Macy's 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

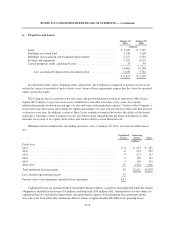

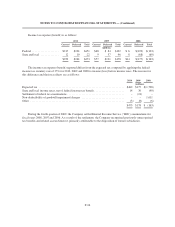

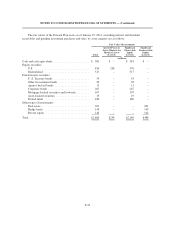

9. Accounts Payable and Accrued Liabilities

January 29,

2011

January 30,

2010

(millions)

Accounts payable .............................................. $ 559 $ 484

Gift cards and customer award certificates ........................... 654 594

Accrued wages and vacation ...................................... 311 307

Lease related liabilities .......................................... 271 265

Taxes other than income taxes .................................... 186 199

Current portion of workers’ compensation and general liability reserves . . . 144 141

Accrued interest ............................................... 98 122

Current portion of post employment and postretirement benefits ......... 88 94

Allowance for future sales returns ................................. 67 65

Severance and relocation ........................................ 1 71

Other ........................................................ 265 284

$2,644 $2,626

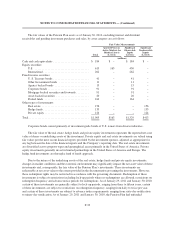

Adjustments to the allowance for future sales returns, which amounted to a charge of $2 million for 2010, a

charge of $6 million for 2009, and a credit of $14 million for 2008 are reflected in cost of sales.

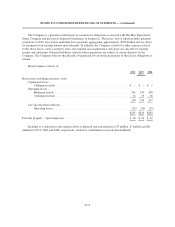

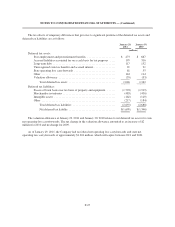

Changes in workers’ compensation and general liability reserves, including the current portion, are as

follows:

2010 2009 2008

(millions)

Balance, beginning of year ................................................. $478 $495 $471

Charged to costs and expenses .............................................. 148 124 164

Payments, net of recoveries ................................................. (138) (141) (140)

Balance, end of year ...................................................... $488 $478 $495

The non-current portion of workers’ compensation and general liability reserves is included in other

liabilities on the Consolidated Balance Sheets. At January 29, 2011 and January 30, 2010, workers’

compensation and general liability reserves included $93 million and $90 million, respectively, of liabilities

which are covered by deposits and receivables included in current assets on the Consolidated Balance Sheets.

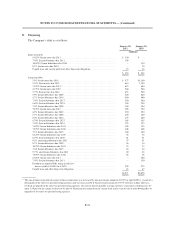

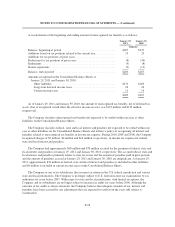

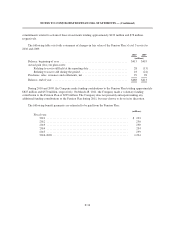

10. Taxes

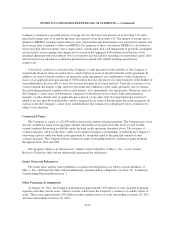

The Company changed its methodology for recording deferred state income taxes from a blended rate basis

to a separate entity basis, and has reflected the effects of such change to 2010 and all prior periods. Even though

the Company considers the change to have had only an immaterial impact on its financial condition, results of

operations and cash flows for the periods presented, the financial condition, results of operations and cash flows

for the prior periods as previously reported have been adjusted to reflect the change.

F-25