receivable; plus

73

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)