Macy's 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

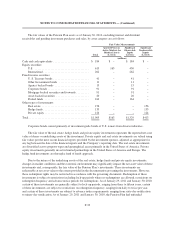

commitments related to certain of these investments totaling approximately $133 million and $78 million,

respectively.

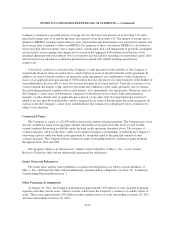

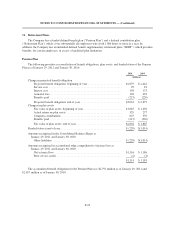

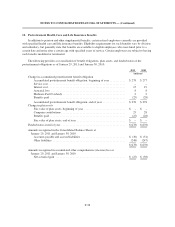

The following table sets forth a summary of changes in fair value of the Pension Plan’s level 3 assets for

2010 and 2009:

2010 2009

(millions)

Balance, beginning of year ............................................... $413 $419

Actual gain (loss) on plan assets:

Relating to assets still held at the reporting date ........................... 28 (13)

Relating to assets sold during the period ................................. 18 (21)

Purchases, sales, issuances and settlements, net ............................... 29 28

Balance, end of year .................................................... $488 $413

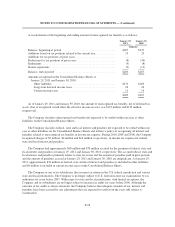

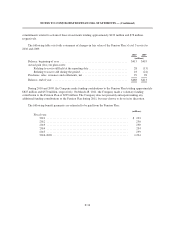

During 2010 and 2009, the Company made funding contributions to the Pension Plan totaling approximately

$825 million and $370 million, respectively. On March 28, 2011, the Company made a voluntary funding

contribution to the Pension Plan of $225 million. The Company does not presently anticipate making any

additional funding contributions to the Pension Plan during 2011, but may choose to do so in its discretion.

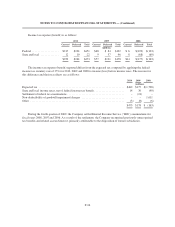

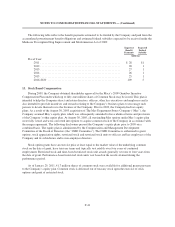

The following benefit payments are estimated to be paid from the Pension Plan:

(millions)

Fiscal year:

2011 ......................................................... $ 233

2012 ......................................................... 230

2013 ......................................................... 230

2014 ......................................................... 234

2015 ......................................................... 239

2016-2020 ..................................................... 1,234

F-34