Macy's 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

these senior notes outstanding at January 29, 2011 could increase by up to 1.50 percent per annum or decrease by

up to .50 percent per annum from its current level in the event of one or more downgrades or upgrades of the

notes by specified rating agencies.

During 2010, the Company repurchased no shares of its common stock under its share repurchase program.

The Company’s share repurchase program is currently suspended. As of January 29, 2011, the Company had

approximately $850 million of authorization remaining under its share repurchase program. The Company may

continue or, from time to time, suspend repurchases of shares under its share repurchase program, depending on

prevailing market conditions, alternate uses of capital and other factors.

On February 25, 2011, the Company’s board of directors declared a quarterly dividend of 5 cents per share

on its common stock, payable April 1, 2011 to Macy’s shareholders of record at the close of business on

March 15, 2011.

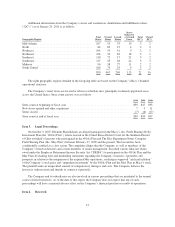

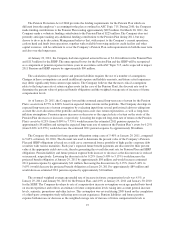

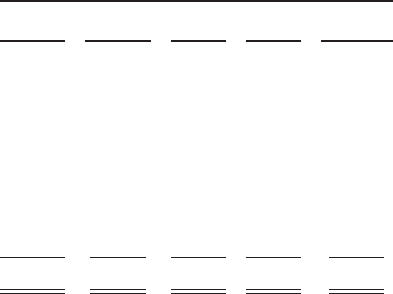

At January 29, 2011, the Company had contractual obligations (within the scope of Item 303(a)(5) of

Regulation S-K) as follows:

Obligations Due, by Period

Total

Less than

1 Year

1–3

Years

3–5

Years

More than

5 Years

(millions)

Short-term debt ..................................... $ 451 $ 451 $ – $ – $ –

Long-term debt ..................................... 6,702 – 1,219 1,179 4,304

Interest on debt ..................................... 5,082 472 814 685 3,111

Capital lease obligations .............................. 58 6 10 7 35

Other long-term liabilities ............................ 1,354 26 375 245 708

Operating leases .................................... 2,612 245 446 340 1,581

Letters of credit ..................................... 38 38 – – –

Other obligations ................................... 2,320 1,988 265 61 6

$18,617 $3,226 $3,129 $2,517 $9,745

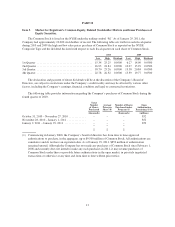

“Other obligations” in the foregoing table consist primarily of merchandise purchase obligations and

obligations under outsourcing arrangements, construction contracts, employment contracts, group medical/dental/

life insurance programs, energy and other supply agreements identified by the Company and liabilities for

unrecognized tax benefits that the Company expects to settle in cash in the next year. The Company’s

merchandise purchase obligations fluctuate on a seasonal basis, typically being higher in the summer and early

fall and being lower in the late winter and early spring. The Company purchases a substantial portion of its

merchandise inventories and other goods and services otherwise than through binding contracts. Consequently,

the amounts shown as “Other obligations” in the foregoing table do not reflect the total amounts that the

Company would need to spend on goods and services in order to operate its businesses in the ordinary course.

The Company has not included in the contractual obligations table approximately $170 million of long-term

liabilities for unrecognized tax benefits for various tax positions taken or approximately $76 million of related

accrued federal, state and local interest and penalties. These liabilities may increase or decrease over time as a

result of tax examinations, and given the status of examinations, the Company cannot reliably estimate the period

of any cash settlement with the respective taxing authorities. The Company has included in the contractual

obligations table $11 million of liabilities for unrecognized tax benefits that the Company expects to settle in

cash in the next year. The Company has not included in the contractual obligation table the $220 million Pension

Plan liability. The Company’s funding policy is to contribute amounts necessary to satisfy pension funding

requirements, including requirements of the Pension Protection Act of 2006, plus such additional amounts from

time to time as are determined to be appropriate to improve the Pension Plan’s funded status. The Pension Plan’s

22