Macy's 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

on the projected cash flows and an estimated risk-adjusted rate of return that would be used by market

participants in valuing these assets or prices of similar assets.

Financial instruments that potentially subject the Company to concentrations of credit risk consist

principally of temporary cash investments. The Company places its temporary cash investments in what it

believes to be high credit quality financial instruments.

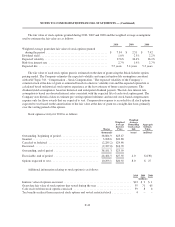

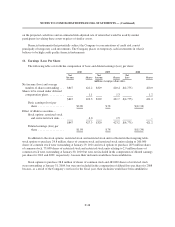

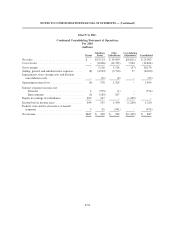

16. Earnings (Loss) Per Share

The following table sets forth the computation of basic and diluted earnings (loss) per share:

2010 2009 2008

Net

Income Shares

Net

Income Shares

Net

Loss Shares

(millions, except per share data)

Net income (loss) and average

number of shares outstanding . . . $847 422.2 $329 420.4 $(4,775) 420.0

Shares to be issued under deferred

compensation plans ........... 1.1 1.3 1.2

$847 423.3 $329 421.7 $(4,775) 421.2

Basic earnings (loss) per

share .................. $2.00 $.78 $(11.34)

Effect of dilutive securities –

Stock options, restricted stock

and restricted stock units . . 4.0 1.5 –

$847 427.3 $329 423.2 $(4,775) 421.2

Diluted earnings (loss) per

share .................. $1.98 $.78 $(11.34)

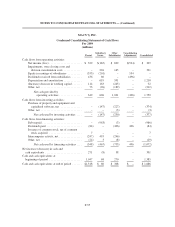

In addition to the stock options, restricted stock and restricted stock units reflected in the foregoing table,

stock options to purchase 24.8 million shares of common stock and restricted stock units relating to 260,000

shares of common stock were outstanding at January 29, 2011 and stock options to purchase 28.9 million shares

of common stock, 75,000 shares of restricted stock and restricted stock units relating to 2.9 million shares of

common stock were outstanding at January 30, 2010 but were not included in the computation of diluted earnings

per share for 2010 and 2009, respectively, because their inclusion would have been antidilutive.

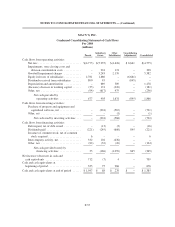

Stock options to purchase 38.8 million of shares of common stock and 483,000 shares of restricted stock

were outstanding at January 31, 2009, but were not included in the computation of diluted loss per share for 2008

because, as a result of the Company’s net loss for the fiscal year, their inclusion would have been antidilutive.

F-48